Worried About a Bear Market? 3 Reasons to Buy PepsiCo Like There's No Tomorrow

-

PepsiCo's stock popped after the company reported unexpectedly strong second -quarter 2025 earnings.

-

The stock remains mired in a deep downturn.

-

One quarter isn't a trend, but this Dividend King has proved it knows how to adapt over the long term.

PepsiCo (PEP -0.70%) announced second-quarter 2025 earnings that were stronger than Wall Street expected. The stock popped 6% the next day, which is great. But it is a typical short-term, news-driven move that probably shouldn't be too important to long-term investors.

The bigger story here is that the stock remains well off its highs, which makes it a buy if you are worried about a bear market. Here are three reasons why.

1. PepsiCo is a consumer staples company

PepsiCo makes beverages, salty snacks, and packaged foods. It owns some of the most iconic brands around, including Pepsi, Frito-Lay, and Quaker Oats.

Its size, distribution strength, marketing prowess, and research and development acumen make it a valuable partner to retailers around the world. It is highly unlikely that PepsiCo goes away anytime soon.

Image source: Getty Images.

And there's a key feature here that is important to remember: PepsiCo makes affordable products that are bought regularly and have high brand loyalty among customers. This is the core of why consumer staples companies are resilient to economic downturns and are often sought out by investors as safe havens during bear markets. PepsiCo's business, while it will vary a bit over short periods of time, is really fairly stable, with a slight growth bias over the long term.

If you are worried about a bear market, consumer staples stocks are a great place to go fishing for new investments. Notice that statement is broad and not specific to PepsiCo. Which brings up the next point: its stock price.

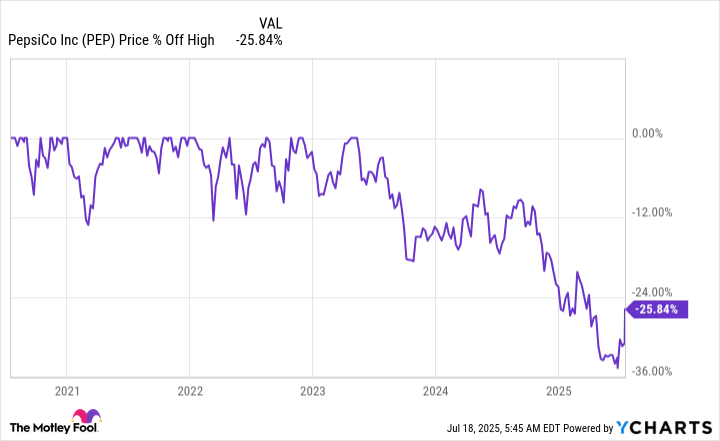

PEP data by YCharts.

2. It's already in its own bear market

Without getting too deep into the details, PepsiCo hasn't been firing on all cylinders lately. Some of its peers, notably Coca-Cola (KO 0.10%), have been performing better. Thus, Wall Street has been downbeat on PepsiCo's stock.

Even after the pop following unexpectedly strong second-quarter 2025 earnings, shares remain down more than 20% from their 2023 highs. A bear market is when the broader indexes fall 20% or more, so PepsiCo is kind of in its own private bear market already.

A market-wide downturn could easily lead investors to seek out safe havens, like already downtrodden consumer staples makers. PepsiCo could quickly find itself gaining favor again in that scenario.

And even if that positive shift doesn't happen, given the already deep drawdown, it seems likely that the stock wouldn't suffer as much as the broader market in a downturn.

3. PepsiCo has a proven record of survival

The final reason to consider buying PepsiCo if you are worried about a bear market is its status as a Dividend King. With over five decades of annual dividend increases, the company has proved it knows how to survive bear markets, recessions, and whatever else the world can throw at it. Simply put, you don't create a dividend record like that by accident.

On this front, you might also want to pay attention to the stock's historically high dividend yield of around 4% or so. Basically, you are getting paid very well to own this reliable dividend stock, and that can help you wait out a broader market downturn without losing your cool.

PepsiCo is muddling through again

To reiterate, PepsiCo is not operating at the top of its game right now. That said, it is making moves to get back into form, including cutting costs and acquiring new, more relevant brands, among other things.

It is basically doing the right things from a business perspective. Add that to what is really a pretty reliable business, the deep decline in the stock price, and an attractive dividend yield, and this dividend stalwart looks like a buy even if you aren't worried about a bear market!

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10