Citizens & Northern (NASDAQ:CZNC) Has Announced A Dividend Of $0.28

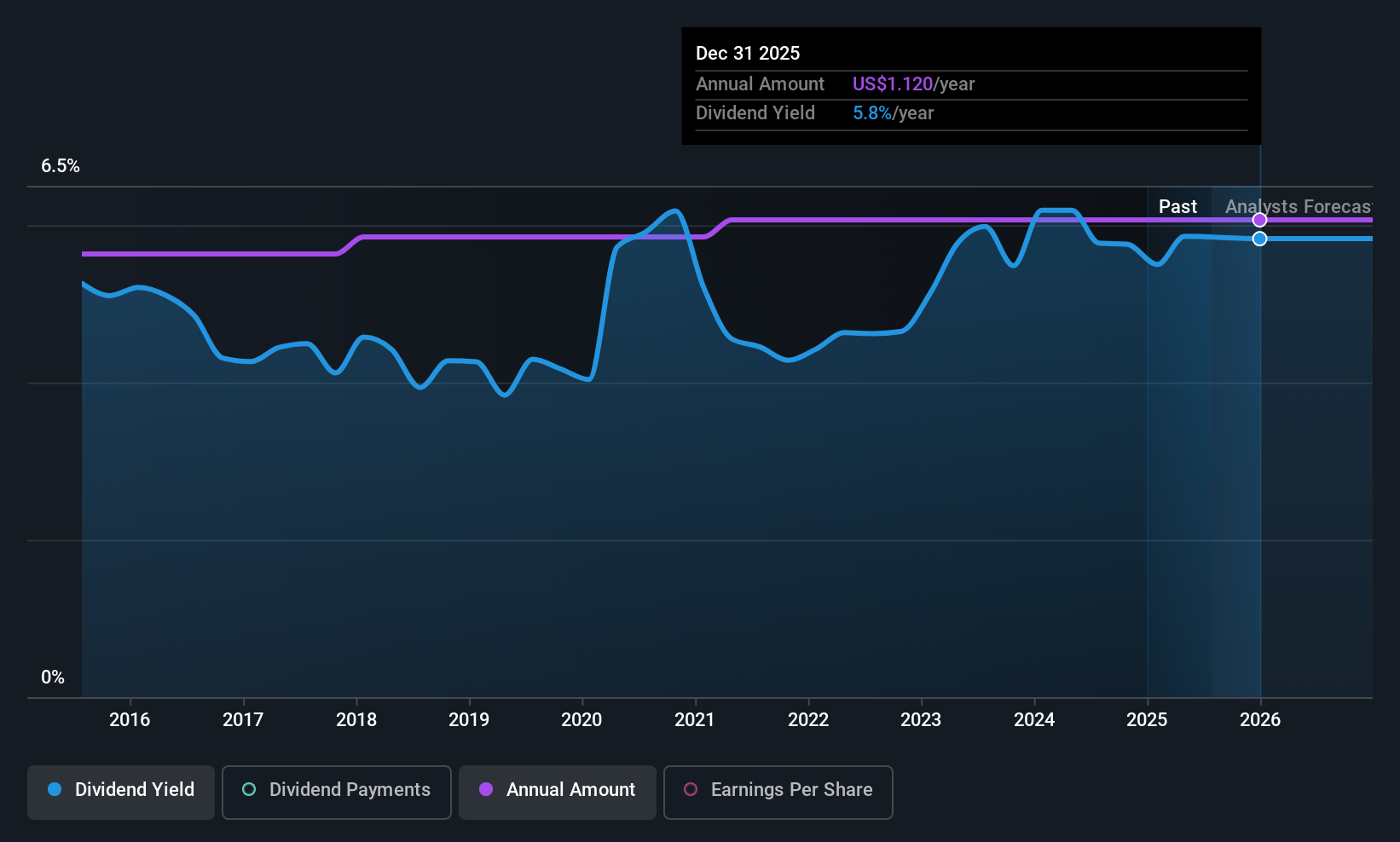

The board of Citizens & Northern Corporation (NASDAQ:CZNC) has announced that it will pay a dividend on the 15th of August, with investors receiving $0.28 per share. This makes the dividend yield 5.8%, which will augment investor returns quite nicely.

AI is about to change healthcare. These 20 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10bn in marketcap - there is still time to get in early.

Citizens & Northern's Payment Expected To Have Solid Earnings Coverage

We like to see robust dividend yields, but that doesn't matter if the payment isn't sustainable.

Having distributed dividends for at least 10 years, Citizens & Northern has a long history of paying out a part of its earnings to shareholders. Past distributions do not necessarily guarantee future ones, but Citizens & Northern's payout ratio of 64% is a good sign as this means that earnings decently cover dividends.

The next year is set to see EPS grow by 10.7%. If the dividend continues on this path, the future payout ratio could be 59% by next year, which we think can be pretty sustainable going forward.

Check out our latest analysis for Citizens & Northern

Citizens & Northern Has A Solid Track Record

The company has an extended history of paying stable dividends. The annual payment during the last 10 years was $1.04 in 2015, and the most recent fiscal year payment was $1.12. Dividend payments have been growing, but very slowly over the period. Dividends have grown relatively slowly, which is not great, but some investors may value the relative consistency of the dividend.

Dividend Growth May Be Hard To Achieve

Investors could be attracted to the stock based on the quality of its payment history. Earnings per share has been crawling upwards at 3.0% per year. The company has been growing at a pretty soft 3.0% per annum, and is paying out quite a lot of its earnings to shareholders. This could mean the dividend doesn't have the growth potential we look for going into the future.

Citizens & Northern Looks Like A Great Dividend Stock

Overall, we think that this is a great income investment, and we think that maintaining the dividend this year may have been a conservative choice. The company is easily earning enough to cover its dividend payments and it is great to see that these earnings are being translated into cash flow. Taking this all into consideration, this looks like it could be a good dividend opportunity.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. Are management backing themselves to deliver performance? Check their shareholdings in Citizens & Northern in our latest insider ownership analysis. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10