Northern Trust Corporation (NASDAQ:NTRS) reported upbeat earnings for the second quarter on Wednesday.

The company posted quarterly earnings of $2.13 per share which beat the analyst consensus estimate of $2.01 per share. The company reported quarterly sales of $1.998 billion which beat the analyst consensus estimate of $1.955 billion.

Northern Trust shares gained 3.7% to trade at $128.77 on Thursday.

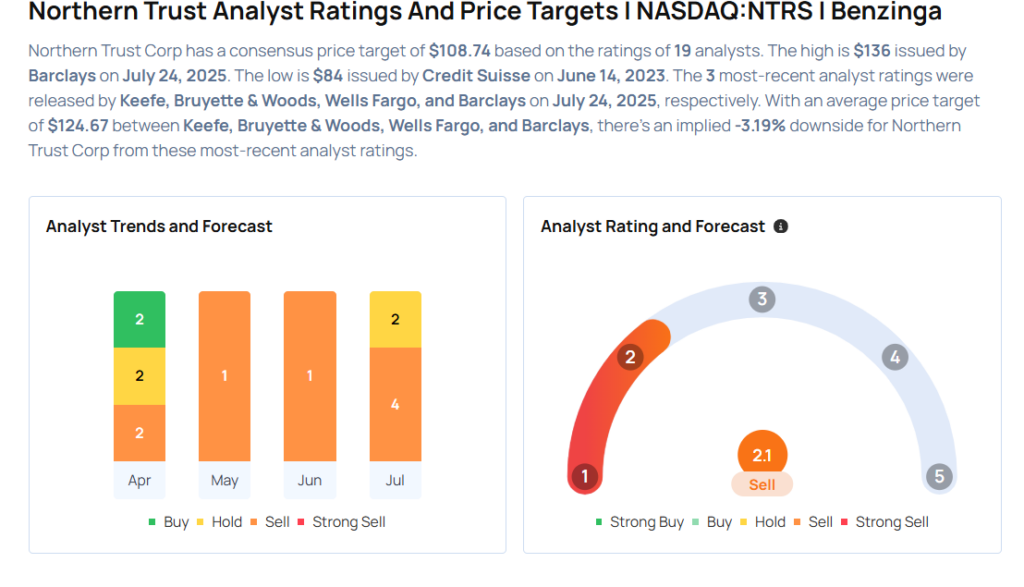

These analysts made changes to their price targets on Northern Trust following earnings announcement.

- Keefe, Bruyette & Woods analyst David Konrad reiterated Northern Trust with an Underperform rating and lowered the price target from $120 to $118.

- Wells Fargo analyst Mike Mayo maintained the stock with an Equal-Weight rating and raised the price target from $111 to $120.

- Barclays analyst Jason Goldberg maintained Northern Trust with an Equal-Weight rating and raised the price target from $128 to $136.

- Wolfe Research analyst Erik Suppiger upgraded Northern Trust from Underperform to Peer Perform.

Considering buying NTRS stock? Here’s what analysts think:

Read This Next:

- Jim Cramer Loves ‘That Yield’ But Passes On This Stock: ‘Fundamentals Are Hurting’

Photo via Shutterstock