Used car retailer, Carvana Co. (NYSE:CVNA), reported a strong second-quarter performance, fueled partly by the chaos and uncertainties surrounding President Donald Trump’s trade and tariff policies during the quarter.

Check out the current price of CVNA stock here.

What Happened: During its second-quarter earnings call on Wednesday, the company revealed that tariff-related pricing dynamics in April contributed to an estimated $100 per unit uplift in retail gross profit.

“We really linked [it] to the announcements of auto tariffs in late March that drove stronger demand and higher margins,” CFO Mark Jenkins said during the call.

See Also: Decoding Carvana’s Options Activity: What’s the Big Picture?

The company’s CEO, Ernie Garcia, acknowledged the temporary nature of the benefit, saying that, “There was a little bit of kind of pull forward and then maybe a little slowness immediately thereafter, but I think for the most part it was relatively flat.”

According to Garcia, Carvana sold 143,280 retail units in the second quarter, up 41% year-over-year. In contrast, he says, “based on our best available data, the market grew by less than 5% in units in the quarter.” He added that the company “grew inventory available for our customers by 50%,” while the broader industry faces stagnation.

“We were once again the fastest growing and most profitable automotive retailer, again by significant margins,” he said, while also highlighting the role of strong execution as the key driver of this performance, besides the temporary macro-driven uplift.

Why It Matters: Carvana's stock has staged one of the most dramatic reversals in recent market history. After peaking at over $360 in 2021, shares collapsed to just $3.72 in late 2022 amid fears of bankruptcy and a cratering used-car market. Over the past year, however, it has once again soared by 8,867%, and currently trades at $333.59 per share.

As the stock continues to test new highs, Garcia, the company’s CEO, sold shares worth $33.5 million this week, while continuing to remain a major shareholder with a 10% ownership in the company.

The stock is back in the spotlight, with retail investors drawing parallels to it with Opendoor Technologies Inc. (NASDAQ:OPEN), another beaten-down stock that is being touted as a potential “100-bagger,” or a stock that could 100x in value from its current levels.

The company released its second-quarter results on Wednesday, reporting $4.84 billion in revenue, up 42% year-over-year, and beating consensus estimates of $4.53 billion. It posted a profit of $1.28 per share, again ahead of Street estimates at $0.97 per share.

Price Action: Carvana’s shares were down 0.86% on Wednesday, trading at $333.59, but are up 15.70% after hours, following the company’s earnings announcement.

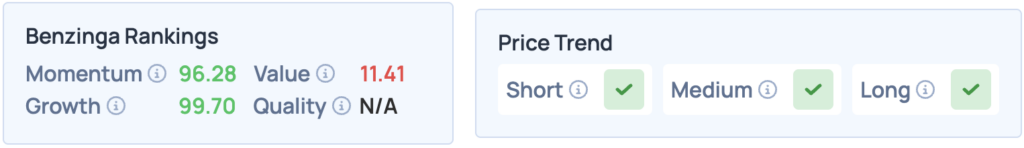

Carvana continues to see strong Momentum and Growth, according to Benzinga’s Edge Stock Rankings, with a favorable price trend in the short, medium and long terms. Click here for deeper insights into the stock, its peers and competitors.

Photo Courtesy: Around the World Photos on Shutterstock.com

Read More:

- With Q2 Earnings On Deck, Carvana’s Growth Story Is Under The Microscope