HiTech Group Australia Limited's (ASX:HIT) Share Price Is Matching Sentiment Around Its Earnings

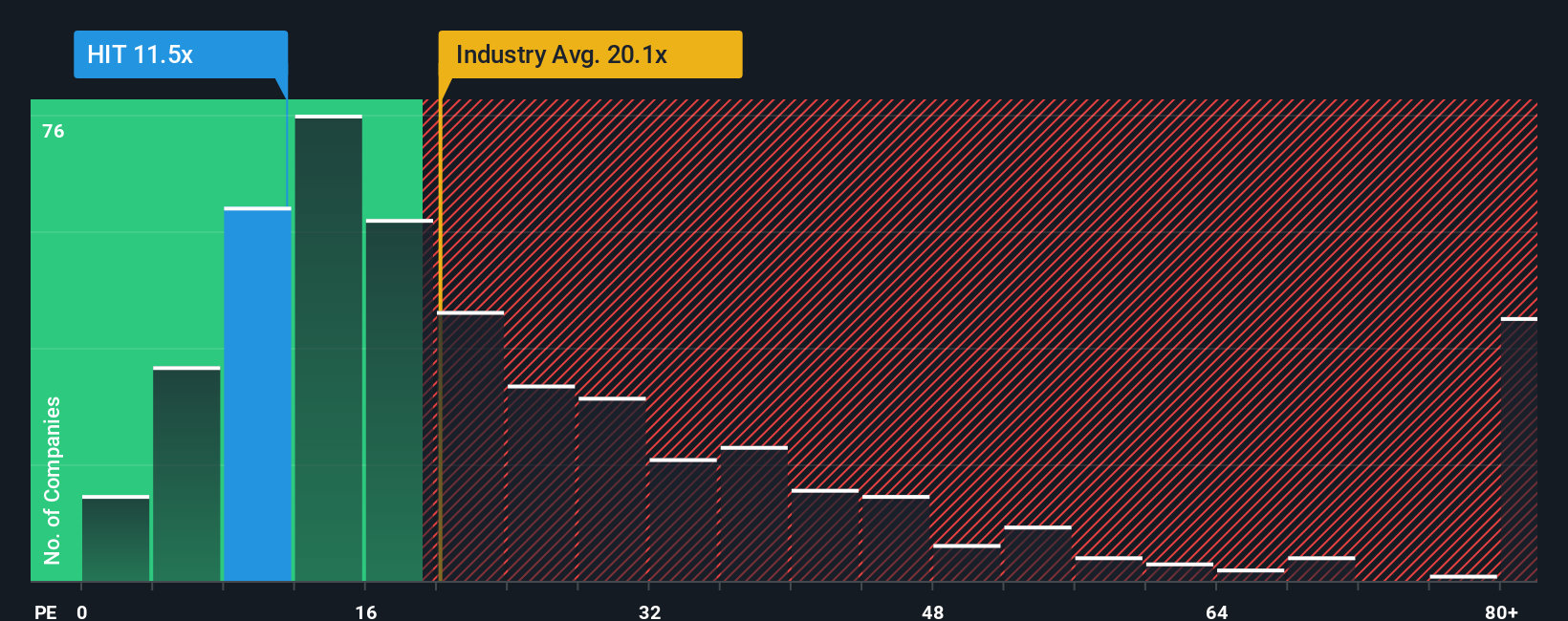

HiTech Group Australia Limited's (ASX:HIT) price-to-earnings (or "P/E") ratio of 11.5x might make it look like a buy right now compared to the market in Australia, where around half of the companies have P/E ratios above 19x and even P/E's above 36x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

The earnings growth achieved at HiTech Group Australia over the last year would be more than acceptable for most companies. One possibility is that the P/E is low because investors think this respectable earnings growth might actually underperform the broader market in the near future. If that doesn't eventuate, then existing shareholders have reason to be optimistic about the future direction of the share price.

See our latest analysis for HiTech Group Australia

Is There Any Growth For HiTech Group Australia?

There's an inherent assumption that a company should underperform the market for P/E ratios like HiTech Group Australia's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 16% gain to the company's bottom line. The latest three year period has also seen an excellent 61% overall rise in EPS, aided by its short-term performance. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

This is in contrast to the rest of the market, which is expected to grow by 21% over the next year, materially higher than the company's recent medium-term annualised growth rates.

In light of this, it's understandable that HiTech Group Australia's P/E sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the bourse.

The Final Word

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of HiTech Group Australia revealed its three-year earnings trends are contributing to its low P/E, given they look worse than current market expectations. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

You should always think about risks. Case in point, we've spotted 2 warning signs for HiTech Group Australia you should be aware of.

If these risks are making you reconsider your opinion on HiTech Group Australia, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if HiTech Group Australia might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10