CBRE Group (CBRE) Reports Strong Earnings Growth and Completes US$663 Million Share Buyback

CBRE Group (CBRE) recently announced substantial second-quarter earnings growth, with sales rising to $5,668 million and net income increasing to $215 million. These strong financial results, paired with the completion of a significant share buyback, seem to have bolstered investor confidence, reflected in the company's 20% stock price increase over the last quarter. Meanwhile, the broader market was largely stable, with indices like the S&P 500 and Nasdaq experiencing slight fluctuations. CBRE’s performance highlights its firm standing within a positively trending market, underscoring the impact of effective management decisions amid favorable economic conditions.

CBRE Group has 1 risk we think you should know about.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 19 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

The recent earnings growth and share buyback announced by CBRE Group have further solidified its strong market presence. Over the past five years, the company's total shareholder return, including share price and dividends, achieved 254.44%. This significant long-term performance underscores the value generated for its investors and reflects positively on the company's growth and operational efficiency. Comparatively, CBRE's stock exceeded both the US Real Estate industry, which returned 21.8% over the past year, and the broader US Market, which returned 17.3% over the same period.

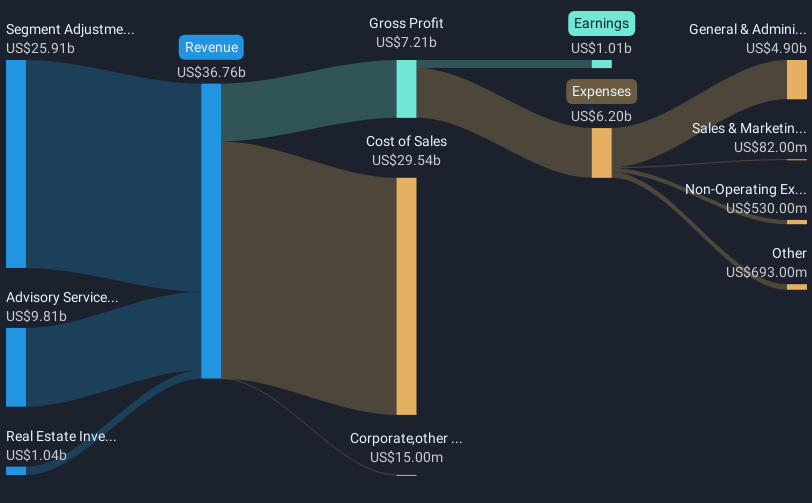

On the revenue and earnings front, the successful second-quarter earnings report and share buyback are expected to bolster future financial prospects. With revenue at $36.74 billion and earnings at $1.01 billion, the company's financial health positions it for sustained growth. The impressive financial figures should positively contribute to the narrative of stable growth amid market uncertainties, driven by strategic realignment and resilient business focus.

In context with the share price target, the current share price of $146.56 is slightly below the consensus analyst price target of $153.18, indicating a modest 4.52% discount. This suggests that while the market acknowledges CBRE's strong performance, there is still room for potential appreciation in the share price. Continued investments, strong cash flow, and strategic M&A activities are expected to support long-term earnings per share growth and shareholder value, aligning with the prevailing price target estimates. Investors may seek to reconcile their evaluations with these targets to assess potential investment returns accurately.

Explore CBRE Group's analyst forecasts in our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10