Breakeven On The Horizon For Natera, Inc. (NASDAQ:NTRA)

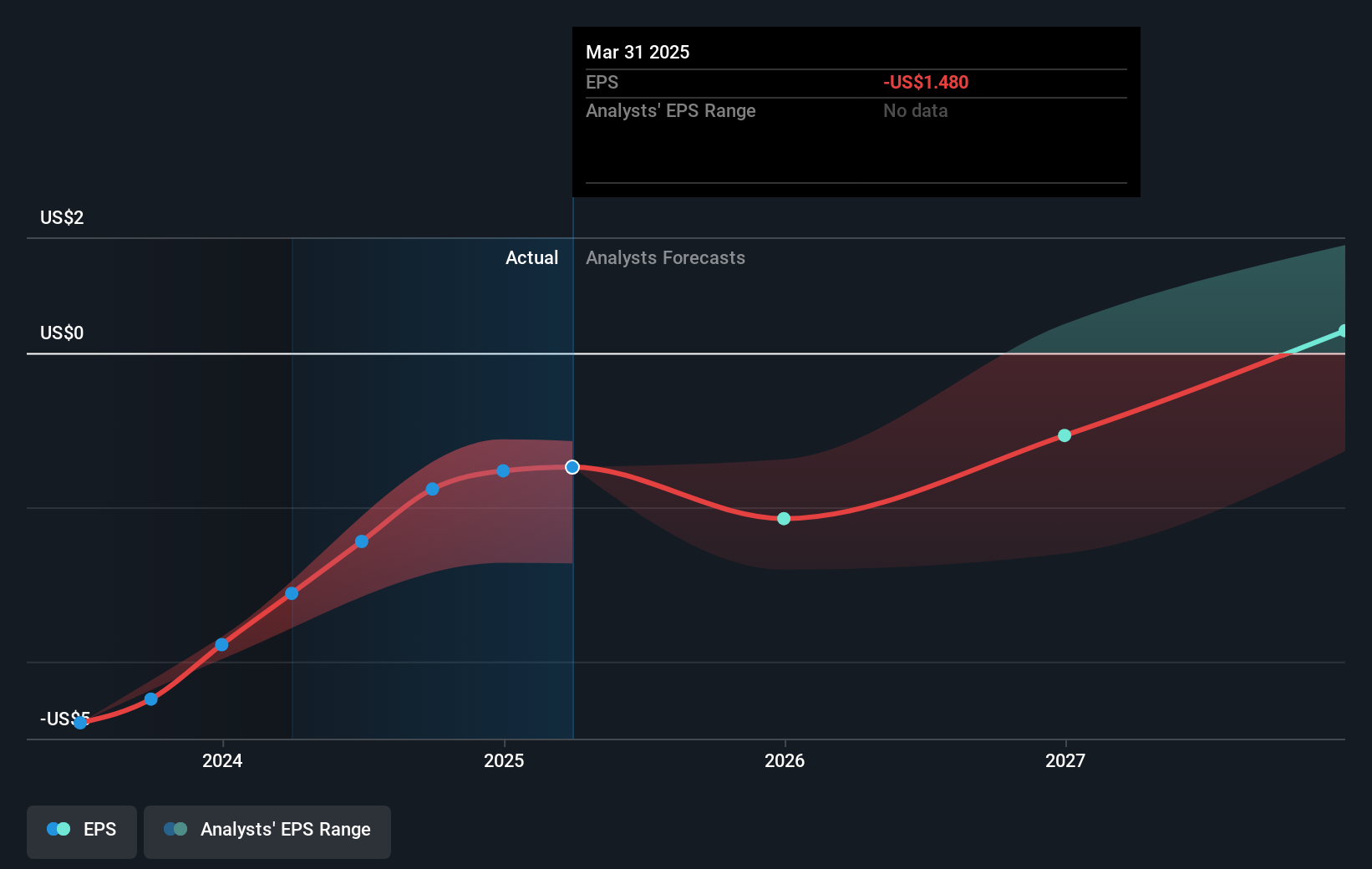

Natera, Inc. (NASDAQ:NTRA) is possibly approaching a major achievement in its business, so we would like to shine some light on the company. Natera, Inc., a diagnostics company, provides molecular testing services worldwide. The US$19b market-cap company’s loss lessened since it announced a US$190m loss in the full financial year, compared to the latest trailing-twelve-month loss of US$190m, as it approaches breakeven. As path to profitability is the topic on Natera's investors mind, we've decided to gauge market sentiment. We've put together a brief outline of industry analyst expectations for the company, its year of breakeven and its implied growth rate.

We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

According to the 18 industry analysts covering Natera, the consensus is that breakeven is near. They anticipate the company to incur a final loss in 2026, before generating positive profits of US$42m in 2027. The company is therefore projected to breakeven around 2 years from today. How fast will the company have to grow each year in order to reach the breakeven point by 2027? Working backwards from analyst estimates, it turns out that they expect the company to grow 59% year-on-year, on average, which signals high confidence from analysts. If this rate turns out to be too aggressive, the company may become profitable much later than analysts predict.

We're not going to go through company-specific developments for Natera given that this is a high-level summary, but, take into account that typically a biotech has lumpy cash flows which are contingent on the product type and stage of development the company is in. This means, large upcoming growth rates are not abnormal as the company is beginning to reap the benefits of earlier investments.

See our latest analysis for Natera

Before we wrap up, there’s one aspect worth mentioning. The company has managed its capital judiciously, with debt making up 6.5% of equity. This means that it has predominantly funded its operations from equity capital, and its low debt obligation reduces the risk around investing in the loss-making company.

Next Steps:

There are too many aspects of Natera to cover in one brief article, but the key fundamentals for the company can all be found in one place – Natera's company page on Simply Wall St. We've also compiled a list of key factors you should further examine:

- Valuation: What is Natera worth today? Has the future growth potential already been factored into the price? The intrinsic value infographic in our free research report helps visualize whether Natera is currently mispriced by the market.

- Management Team: An experienced management team on the helm increases our confidence in the business – take a look at who sits on Natera’s board and the CEO’s background.

- Other High-Performing Stocks: Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here.

Valuation is complex, but we're here to simplify it.

Discover if Natera might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10