Costco Is One of the Largest Consumer Goods Companies by Market Cap. But Is It a Buy?

-

Costco is America's second-largest consumer-staples stock by market cap, trailing only Walmart.

-

The company's subscription model and its popular private-label products set it apart from many of its competitors in the retail sector.

-

The artificial intelligence (AI) revolution could be a game changer for Costco, which could use AI to lower its labor and logistics costs.

Consumer-staples stocks are some of the best-known names on Wall Street. Walmart, Coca-Cola, Procter & Gamble, and PepsiCo are all legendary American companies. What's more, most of us have at least one of their products in our homes right now.

Yet what about Costco (COST -0.16%)? It's a relative newcomer compared with many companies in the consumer staples sector, but there's no denying its impact and influence. Is it a buy? Let's find out.

Image source: Getty Images.

Getting to know Costco

Let's start by answering two central questions about the company: What does Costco do, and how large is it?

To take the second question first, Costco is one of the world's biggest retailers. The company operates over 900 warehouse stores across 14 countries, with the majority of locations in the United States. It boasts a market cap of around $400 billion, making it the second-largest stock in the consumer staples sector.

The key feature of Costco's business model is its membership strategy. The company limits entry to its stores to members only, thus gaining a significant amount of revenue from membership fees.

In 2024, Costco generated $4.8 billion in revenue from membership fees alone, accounting for approximately 2% of its total revenue. While that figure might seem small on a percentage basis, the membership revenue is crucial, as it accounts for the bulk of Costco's profits. Indeed, most of the company's $1.9 billion in net income stems from its high-margin membership fees, enabling it to maintain low retail prices.

The benefits and risks of owning Costco stock

There are several bullish reasons to own Costco stock.

First of all, the company's business model gives it a unique competitive advantage within the retail sector. Most stores need shoppers -- and lots of them -- to generate even a little bit of profit. As noted earlier, that's not necessarily the case for Costco. The bulk of its profits come from membership fees -- whether those members turn up to shop or not.

Second, the company isn't just a retailer; it has its own private-label products, sold under the "Kirkland" label. Roughly one-third of all sales at Costco are Kirkland products, which generate more profit for the company than other products.

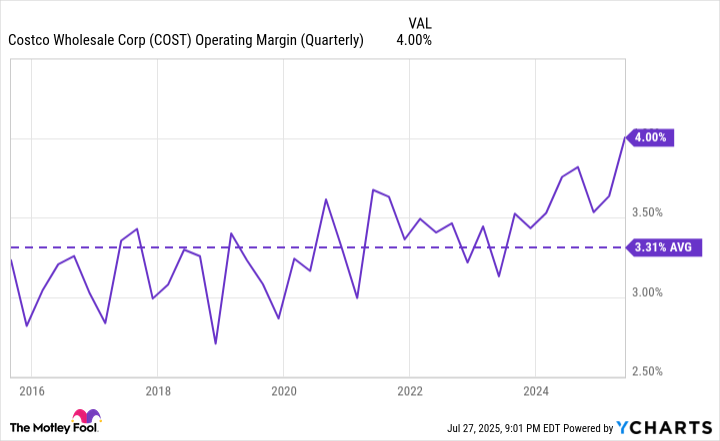

Finally, the artificial intelligence (AI) boom could deliver massive improvements for a company like Costco, which operates on relatively tight margins. For example, over the last 10 years, it has had an average operating margin of around 3%. In recent quarters, that has increased to 4%. This figure could improve even further in the coming years as the company introduces new technologies, including humanoid robots, as well as AI-driven inventory management and logistics.

COST Operating Margin (Quarterly) data by YCharts.

On the flip side, trade and tariff concerns loom over Costco. Many of the products sold at any given warehouse originate abroad, making them susceptible to tariffs. In addition to trade, consumer spending can quickly dry up, particularly if the labor market weakens or inflation once again picks up. All of these macroeconomic concerns pose risks for the company and its shareholders.

Finally, Costco operates in a highly competitive environment. Deep-pocketed rivals like Walmart and Amazon are constantly circling, looking to take customers and market share from it whenever possible.

Is Costco stock a buy now?

The simple truth is that Costco isn't a stock for every investor. It isn't cheap; shares trade at a price-to-earnings (P/E) multiple of 53, which is far higher than most consumer staples stocks. But the company does have appeal thanks to its business model, which offers a far more reliable form of revenue than most retailers can count on. Moreover, if Costco uses AI-powered tools in a smart way, its margins could widen, generating much more profit.

If you're a growth-oriented investor, you may want to consider Costco stock. If you're a value- or income-oriented investor, you may be best served elsewhere.

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10