Investors Met With Slowing Returns on Capital At UFP Technologies (NASDAQ:UFPT)

If you're looking for a multi-bagger, there's a few things to keep an eye out for. In a perfect world, we'd like to see a company investing more capital into its business and ideally the returns earned from that capital are also increasing. Basically this means that a company has profitable initiatives that it can continue to reinvest in, which is a trait of a compounding machine. So, when we ran our eye over UFP Technologies' (NASDAQ:UFPT) trend of ROCE, we liked what we saw.

This technology could replace computers: discover the 20 stocks are working to make quantum computing a reality.

Understanding Return On Capital Employed (ROCE)

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. Analysts use this formula to calculate it for UFP Technologies:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.16 = US$92m ÷ (US$643m - US$80m) (Based on the trailing twelve months to March 2025).

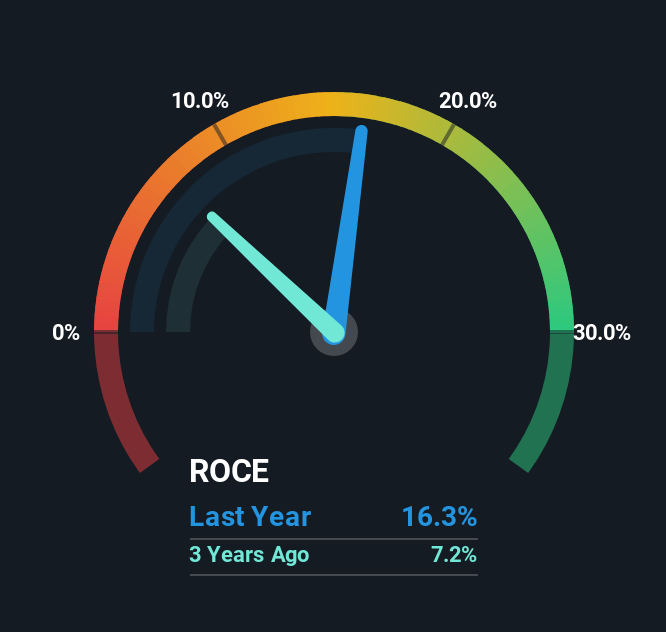

Thus, UFP Technologies has an ROCE of 16%. On its own, that's a standard return, however it's much better than the 10% generated by the Medical Equipment industry.

See our latest analysis for UFP Technologies

Above you can see how the current ROCE for UFP Technologies compares to its prior returns on capital, but there's only so much you can tell from the past. If you'd like, you can check out the forecasts from the analysts covering UFP Technologies for free.

What Can We Tell From UFP Technologies' ROCE Trend?

The trend of ROCE doesn't stand out much, but returns on a whole are decent. The company has employed 218% more capital in the last five years, and the returns on that capital have remained stable at 16%. Since 16% is a moderate ROCE though, it's good to see a business can continue to reinvest at these decent rates of return. Stable returns in this ballpark can be unexciting, but if they can be maintained over the long run, they often provide nice rewards to shareholders.

What We Can Learn From UFP Technologies' ROCE

In the end, UFP Technologies has proven its ability to adequately reinvest capital at good rates of return. And long term investors would be thrilled with the 455% return they've received over the last five years. So while the positive underlying trends may be accounted for by investors, we still think this stock is worth looking into further.

One more thing to note, we've identified 2 warning signs with UFP Technologies and understanding them should be part of your investment process.

For those who like to invest in solid companies, check out this free list of companies with solid balance sheets and high returns on equity.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10