Meta Platforms (META) Joins Global Signal Exchange To Combat Online Scams Worth Over US$1 Trillion

Meta Platforms (META) has recently entered a partnership with the Global Signal Exchange (GSE) alongside Microsoft, aiming to enhance efforts to combat online scams. Meanwhile, the company's total shareholder return rose by 30% over the last quarter, contrasting with recent volatility in broader markets due to tariff fears and weak job data. Factors contributing to this positive price movement include Meta's solid earnings report, highlighting increased revenue and net income, and updates on significant buyback programs and strategic energy initiatives. These developments likely provided a positive counterbalance against marketwide declines affecting many tech stocks.

Every company has risks, and we've spotted 1 risk for Meta Platforms you should know about.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

The recent partnership between Meta Platforms and the Global Signal Exchange, alongside Microsoft, could significantly influence the company's narrative by bolstering its efforts against online scams. This initiative may enhance user trust, potentially impacting future revenue positively by increasing user engagement across Meta’s platforms. Over the past three years, Meta's share price and dividends combined to deliver a very large total return of 355.93%, underscoring substantial long-term growth. In comparison, over the past year, Meta exceeded both the US Interactive Media and Services industry and the broader US market, which returned 26.7% and 16.8% respectively.

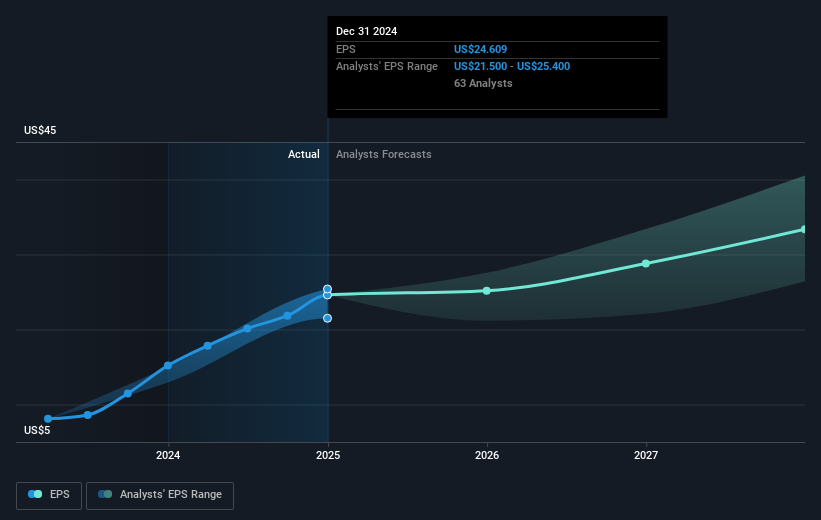

Analysts’ revenue and earnings forecasts might be favorably impacted by this collaboration, as enhanced trust and security measures can drive user engagement and retention, indirectly supporting revenue growth. The company's focus on AI to improve ad targeting and business messaging also aims to strengthen its revenue streams further. Despite recent price movements, Meta shares are currently trading at US$773.44, slightly below the consensus price target of approximately US$830.76, suggesting some upside potential, yet also highlighting that many believe the shares are approaching fair value. These dynamics set the stage for potential future growth, while investors keep an eye on AI advancements and European regulatory responses, which might pose challenges to these forecasts.

Assess Meta Platforms' previous results with our detailed historical performance reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10