IonQ (IONQ) Partners With ORNL To Tackle Energy Grid Optimization Challenges

IonQ (IONQ) has made significant strides recently through substantial collaborations and executive appointments that shine a light on its promising quantum computing endeavors. Noteworthy is its partnership with Oak Ridge National Laboratory and the U.S. Department of Energy, which underscores IonQ's expanding influence in energy grid optimization using quantum technology. This advancement aligns with the broader market trends, which saw tech giants like Microsoft and Meta report strong earnings, catalyzing a positive sentiment in tech stocks across the board. IonQ’s stock rose 46% over the last quarter, a performance that echoes the tech-driven market uptrend.

We've discovered 5 weaknesses for IonQ (2 are significant!) that you should be aware of before investing here.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Over the past three years, IonQ's total shareholder return surged by a very large percentage, highlighting its performance amid the burgeoning developments in quantum computing. This significant return notably outpaced the US tech industry, which declined 3.9% over the last year, as well as the broader US market's 15.7% gain during the same period. This long-term growth was juxtaposed against the short-term gains mentioned in the introduction, underscoring IonQ's robust trajectory.

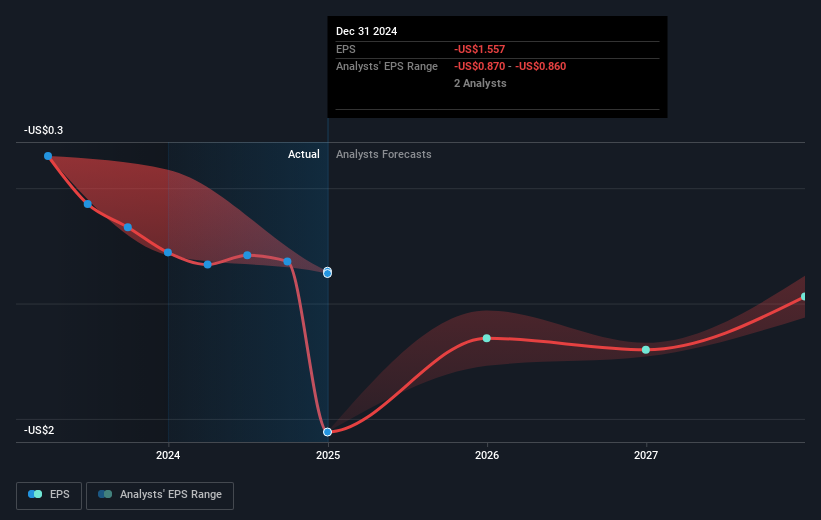

The company’s recent collaborative endeavors and executive appointments suggest potential positive impacts on revenue and earnings forecasts. With a current share price of US$39.88, there exists a 20% discount compared to the consensus analyst price target of US$47.86, indicating a bullish sentiment from analysts despite IonQ’s forecast of continued unprofitability over the next three years. The strategic and technological advancements mentioned earlier may bolster future revenue, projected to grow by 39.2% annually, even as the company navigates its profitability challenges.

Explore historical data to track IonQ's performance over time in our past results report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10