Is Schwab U.S. Dividend Equity ETF the Smartest Investment You Can Make Today?

-

The Schwab U.S. Dividend Equity ETF tracks an index of dividend stocks.

-

The index it tracks uses a fairly complex screening process.

-

The Schwab U.S. Dividend Equity ETF basically owns a portfolio of high-quality stocks with growing dividends.

Some investors enjoy the investment process, which is why they pick individual stocks. Other investors hate picking stocks and prefer to go with a pooled investment product, like a mutual fund or exchange-traded fund (ETF). If you are in the latter camp and focused on generating income from your investments, the Schwab U.S. Dividend Equity ETF (SCHD -0.45%) could be one of the smartest investments you can make today.

Keeping it simple, but not too simple

For most people, just living a normal life is enough to keep them occupied. Adding in trying to manage a portfolio of individual stocks is just too much to bother with. It's stressful, too! That's why pooled investment products like the Vanguard 500 ETF (VOO -1.60%), which tracks the S&P 500 index, exist. With one purchase, you get a diversified portfolio, and you don't have to worry about keeping tabs on all the stocks in the ETF.

Image source: Getty Images.

If you like to keep things simple, the question really boils down to which ETF or mutual fund fits best with your investment needs. If that need is income, an S&P 500 tracker isn't a great pick right now. A better choice is the Schwab U.S. Dividend Equity ETF.

For starters, the Schwab U.S. Dividend Equity ETF offers an attractive 3.8% dividend yield at a time when the S&P 500 index is only offering a yield of roughly 1.2%. Second, the Schwab U.S. Dividend Equity ETF is very cost-effective, with an expense ratio of only 0.06%. That said, the really big reason a dividend-focused investor would want to buy this particular ETF is all about how it picks the 100 stocks that it owns.

What does the Schwab U.S. Dividend Equity ETF do?

Technically speaking, the Schwab U.S. Dividend Equity ETF doesn't actually pick any stocks. It tracks an index and just buys whatever the index includes. So the real question is: What does the Dow Jones U.S. Dividend 100 Index do? That's the index the ETF mimics.

The index, and thus the ETF, only look at companies that have increased their dividends for a decade or more. Real estate investment trusts are removed from consideration. Each company with more than 10 years of dividend increases gets a composite score that includes cash flow to total debt, return on equity, dividend yield, and a company's five-year dividend growth rate. The 100 companies with the highest scores are included in the index, and thus the ETF, using a market cap weighting.

The Schwab U.S. Dividend Equity ETF owns high-quality companies with attractive yields that also have a history of increasing their dividends. That is pretty much what every long-term dividend investor is looking for, too. Thus, you get an instant and attractive dividend-focused stock portfolio with one investment, all for the low price of a 0.06% expense ratio.

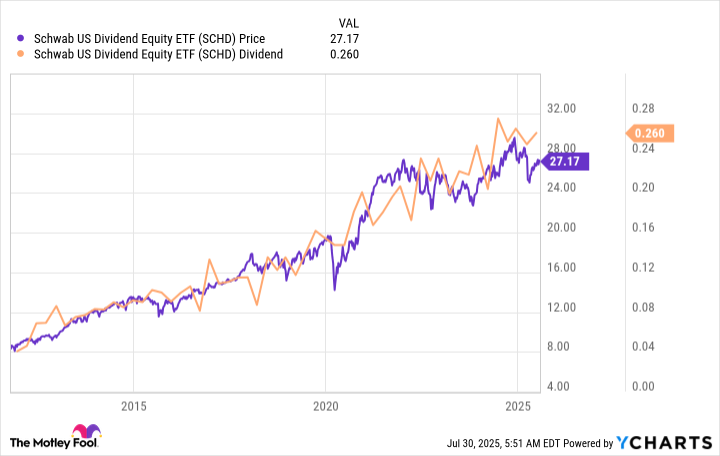

SCHD data by YCharts.

Notice in the chart above that the price of the Schwab U.S. Dividend Equity ETF and the dividend it pays have trended generally higher over time. There will be zigs and zags along the way, of course, but buying good companies with growing dividends has worked very well so far.

Should you buy the ETF today?

There are nuanced answers to the question of whether or not to buy today, given that the market is trading near all-time highs right now. But history suggests that sticking to a long-term investment plan is going to be more beneficial for most investors than trying to time the market. So if you are an income-focused investor looking for a simple investment, even today, buying the Schwab U.S. Dividend Equity ETF is likely to be a good long-term investment choice.

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10