ASX Growth Companies With High Insider Ownership August 2025

As the Australian market faces a challenging period with the ASX 200 futures down in response to impending U.S. tariffs, investors are closely monitoring economic developments that could impact growth prospects. In such uncertain times, companies with high insider ownership often attract attention as they may indicate strong confidence from those who know the business best, potentially offering stability and resilience amidst broader market volatility.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Newfield Resources (ASX:NWF) | 31.5% | 72.1% |

| Image Resources (ASX:IMA) | 22.3% | 79.8% |

| Gratifii (ASX:GTI) | 17.9% | 114.0% |

| Findi (ASX:FND) | 33.6% | 91.2% |

| Fenix Resources (ASX:FEX) | 21.1% | 53.9% |

| Echo IQ (ASX:EIQ) | 18% | 51.4% |

| Cyclopharm (ASX:CYC) | 11.3% | 97.8% |

| BlinkLab (ASX:BB1) | 39.8% | 52.7% |

| Alfabs Australia (ASX:AAL) | 10.8% | 41.3% |

| Acrux (ASX:ACR) | 15.5% | 106.9% |

Click here to see the full list of 99 stocks from our Fast Growing ASX Companies With High Insider Ownership screener.

We're going to check out a few of the best picks from our screener tool.

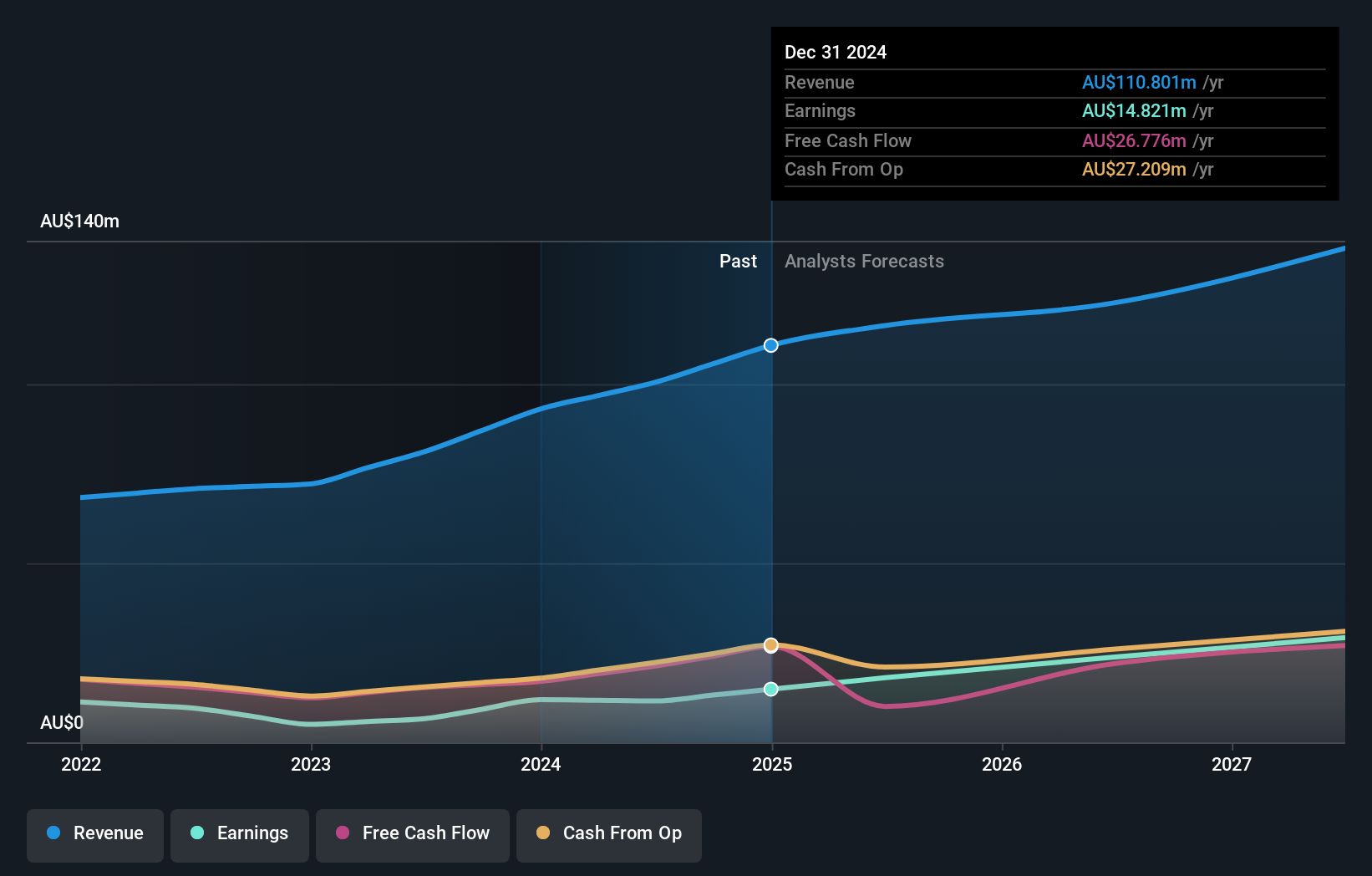

Australian Ethical Investment (ASX:AEF)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Australian Ethical Investment Ltd is a publicly owned investment manager with a market cap of A$875.60 million, focusing on ethical and sustainable investment strategies.

Operations: The company generates revenue primarily from its Funds Management segment, amounting to A$110.80 million.

Insider Ownership: 21.8%

Australian Ethical Investment is poised for growth, with revenue projected to increase by 10.9% annually, outpacing the broader Australian market. The company's earnings grew by 24.6% last year and are expected to rise significantly over the next three years, surpassing market averages. Its return on equity is forecasted to reach a very high level in three years, indicating strong profitability potential. Despite no recent insider trading activity, these factors highlight its growth prospects.

- Dive into the specifics of Australian Ethical Investment here with our thorough growth forecast report.

- Our comprehensive valuation report raises the possibility that Australian Ethical Investment is priced higher than what may be justified by its financials.

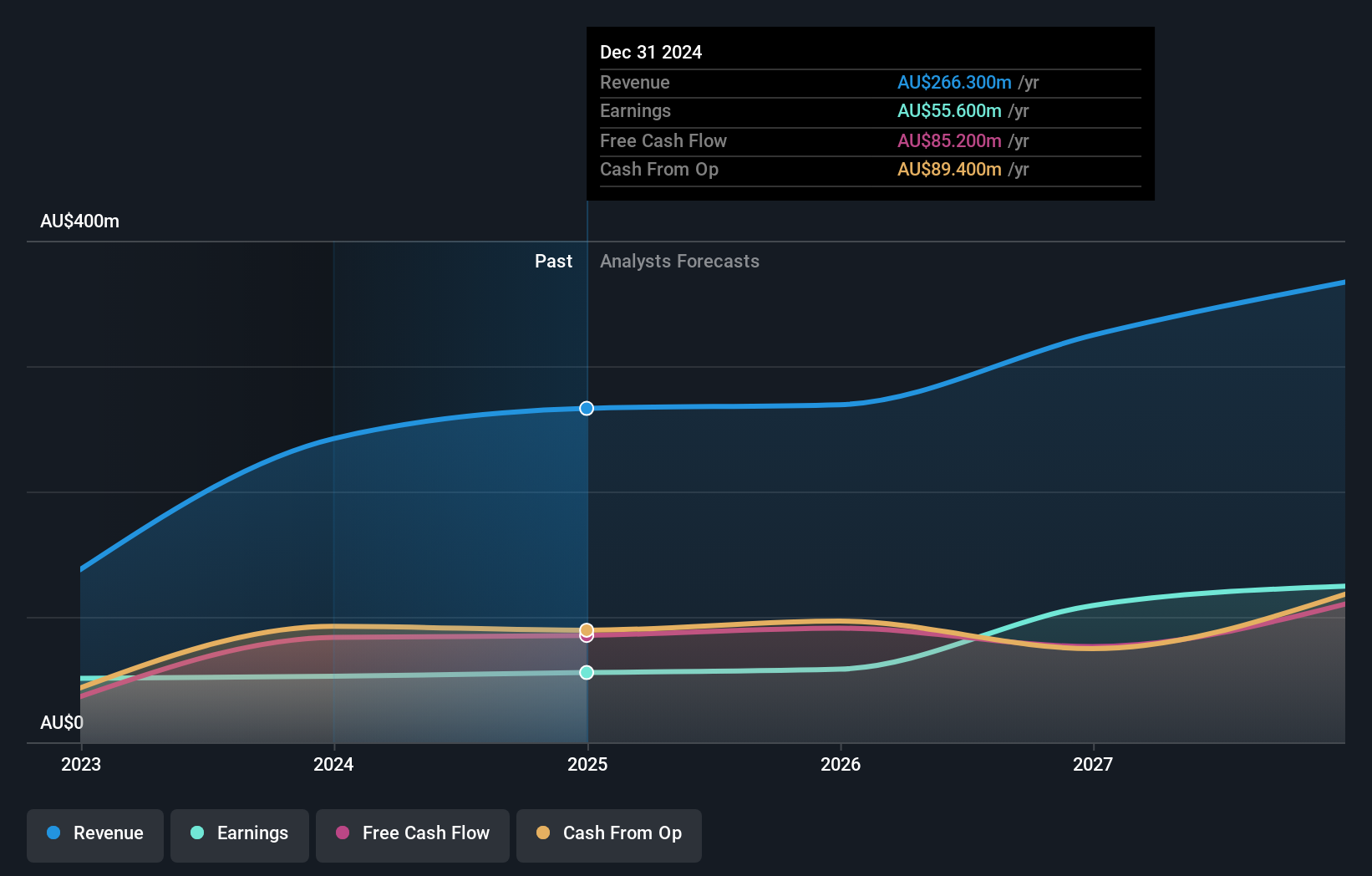

GemLife Communities Group (ASX:GLF)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: GemLife Communities Group operates as a developer, builder, owner, and operator in the land lease community sector, providing resort-style communities for homeowners aged 50 and over in Australia with a market cap of A$1.65 billion.

Operations: GemLife Communities Group generates revenue through its activities in developing, constructing, owning, and managing resort-style residential communities for individuals aged 50 and above within Australia.

Insider Ownership: 26.6%

GemLife Communities Group recently completed a significant A$750 million IPO, enhancing its capital base. The company's earnings are forecast to grow at 29.7% annually, outpacing the Australian market's average growth rate of 10.7%. Despite trading below fair value and having illiquid shares, GemLife's revenue is expected to grow faster than the market at 11.7% per year. However, interest payments are not well covered by earnings, which could pose financial challenges.

- Unlock comprehensive insights into our analysis of GemLife Communities Group stock in this growth report.

- Our expertly prepared valuation report GemLife Communities Group implies its share price may be too high.

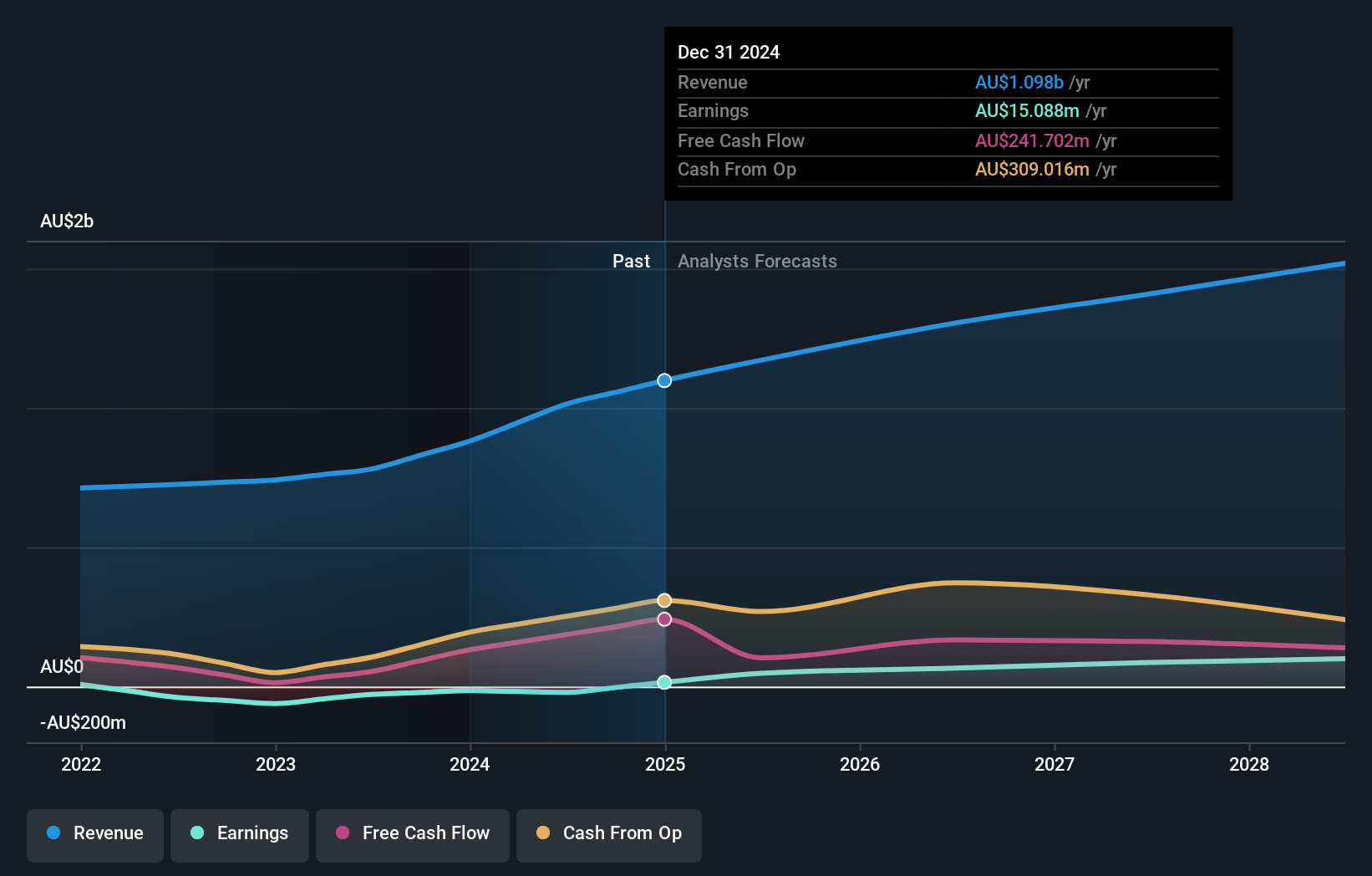

Regis Healthcare (ASX:REG)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Regis Healthcare Limited provides residential aged care services in Australia and has a market cap of A$2.55 billion.

Operations: The company's revenue is primarily derived from its residential aged care services, totaling A$1.10 billion.

Insider Ownership: 39%

Regis Healthcare is experiencing significant earnings growth, forecasted at 24.4% annually, outpacing the Australian market's average. Despite negative shareholder equity and trading at 31.5% below fair value, Regis became profitable this year. Insider activity shows substantial selling over the past three months without notable buying. Revenue is expected to grow by 7.9% per year, slower than high-growth benchmarks but still above market averages. Return on Equity is projected to be very high in three years.

- Click here and access our complete growth analysis report to understand the dynamics of Regis Healthcare.

- Our valuation report unveils the possibility Regis Healthcare's shares may be trading at a premium.

Make It Happen

- Gain an insight into the universe of 99 Fast Growing ASX Companies With High Insider Ownership by clicking here.

- Interested In Other Possibilities? Rare earth metals are the new gold rush. Find out which 25 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10