If You'd Invested $3,000 in Nvidia (NVDA) Stock 20 Years Ago, Here's How Much You'd Have Today

-

The answer may make you want to kick yourself.

-

Hindsight is 20-20, and few back then expected Nvidia to grow so quickly.

-

You still may do well investing in the company now.

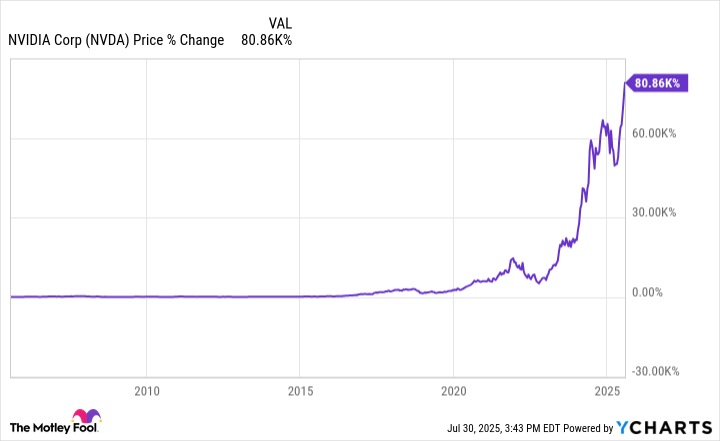

Here's a question and answer that might make you kick yourself: If you'd invested $3,000 in shares of Nvidia (NVDA -1.79%) 20 years ago, what would it be worth today?

The answer: $2.3 million. (It would be even better if you had reinvested your dividends in more shares of Nvidia along the way. Your stake would be worth around $2.5 million.)

That's an average annual gain of 39.5%! The S&P 500 averaged a solid 9.22% in the same period.

Image source: Getty Images.

Don't be too hard on yourself if you missed the monster growth, though. Ask 100 people, and you may not find one who invested in Nvidia back in 2005 and held on.

Holding on to great companies for many years, if not decades, is one of the best ways to build wealth, but it's easier said than done. For one thing, it's not always clear which companies will become long-term winners, and even some extremely promising companies fall on hard times occasionally, with their stock sinking. It can be hard psychologically to not sell shares `at those times.

For a long time, Nvidia was a semiconductor company specializing in chips for gaming. It was very successful at that, but its explosive growth in recent years is largely due to its dominance in chips for data centers, which are in high demand due to artificial intelligence (AI) computing activities.

NVDA data by YCharts

Too late to buy?

While it's too late to buy shares of Nvidia in 2005, it's not too late to buy shares in 2025, and they don't look terribly overvalued at recent levels, either -- despite the stock hitting an all-time high. Nvidia's recent forward price-to-earnings ratio (P/E) of 38 is roughly on par with its five-year average of 39.

In its last quarter, Nvidia's revenue popped by 69%, with double-digit gains expected in the quarters to come. If you expect the use of AI to increase in the near future along with more demand for data centers and the chips on which they run, take a closer look at Nvidia.

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10