Old Dominion Freight Line (ODFL) Sees 10% Stock Drop Over Last Quarter

Old Dominion Freight Line (ODFL) reported disappointing second-quarter earnings, with sales and net income both declining compared to the previous year. Despite affirmative news about a 7.7% dividend increase and share repurchase activity, ODFL saw its stock fall by 10.23% over the past quarter. This decline mirrored broader market concerns, as stocks generally fell due to weak job reports and renewed tariff worries. Old Dominion's on-market total return decline may have been amplified by these external economic pressures, alongside its own decreased financial performance, reinforcing the downward trend across the transportation sector.

Buy, Hold or Sell Old Dominion Freight Line? View our complete analysis and fair value estimate and you decide.

AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

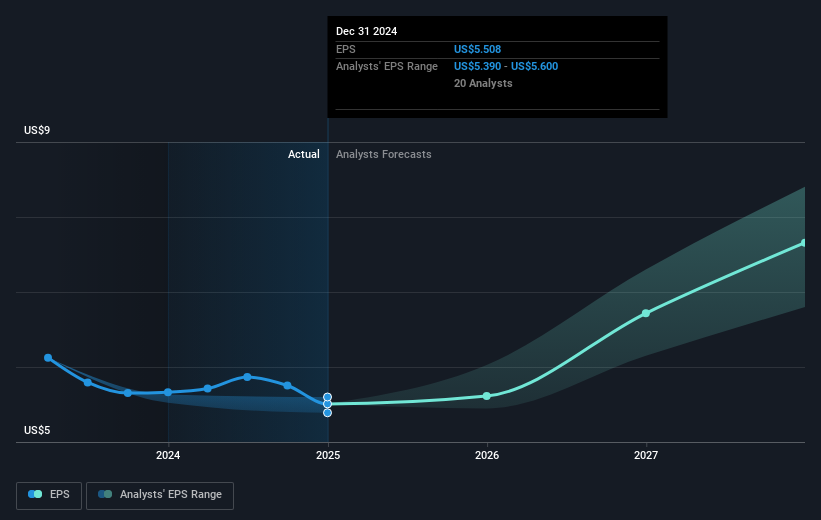

The disappointing second-quarter earnings reported by Old Dominion Freight Line have intensified the potential challenges discussed in the company's narrative, especially in terms of revenue growth and margin pressures. With sales and net income both declining compared to the previous year, forecasting a revenue increase of 5.4% annually over three years may prove difficult if economic conditions remain unfavorable and less-than-truckload volumes continue to decrease. The company's efforts to improve operating efficiency and protect its operating ratio are crucial to mitigate the impact of rising overhead costs and maintain net margins.

Old Dominion's total shareholder return of 55.86% over the past five years provides a broader context of its performance, showing resilience and solid returns in the long run despite the recent quarterly setback. This compares favorably to its one-year underperformance relative to the US Transportation Industry, which experienced a 7.5% increase, highlighting the impact of current economic challenges on its recent share price behavior. When compared against the analyst price target of $161.82, the current share price of $141.85 suggests a potential undervaluation by market players in the context of long-term growth potential, despite short-term headwinds.

Jump into the full analysis health report here for a deeper understanding of Old Dominion Freight Line.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10