AAVE crypto price crashes as its top network metrics surge

AAVE crypto price continued its freefall this week, hitting its lowest level since June 28. The token has entered a local bear market after falling 23% from its July high of $337.

- Aave crypto has moved into a local bear market after falling by 23% from the July high.

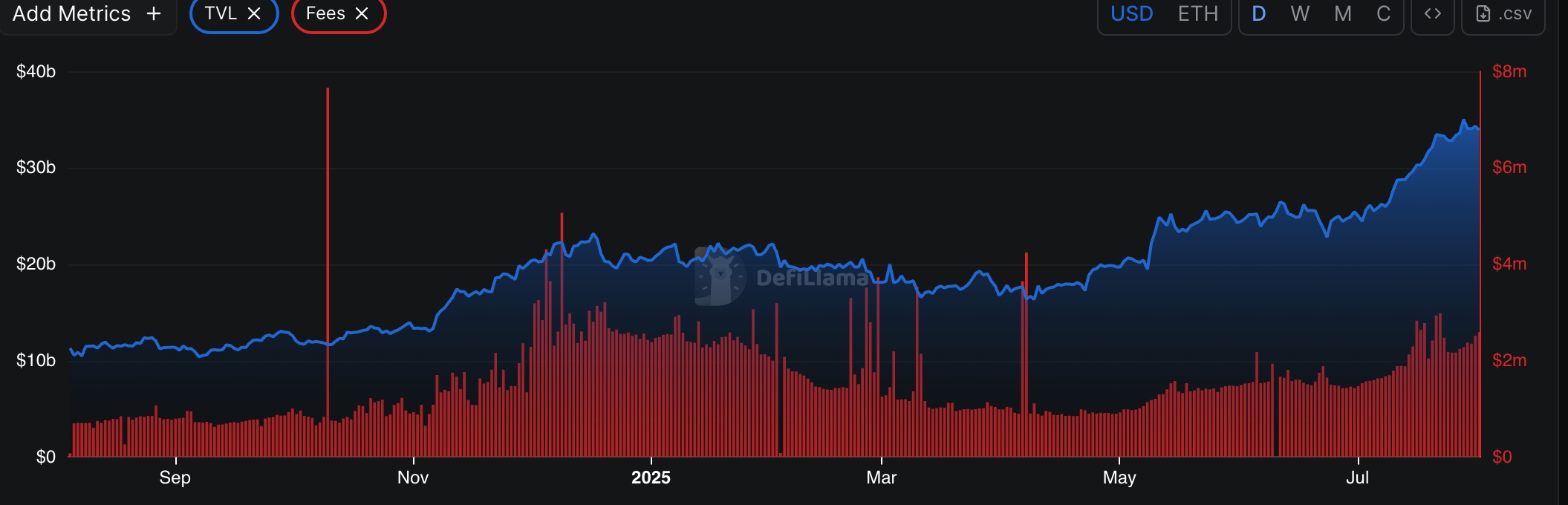

- The total value locked in the ecosystem surged to a record high this week.

- Data shows that the fees and revenue in the network is soaring.

AAVE crypto price crashed despite booming ecosystem

Aave (AAVE), the biggest player in the decentralized finance industry, is firing on all cylinders as its assets and fees jump.

DeFi Llama data shows that the total value locked in the ecosystem jumped to a record high of $35 billion this week. This is a strong surge for a platform that started the year with $21 billion in assets.

One of the main catalysts for the surge is Ethena (ENA), whose assets have jumped to nearly $5 billion recently. Dune Analytics data shows that they have jumped by over $1 billion in the past two days.

This growth has led to a big increase in its fees. Data shows that AAVE has collected over $783 million in fees in the last 12 months. Its annualized earnings have jumped to $47 million, while the revenue soared to over $110 million.

Data from TokenTerminal shows that Aave’s net deposits rose by 21% in July, with active loans increasing by 25% to $20.5 billion. Monthly fees and revenue grew by 49% and 85%, respectively.

This growth comes as the DeFi lending space becomes increasingly competitive, with platforms like Morpho, Compound Finance, and Maple Finance gaining ground.

AAVE price technical analysis

The daily chart shows that AAVE has been in a steep decline after peaking at $337.25 in July. The drop coincided with a broader sell-off across crypto markets.

AAVE has fallen below both the 50-day and 100-day Exponential Moving Averages and is approaching the psychological support level of $250. The Relative Strength Index is also nearing oversold territory.

The token is now sitting at an ascending trendline connecting the lowest swing points since April 7. A potential rebound could send it toward resistance at the Murrey Math Lines level of $312. However, a break below the trendline would invalidate this bullish scenario.

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10