Airbnb, Inc. (NASDAQ:ABNB) will release earnings results for the second quarter, after the closing bell on Wednesday, Aug. 6.

Analysts expect the San Francisco, California-based company to report quarterly earnings at 94 cents per share, up from 86 cents per share in the year-ago period. Airbnb projects to report quarterly revenue at $3.03 billion, compared to $2.75 billion a year earlier, according to data from Benzinga Pro.

On May 1, Airbnb said its first-quarter revenue increased 6% year-over-year to $2.27 billion, beating analyst estimates of $2.26 billion, according to Benzinga Pro.

Airbnb shares fell 0.8% to close at $129.96 on Tuesday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

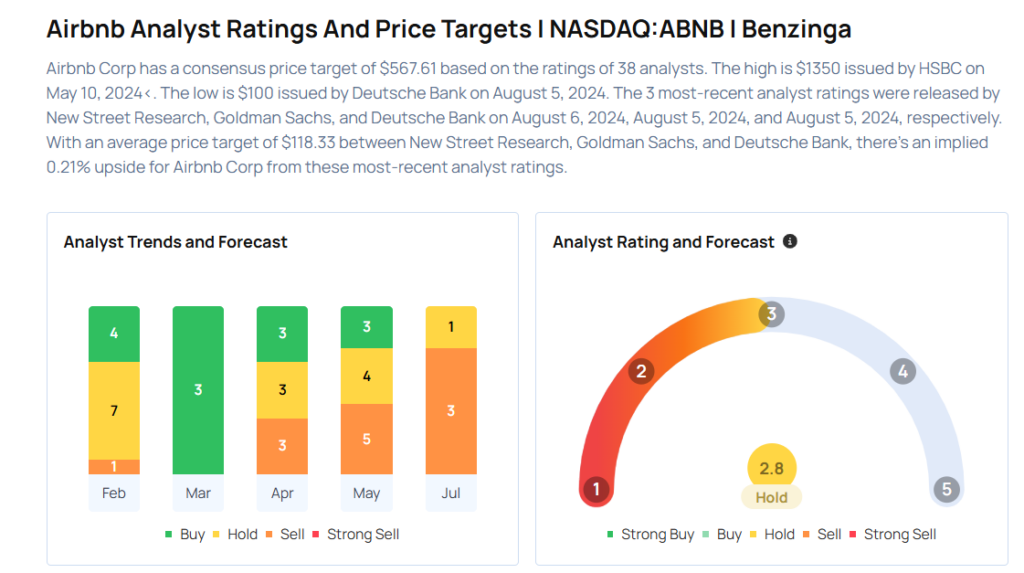

Let's have a look at how Benzinga's most-accurate analysts have rated the company in the recent period.

- UBS analyst Stephen Ju maintained a Neutral rating and increased the price target from $137 to $156 on July 28, 2025. This analyst has an accuracy rate of 75%.

- Morgan Stanley analyst Brian Nowak maintained an Underweight rating and increased the price target from $125 to $130 on July 21, 2025. This analyst has an accuracy rate of 69%.

- Wells Fargo analyst Ken Gawrelski maintained an Underweight rating and boosted the price target from $104 to $111 on July 7, 2025. This analyst has an accuracy rate of 77%.

- Truist Securities analyst Patrick Scholes downgraded the stock from Hold to Sell and cut the price target from $112 to $106 on May 30, 2025. This analyst has an accuracy rate of 69%.

- Cantor Fitzgerald analyst Deepak Mathivanan reiterated an Underweight rating with a price target of $100 on May 14, 2025. This analyst has an accuracy rate of 80%.

Considering buying ABNB stock? Here’s what analysts think:

Read This Next:

- Top 2 Health Care Stocks You May Want To Dump In Q3

Photo via Shutterstock