Will DXC Technology’s (DXC) AI Security Push Reshape Its Long-Term Competitive Edge?

- In recent days, DXC Technology announced new partnerships in AI-driven security operations and digital accessibility, including a multi-million customer engagement with Banco Sabadell, alongside reporting its first quarter fiscal 2026 earnings and updated revenue guidance for the rest of the year.

- A key highlight is the launch of DXC’s AI-powered Security Operations Center with 7AI, which promises substantial cost efficiencies and strengthens their position in managed security services.

- We will assess how this AI-centered service launch could influence DXC’s long-term investment outlook and business transformation narrative.

AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

DXC Technology Investment Narrative Recap

To be a shareholder in DXC Technology today, you need confidence in the company’s ability to pivot from persistent revenue declines toward lasting digital growth, while navigating operational restructuring and leadership changes. The first-quarter results and renewed guidance confirm that organic revenue is still forecast to contract by 3–5% in fiscal 2026, keeping the spotlight on slow top-line recovery as the most material short-term risk; the recent product and client wins, while promising, do not offset this near-term revenue pressure.

Among the recent announcements, the launch of DXC’s AI-powered Security Operations Center in partnership with 7AI stands out, delivering measurable efficiency gains to clients and positioning DXC as a player in automation-driven cyber services. While this initiative could build credibility for future contract bookings and support medium-term catalysts, it does not materially change the urgency for DXC to accelerate high-quality, scalable digital revenue near term.

By contrast, investors should also have clear visibility into ongoing execution risks such as leadership turnover and its impact on strategy, since...

Read the full narrative on DXC Technology (it's free!)

DXC Technology's narrative projects $12.3 billion in revenue and $246.9 million in earnings by 2028. This requires a 1.6% annual revenue decline and a $142.1 million decrease in earnings from the current $389.0 million.

Uncover how DXC Technology's forecasts yield a $16.50 fair value, a 25% upside to its current price.

Exploring Other Perspectives

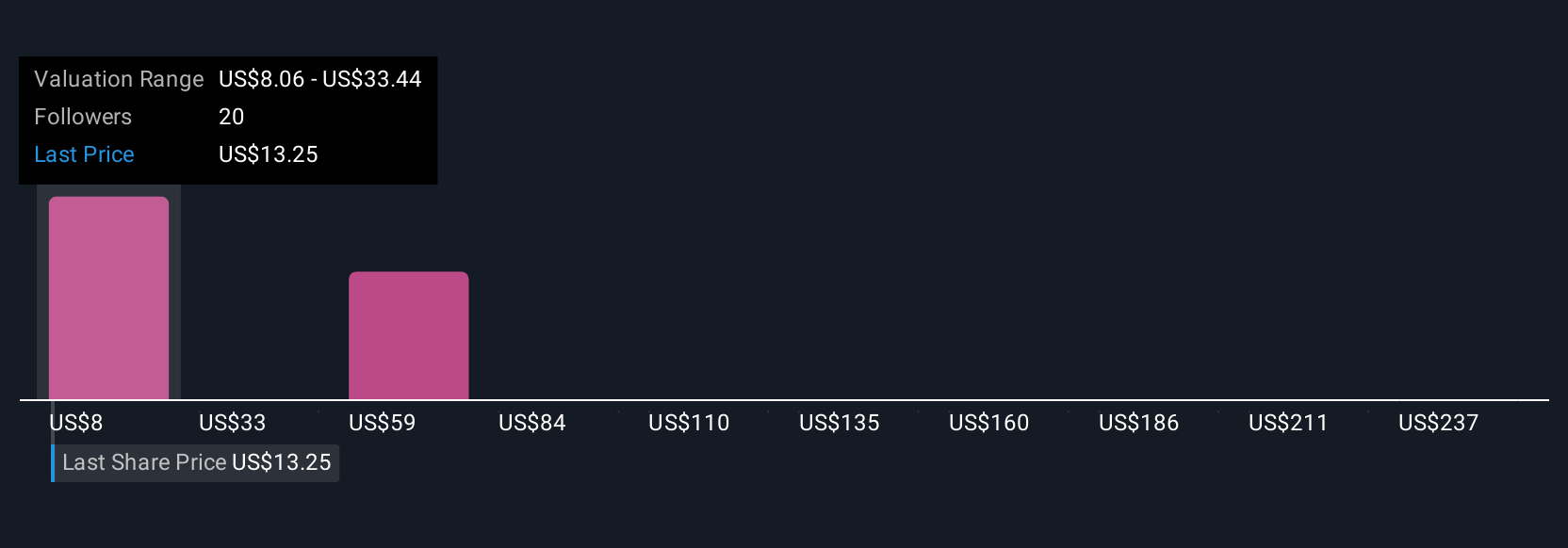

Fair value estimates from six Simply Wall St Community members for DXC range dramatically from US$8.06 to US$261.89 per share. Yet, persistent organic revenue decline remains a core concern that could shape DXC’s performance for those weighing various outlooks.

Explore 6 other fair value estimates on DXC Technology - why the stock might be worth 39% less than the current price!

Build Your Own DXC Technology Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your DXC Technology research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free DXC Technology research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate DXC Technology's overall financial health at a glance.

Curious About Other Options?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 19 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10