Kimberly-Clark Corporation (NASDAQ:KMB) posted better-than-expected earnings for the second quarter on Friday.

The company reported second-quarter adjusted earnings per share of $1.92, beating the analyst consensus estimate of $1.66. Quarterly sales of $4.20 billion (down 1.6% year over year) missed the Street view of $4.86 billion.

“Our second quarter results are indicative of the exceptional progress we are making executing our Powering Care strategy” said Kimberly-Clark Chairman and CEO, Mike Hsu. “This was a very active quarter and one of the strongest in our recent history. We delivered strong organic sales growth, fueled by the highest volume growth we’ve achieved in five years. Our durable brands, differentiated value propositions and innovation investments enabled us to enhance and maintain leading market share positions across categories and price tiers. We took decisive actions to set Kimberly-Clark up for enhanced, sustainable growth and profitability.

The company expects its 2025 adjusted operating profit to grow at a low-to-mid single-digit rate on a constant-currency basis versus the prior year. Adjusted earnings per share are expected to grow at a low-to-mid single-digit rate on a constant-currency basis, including a negative 320 basis point impact from a combination of its PPE divestiture and the exit of the company's private label diaper business in the US.

Kimberly-Clark shares gained 1.6% to trade at $132.71 on Monday.

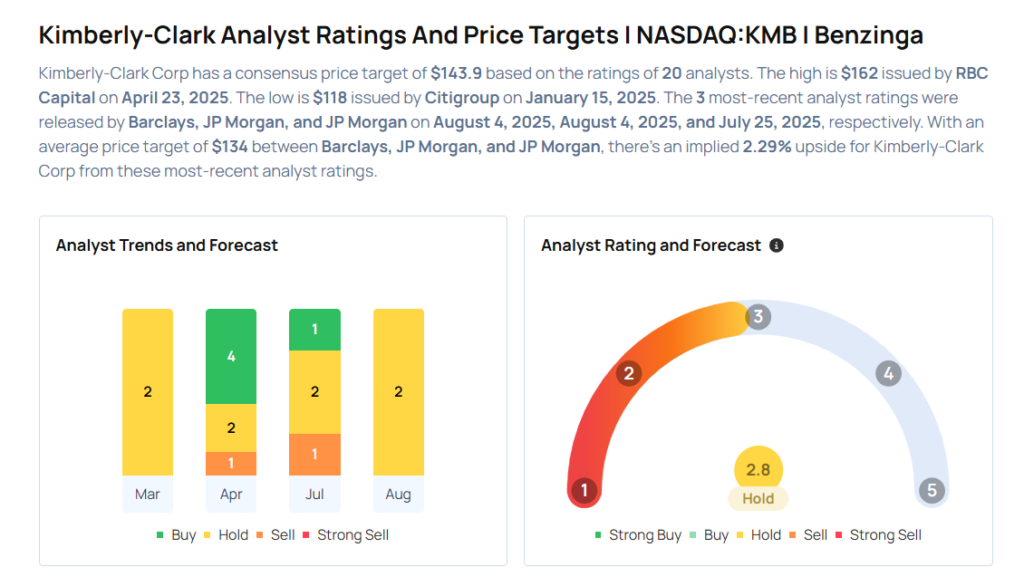

These analysts made changes to their price targets on Kimberly-Clark following earnings announcement.

- JP Morgan analyst Andrea Teixeira upgraded Kimberly-Clark from Underweight to Neutral and raised the price target from $125 to $138.

- Barclays analyst Lauren Lieberman maintained the stock with an Equal-Weight rating and raised the price target from $134 to $139.

Considering buying KMB stock? Here’s what analysts think:

Read This Next:

- Top 2 Financial Stocks That May Collapse This Month

Photo via Shutterstock