Why Lululemon Stock Lost 16% in July

-

Reports from Wall Street analysts revealed soft traffic at Lululemon stores and weak demand.

-

New tariffs, including a 20% rate on Vietnam, also added to customer concerns.

-

The stock looks cheap at a P/E ratio of just 13.

Shares of Lululemon Athletica (LULU 1.61%) were pulling back last month as concerns about the tariffs and the company's internal challenges weighed on the stock in a month when there was little company-specific news.

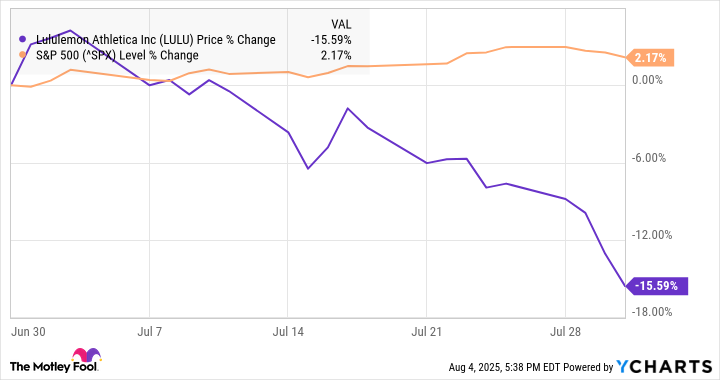

According to data from S&P Global Market Intelligence, the stock finished the month down 16%. As you can see from the chart below, an early July gain was wiped out by the second week of the month, and the stock fell sharply at the end of July as new tariff rates came into focus.

LULU data by YCharts.

Lululemon faces pressure

Lululemon stock has slumped this year as the athleisure pioneer has reported slowing growth and as tariff concerns have roiled the apparel industry.

The month began with gains in the stock after Lululemon sued another company for selling "dupes," or unauthorized imitations of its clothing that could infringe on its patents.

The following day, Jefferies came out with a negative note on the stock after the firm observed softer traffic at several stores in the Northeast and said that challenges were mounting across the business, including increased markdowns, new competition, and inventory outgrowing sales. The firm reiterated an underperform rating on the stock.

Later in the month, JPMorgan Chase echoed those concerns, downgrading the stock from overweight to neutral, and said customers weren't responding well to core seasonal colors, which represent 40% of its inventory. The analyst also noted a challenging macrobackdrop and said they expected the company to miss its fiscal 2026 targets.

Over the last week of July, the stock price fell as the Trump administration announced new tariff rates, including 20% on Vietnam, where 40% of its products are produced, and 19% on imports from Cambodia, where 17% of its products are produced.

Image source: Getty Images.

What's next for Lululemon

July's slide comes after a disappointing earnings report in June that included a comparable-sales increase of 1% and a decision to lay off 150 employees.

Lululemon is clearly facing challenges, especially when factoring in the risks around tariffs, but those seem more than priced in at a price-to-earnings (P/E) ratio of just 13.4, which is closer to what a struggling retailer like Target trades for.

The yoga-inspired apparel company is still delivering solid growth in China, and the company has overcome brand challenges in the past.

A P/E of 13 looks like a great price to pay for what's historically been a strong growth stock. If Lululemon can get past the current headwinds, the stock should be a winner.

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10