CVR Partners (UAN) Is Up 8.7% After Strong Q2 Results and Raised Distribution Has the Bull Case Changed?

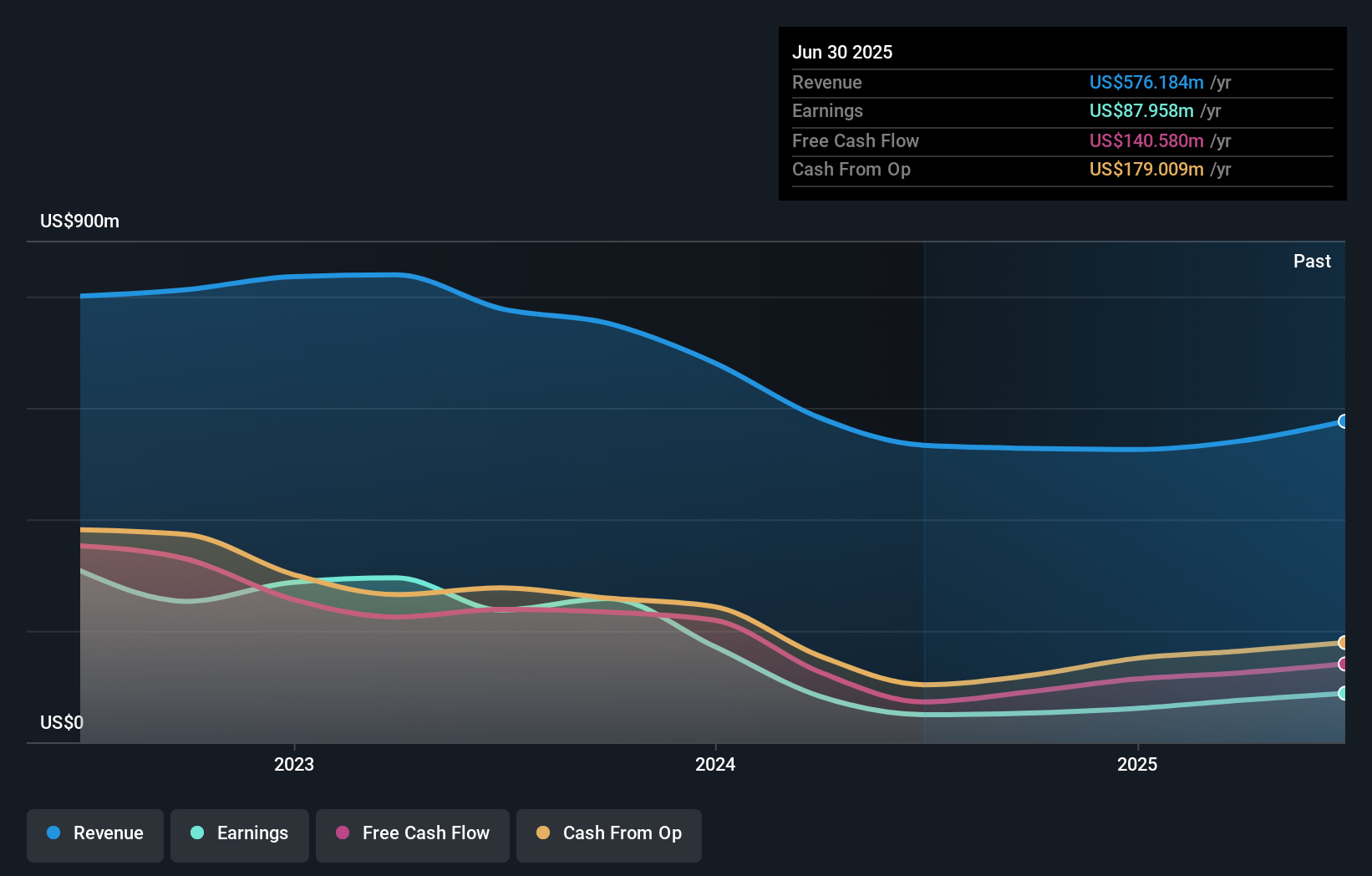

- CVR Partners reported strong second quarter 2025 results, including year-over-year increases in sales and net income, alongside a higher cash distribution of US$3.89 per common unit to be paid in August.

- The company plans capital projects to enhance operational flexibility and environmental compliance, with management changes also on the horizon as the current CEO prepares to lead both CVR Partners and its parent CVR Energy.

- We'll explore how the focus on feedstock flexibility and environmental upgrades could reshape CVR Partners' investment narrative amid market demand for fertilizers.

Outshine the giants: these 19 early-stage AI stocks could fund your retirement.

What Is CVR Partners' Investment Narrative?

To be a confident shareholder in CVR Partners right now, you need to believe in the company's ability to sustain strong cash distributions, manage feedstock costs, and adapt rapidly to shifting agricultural demand. The recent cash distribution increase and robust financials in Q2 signal management's priority on returning value, but the shelf registration filing for up to US$49.25 million, primarily for an ESOP-related offering, appears unlikely to materially change short-term catalysts. Production came in slightly below the prior year due to downtime, but price action remained positive, suggesting that investors remain focused on the demand outlook for fertilizer and the company’s margin resilience. The ramp-up in environmental upgrades and feedstock flexibility projects could reduce some operational risk, but the biggest near-term watchpoint remains production consistency amid fluctuating ammonia output and sector volatility. For now, the risks and catalysts haven’t dramatically shifted, but investor attention should stay on execution.

Yet, reliance on stable ammonia production is a risk investors shouldn’t underestimate.

CVR Partners' shares have been on the rise but are still potentially undervalued by 33%. Find out what it's worth.Exploring Other Perspectives

Explore 3 other fair value estimates on CVR Partners - why the stock might be worth as much as 49% more than the current price!

Build Your Own CVR Partners Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CVR Partners research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free CVR Partners research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CVR Partners' overall financial health at a glance.

Searching For A Fresh Perspective?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10