Industry Analysts Just Upgraded Their Coherus Oncology, Inc. (NASDAQ:CHRS) Revenue Forecasts By 21%

Shareholders in Coherus Oncology, Inc. (NASDAQ:CHRS) may be thrilled to learn that the analysts have just delivered a major upgrade to their near-term forecasts. The analysts have sharply increased their revenue numbers, with a view that Coherus Oncology will make substantially more sales than they'd previously expected.

AI is about to change healthcare. These 20 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10bn in marketcap - there is still time to get in early.

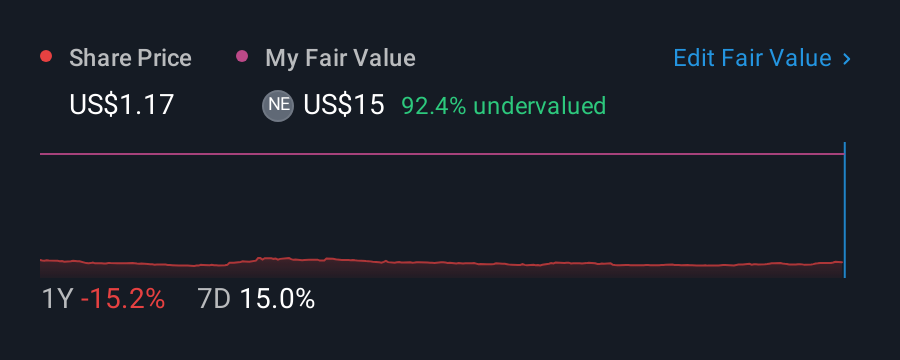

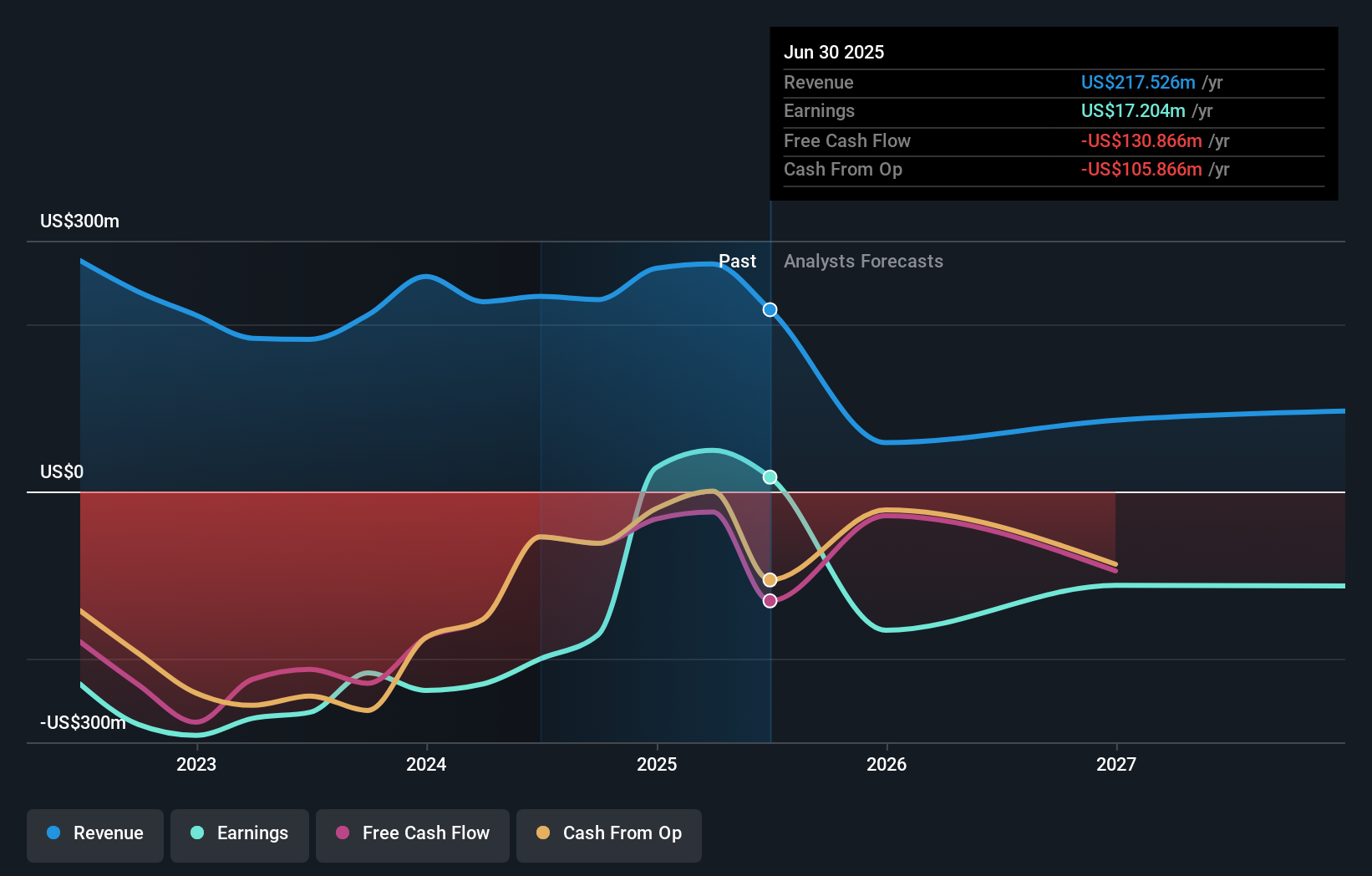

Following the latest upgrade, the current consensus, from the six analysts covering Coherus Oncology, is for revenues of US$58m in 2025, which would reflect a disturbing 73% reduction in Coherus Oncology's sales over the past 12 months. Before the latest update, the analysts were foreseeing US$48m of revenue in 2025. It looks like there's been a clear increase in optimism around Coherus Oncology, given the sizeable gain to revenue forecasts.

View our latest analysis for Coherus Oncology

Looking at the bigger picture now, one of the ways we can make sense of these forecasts is to see how they measure up against both past performance and industry growth estimates. Over the past five years, revenues have declined around 18% annually. Worse, forecasts are essentially predicting the decline to accelerate, with the estimate for an annualised 93% decline in revenue until the end of 2025. Compare this against analyst estimates for companies in the broader industry, which suggest that revenues (in aggregate) are expected to grow 19% annually. So while a broad number of companies are forecast to grow, unfortunately Coherus Oncology is expected to see its sales affected worse than other companies in the industry.

The Bottom Line

The highlight for us was that analysts increased their revenue forecasts for Coherus Oncology this year. They also expect company revenue to perform worse than the wider market. Seeing the dramatic upgrade to this year's forecasts, it might be time to take another look at Coherus Oncology.

Analysts are clearly in love with Coherus Oncology at the moment, but before diving in - you should be aware that we've identified some warning flags with the business, such as recent substantial insider selling. For more information, you can click through to our platform to learn more about this and the 3 other flags we've identified .

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are upgrading their estimates. So you may also wish to search this free list of stocks with high insider ownership.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10