Did a $10 Million Milestone from Merck Just Shift Janux Therapeutics' (JANX) Investment Narrative?

- Janux Therapeutics announced the dosing of the first patient in its TRACTr collaboration with Merck, which resulted in a US$10 million milestone payment as part of the ongoing clinical trials of their cancer immunotherapy candidates.

- This milestone underscores the potential of Janux's modular TRACTr platform to advance new treatment options in partnership with a major pharmaceutical company.

- We’ll explore how the collaboration milestone with Merck shapes Janux's investment narrative, especially regarding pipeline progress and partnerships.

Rare earth metals are the new gold rush. Find out which 26 stocks are leading the charge.

What Is Janux Therapeutics' Investment Narrative?

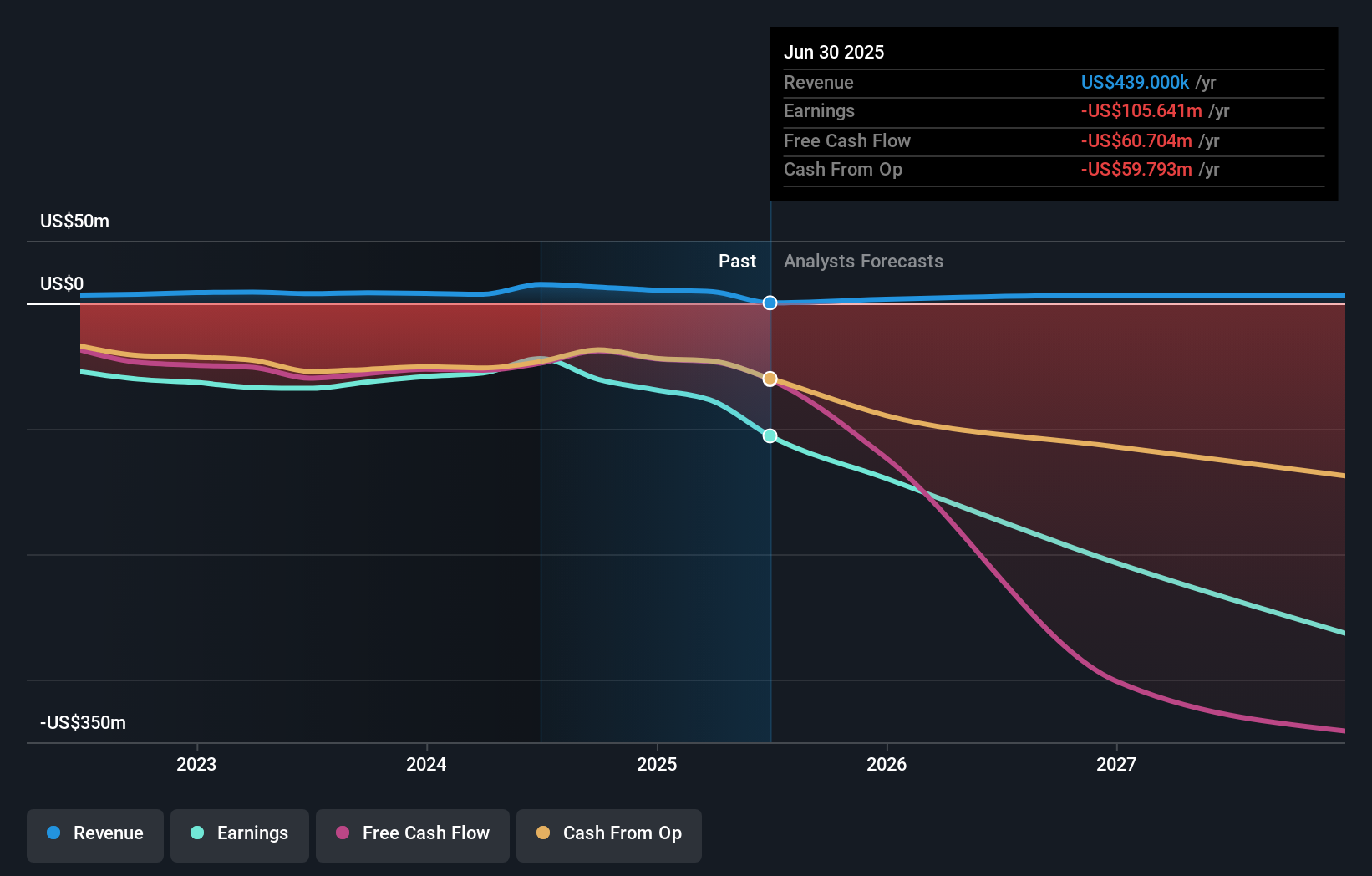

To be a shareholder in Janux Therapeutics, belief in the company's innovative immunotherapy platforms and potential to bring first-in-class cancer treatments to market is essential. The recent progress in its collaboration with Merck, including the first patient dosed and the US$10 million milestone payment, directly supports Janux's pipeline story and helps validate its technology with a major pharmaceutical partner. Yet, this news has caused only a modest positive share price reaction and does not appear to materially change the most important short-term catalysts or risks. Janux’s near-term outlook still relies on further clinical milestones, additional data readouts, and the ability to manage large operating losses that have accelerated year over year, highlighted by the recent increase in net losses. The key risk remains funding ongoing clinical programs amid unprofitability; a milestone payment adds runway, but financial pressure persists unless breakthrough results or additional partnerships arise. Investors should pay close attention to cash burn and future capital needs, as these factors shape both the upside and downside scenarios here.

But with higher expenses and deeper losses, the funding challenge shouldn’t be underestimated. The analysis detailed in our Janux Therapeutics valuation report hints at an inflated share price compared to its estimated value.Exploring Other Perspectives

Explore 2 other fair value estimates on Janux Therapeutics - why the stock might be worth over 6x more than the current price!

Build Your Own Janux Therapeutics Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Janux Therapeutics research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Janux Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Janux Therapeutics' overall financial health at a glance.

Looking For Alternative Opportunities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10