Top Dividend Stocks To Consider In August 2025

As of August 2025, the U.S. markets are experiencing a robust upswing, with the Nasdaq reaching record highs and major indexes posting solid weekly gains amid easing concerns over tariffs and economic health. This positive momentum presents an opportune moment to explore dividend stocks, which can offer investors a blend of income and potential capital appreciation in a thriving market environment.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Valley National Bancorp (VLY) | 4.68% | ★★★★★☆ |

| Peoples Bancorp (PEBO) | 5.76% | ★★★★★☆ |

| Huntington Bancshares (HBAN) | 3.85% | ★★★★★☆ |

| First Interstate BancSystem (FIBK) | 6.43% | ★★★★★★ |

| Ennis (EBF) | 5.51% | ★★★★★★ |

| Douglas Dynamics (PLOW) | 3.82% | ★★★★★☆ |

| Dillard's (DDS) | 5.52% | ★★★★★★ |

| Columbia Banking System (COLB) | 5.98% | ★★★★★★ |

| Citizens & Northern (CZNC) | 5.99% | ★★★★★☆ |

| Archer-Daniels-Midland (ADM) | 3.53% | ★★★★★☆ |

Click here to see the full list of 142 stocks from our Top US Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

Copa Holdings (CPA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Copa Holdings, S.A. operates through its subsidiaries to offer airline passenger and cargo transport services, with a market cap of approximately $4.86 billion.

Operations: Copa Holdings generates revenue primarily from its air transportation segment, which accounted for $3.48 billion.

Dividend Yield: 5.5%

Copa Holdings offers a dividend yield of 5.47%, placing it in the top 25% of US market payers, though its dividends have been volatile over the past decade. The company's payout ratio is reasonable at 41.9%, but high cash payout ratios indicate dividends are not well covered by free cash flows. Recent earnings show growth, with Q2 revenue at US$842.6M and net income rising to US$148.91M, supporting potential future payouts despite past unreliability.

- Click here and access our complete dividend analysis report to understand the dynamics of Copa Holdings.

- The analysis detailed in our Copa Holdings valuation report hints at an deflated share price compared to its estimated value.

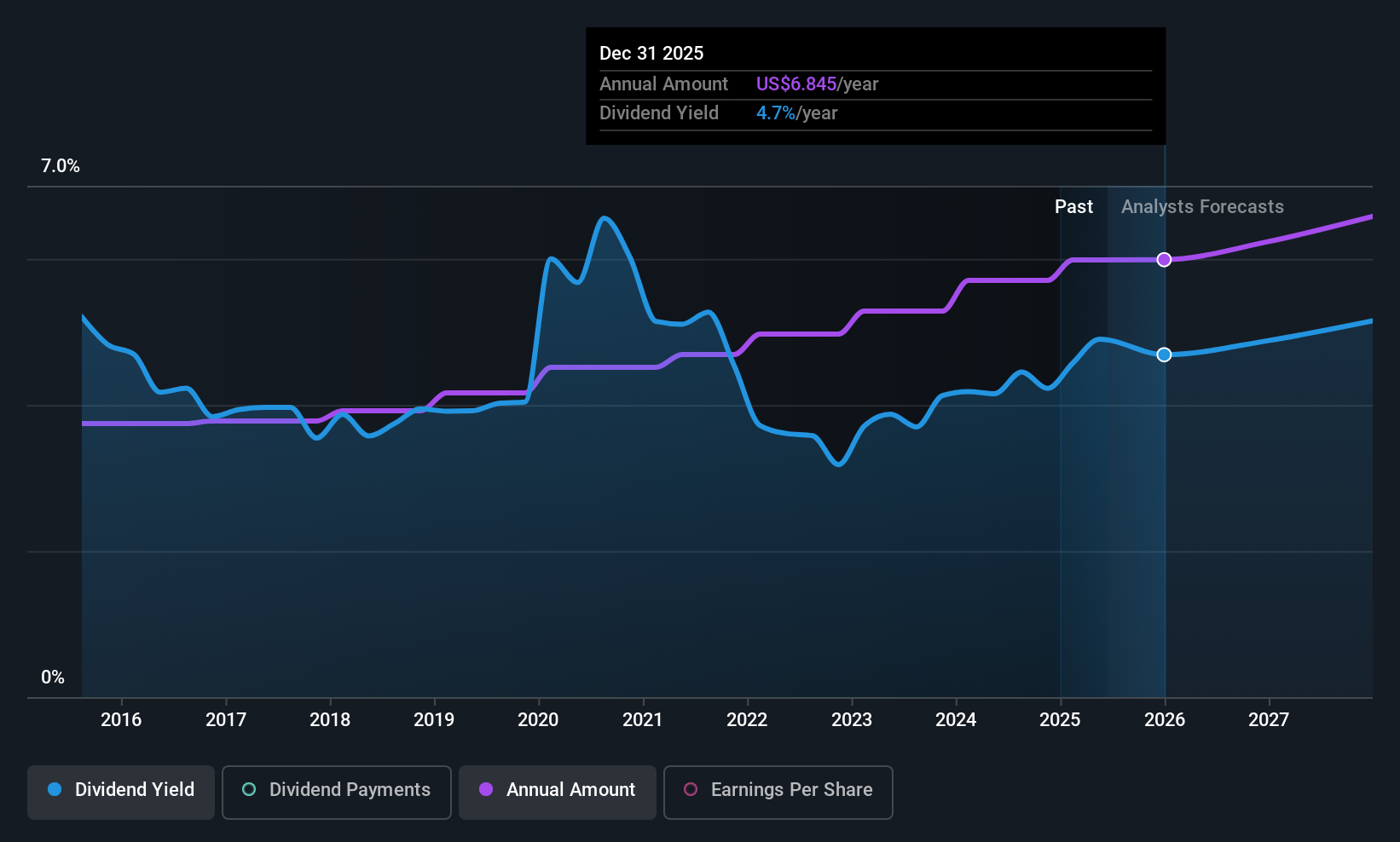

Chevron (CVX)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Chevron Corporation, with a market cap of $314.55 billion, operates through its subsidiaries in integrated energy and chemicals sectors both in the United States and internationally.

Operations: Chevron Corporation generates revenue through its Upstream operations in the United States ($46.35 billion) and internationally ($46.48 billion), as well as its Downstream operations in the United States ($77.86 billion) and internationally ($73.13 billion).

Dividend Yield: 4.4%

Chevron's dividend payments are well-covered by both earnings and cash flows, with a payout ratio of 85.7% and a cash payout ratio of 86.2%. The company has maintained stable and reliable dividends over the past decade, though its current yield of 4.41% is slightly below top-tier US payers. Recent earnings show a decline in net income to US$2.49 billion for Q2 2025 from US$4.43 billion a year ago, yet dividends remain affirmed at $1.71 per share, reflecting ongoing commitment despite legal challenges and asset restructuring efforts in Asia.

- Delve into the full analysis dividend report here for a deeper understanding of Chevron.

- The valuation report we've compiled suggests that Chevron's current price could be inflated.

Macy's (M)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Macy's, Inc. is an omni-channel retail organization that operates stores, websites, and mobile applications in the United States with a market cap of approximately $3.28 billion.

Operations: Macy's generates its revenue primarily from its retail department stores, amounting to $22.80 billion.

Dividend Yield: 6%

Macy's dividend payments are covered by earnings and cash flows, with payout ratios of 35.1% and 77.7%, respectively. However, dividends have been unstable over the past decade, showing volatility and decline. Macy's faces financial challenges with high debt levels but trades at a good value relative to peers. Recent initiatives include a US$250 million debt tender offer and new brand collaborations to enhance its product portfolio, though sales have recently declined from US$5 billion to US$4.79 billion year-over-year.

- Navigate through the intricacies of Macy's with our comprehensive dividend report here.

- Our expertly prepared valuation report Macy's implies its share price may be lower than expected.

Where To Now?

- Explore the 142 names from our Top US Dividend Stocks screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10