Under Armour, Inc. (NYSE:UAA) reported first-quarter fiscal 2026 results that met or exceeded internal expectations but missed Wall Street estimates on Friday.

Revenue declined 4% year over year to $1.13 billion, falling short of the $1.154 billion consensus estimate. The company reported a GAAP net loss of $3 million, or 1 cent per diluted share, and adjusted net income of $9 million, or 2 cents per share, up from 1 cent a year ago.

"Despite ongoing uncertainty, our brand is gaining strength and we're executing our strategic plan with clarity and confidence," said President and CEO Kevin Plank.

For the second quarter of fiscal 2026, Under Armour expects revenue between $1.055 billion and $1.066 billion, well below the $1.374 billion analyst estimate. Adjusted diluted earnings per share are projected to range from 1 to 2 cents, compared to the 28 cents consensus.

The outlook calls for a low double-digit revenue decline in North America, high single-digit growth in EMEA, and a low-teens decline in Asia-Pacific.

Under Armour shares fell 4.1% to trade at $5.22 on Monday.

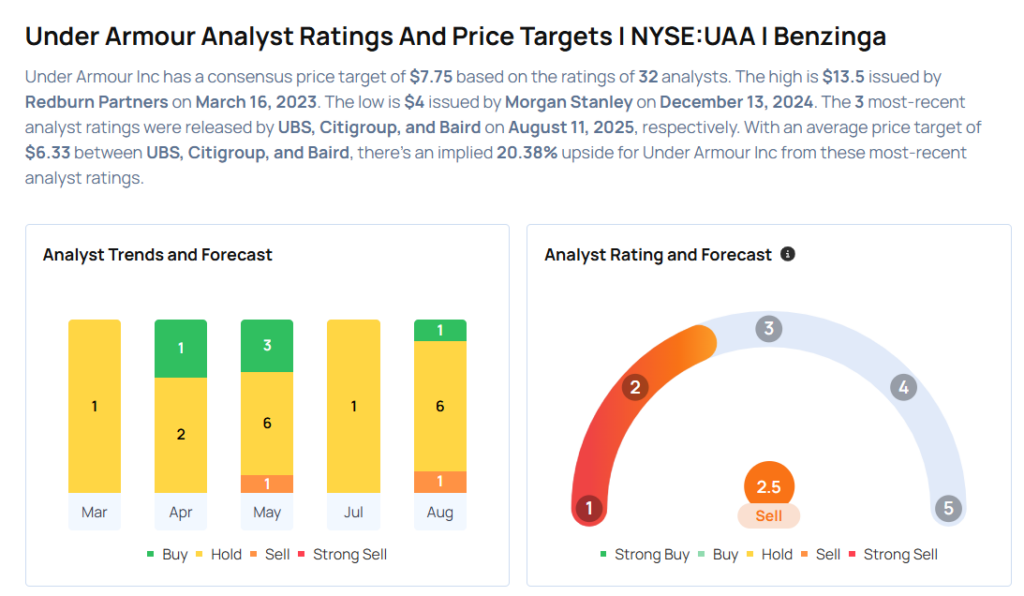

These analysts made changes to their price targets on Under Armour following earnings announcement.

- Telsey Advisory Group analyst Cristina Fernandez maintained Under Armour with a Market Perform and lowered the price target from $7 to $5.

- B of A Securities analyst Lorraine Hutchinson maintained the stock with a Neutral and lowered the price target from $8 to $6.5.

- Baird analyst Jonathan Komp maintained Under Armour with a Neutral and slashed the price target from $7 to $6.

- Citigroup analyst Paul Lejuez maintained Under Armour with a Neutral and lowered the price target from $6 to $5.5.

- UBS analyst Jay Sole maintained the stock with a Buy and lowered the price target from $8 to $7.5.

Considering buying UAA stock? Here’s what analysts think:

Read This Next:

- Wall Street’s Most Accurate Analysts Give Their Take On 3 Tech And Telecom Stocks Delivering High-Dividend Yields

Photo via Shutterstock