Be Sure To Check Out Penske Automotive Group, Inc. (NYSE:PAG) Before It Goes Ex-Dividend

Penske Automotive Group, Inc. (NYSE:PAG) is about to trade ex-dividend in the next 4 days. The ex-dividend date occurs one day before the record date, which is the day on which shareholders need to be on the company's books in order to receive a dividend. The ex-dividend date is of consequence because whenever a stock is bought or sold, the trade takes at least one business day to settle. Accordingly, Penske Automotive Group investors that purchase the stock on or after the 15th of August will not receive the dividend, which will be paid on the 3rd of September.

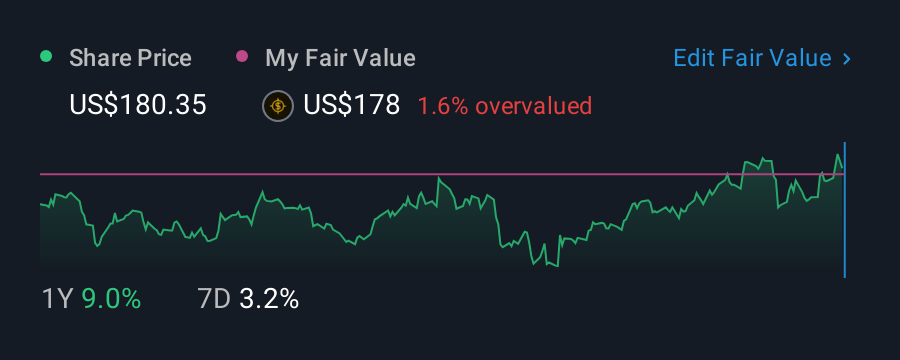

The company's next dividend payment will be US$1.32 per share, and in the last 12 months, the company paid a total of US$5.28 per share. Looking at the last 12 months of distributions, Penske Automotive Group has a trailing yield of approximately 3.0% on its current stock price of US$174.83. Dividends are an important source of income to many shareholders, but the health of the business is crucial to maintaining those dividends. We need to see whether the dividend is covered by earnings and if it's growing.

We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned in profit, then the dividend could be unsustainable. Fortunately Penske Automotive Group's payout ratio is modest, at just 35% of profit. Yet cash flow is typically more important than profit for assessing dividend sustainability, so we should always check if the company generated enough cash to afford its dividend. Thankfully its dividend payments took up just 49% of the free cash flow it generated, which is a comfortable payout ratio.

It's positive to see that Penske Automotive Group's dividend is covered by both profits and cash flow, since this is generally a sign that the dividend is sustainable, and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut.

View our latest analysis for Penske Automotive Group

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

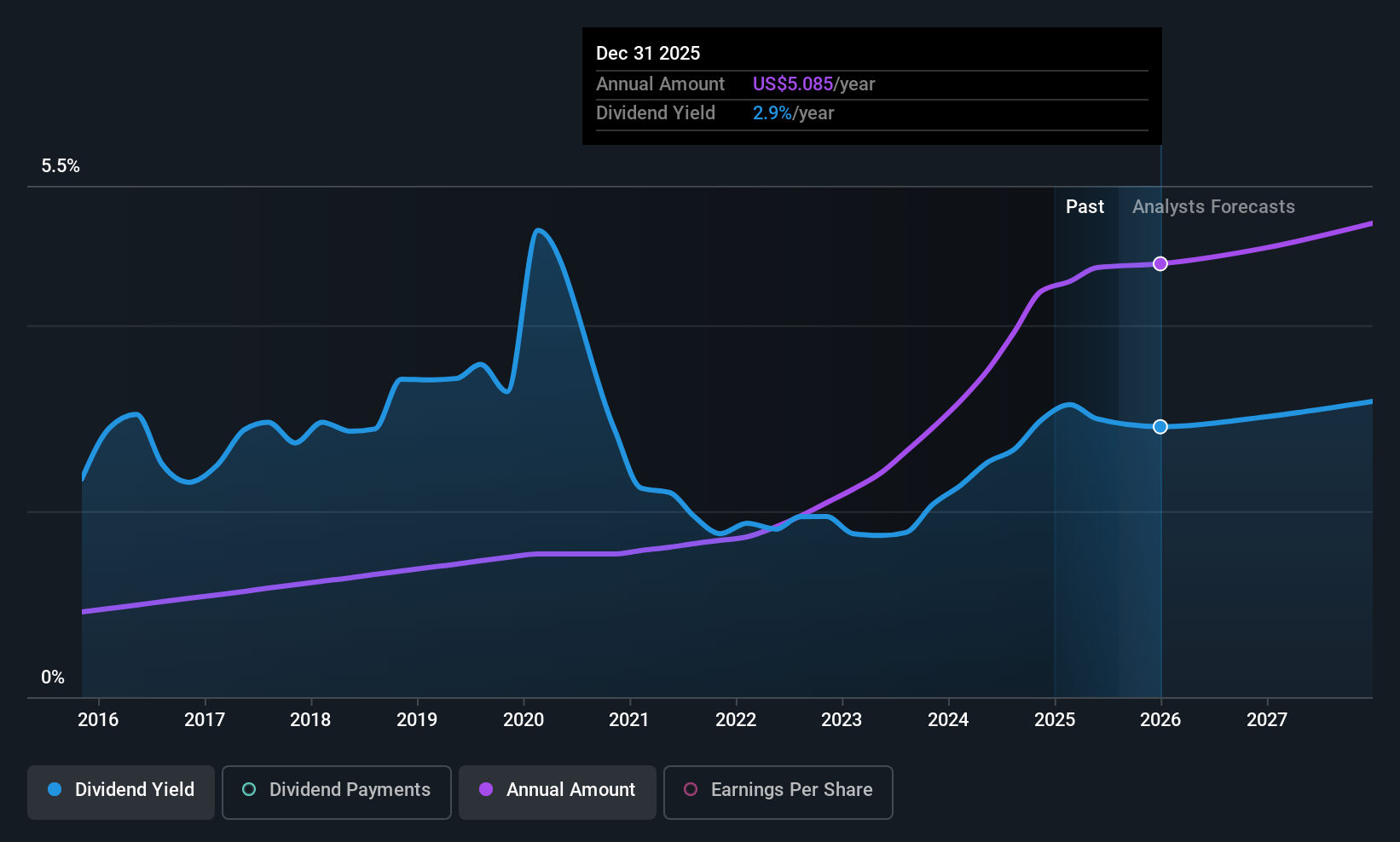

Businesses with strong growth prospects usually make the best dividend payers, because it's easier to grow dividends when earnings per share are improving. If earnings fall far enough, the company could be forced to cut its dividend. That's why it's comforting to see Penske Automotive Group's earnings have been skyrocketing, up 22% per annum for the past five years. Earnings per share have been growing very quickly, and the company is paying out a relatively low percentage of its profit and cash flow. This is a very favourable combination that can often lead to the dividend multiplying over the long term, if earnings grow and the company pays out a higher percentage of its earnings.

Another key way to measure a company's dividend prospects is by measuring its historical rate of dividend growth. In the past 10 years, Penske Automotive Group has increased its dividend at approximately 20% a year on average. Both per-share earnings and dividends have both been growing rapidly in recent times, which is great to see.

Final Takeaway

Should investors buy Penske Automotive Group for the upcoming dividend? It's great that Penske Automotive Group is growing earnings per share while simultaneously paying out a low percentage of both its earnings and cash flow. It's disappointing to see the dividend has been cut at least once in the past, but as things stand now, the low payout ratio suggests a conservative approach to dividends, which we like. There's a lot to like about Penske Automotive Group, and we would prioritise taking a closer look at it.

While it's tempting to invest in Penske Automotive Group for the dividends alone, you should always be mindful of the risks involved. For example, Penske Automotive Group has 3 warning signs (and 1 which makes us a bit uncomfortable) we think you should know about.

Generally, we wouldn't recommend just buying the first dividend stock you see. Here's a curated list of interesting stocks that are strong dividend payers.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10