3 ASX Stocks That Might Be Undervalued In August 2025

As the ASX200 edges higher with positive investor sentiment, the Materials sector leads the charge, followed closely by Financials and Telecommunications. In this environment, identifying undervalued stocks becomes crucial for investors looking to capitalize on potential growth opportunities amidst fluctuating sector performances.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Vysarn (ASX:VYS) | A$0.52 | A$0.98 | 47.1% |

| Reckon (ASX:RKN) | A$0.655 | A$1.18 | 44.7% |

| PointsBet Holdings (ASX:PBH) | A$1.26 | A$2.14 | 41.1% |

| Fenix Resources (ASX:FEX) | A$0.305 | A$0.51 | 39.9% |

| Elders (ASX:ELD) | A$7.55 | A$14.04 | 46.2% |

| Collins Foods (ASX:CKF) | A$9.35 | A$16.20 | 42.3% |

| Charter Hall Group (ASX:CHC) | A$21.70 | A$36.21 | 40.1% |

| Austal (ASX:ASB) | A$6.86 | A$13.11 | 47.7% |

| archTIS (ASX:AR9) | A$0.21 | A$0.41 | 48.3% |

| Advanced Braking Technology (ASX:ABV) | A$0.10 | A$0.16 | 39.3% |

Click here to see the full list of 31 stocks from our Undervalued ASX Stocks Based On Cash Flows screener.

Here we highlight a subset of our preferred stocks from the screener.

Capricorn Metals (ASX:CMM)

Overview: Capricorn Metals Ltd is involved in the evaluation, exploration, development, and production of gold properties in Australia with a market cap of A$4.24 billion.

Operations: The company's revenue primarily comes from its Karlawinda gold operations, generating A$379.47 million.

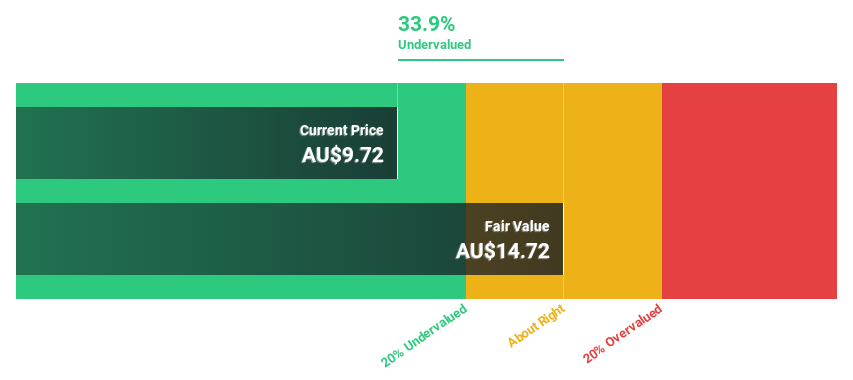

Estimated Discount To Fair Value: 36.8%

Capricorn Metals appears undervalued, trading at A$9.83 against an estimated fair value of A$15.54, a 36.8% discount. The company recently repaid its $50 million debt early, supported by strong cash flows and $405 million in cash and bullion holdings as of March 2025. With earnings forecasted to grow significantly at 24.73% annually, outpacing the Australian market's growth rate of 10.9%, Capricorn is well-positioned for future expansion projects like Karlawinda and Mt Gibson Gold Projects.

- Our comprehensive growth report raises the possibility that Capricorn Metals is poised for substantial financial growth.

- Take a closer look at Capricorn Metals' balance sheet health here in our report.

Nanosonics (ASX:NAN)

Overview: Nanosonics Limited is a global infection prevention company with a market capitalization of A$1.21 billion.

Operations: The company's revenue is primarily derived from its Healthcare Equipment segment, totaling A$183.97 million.

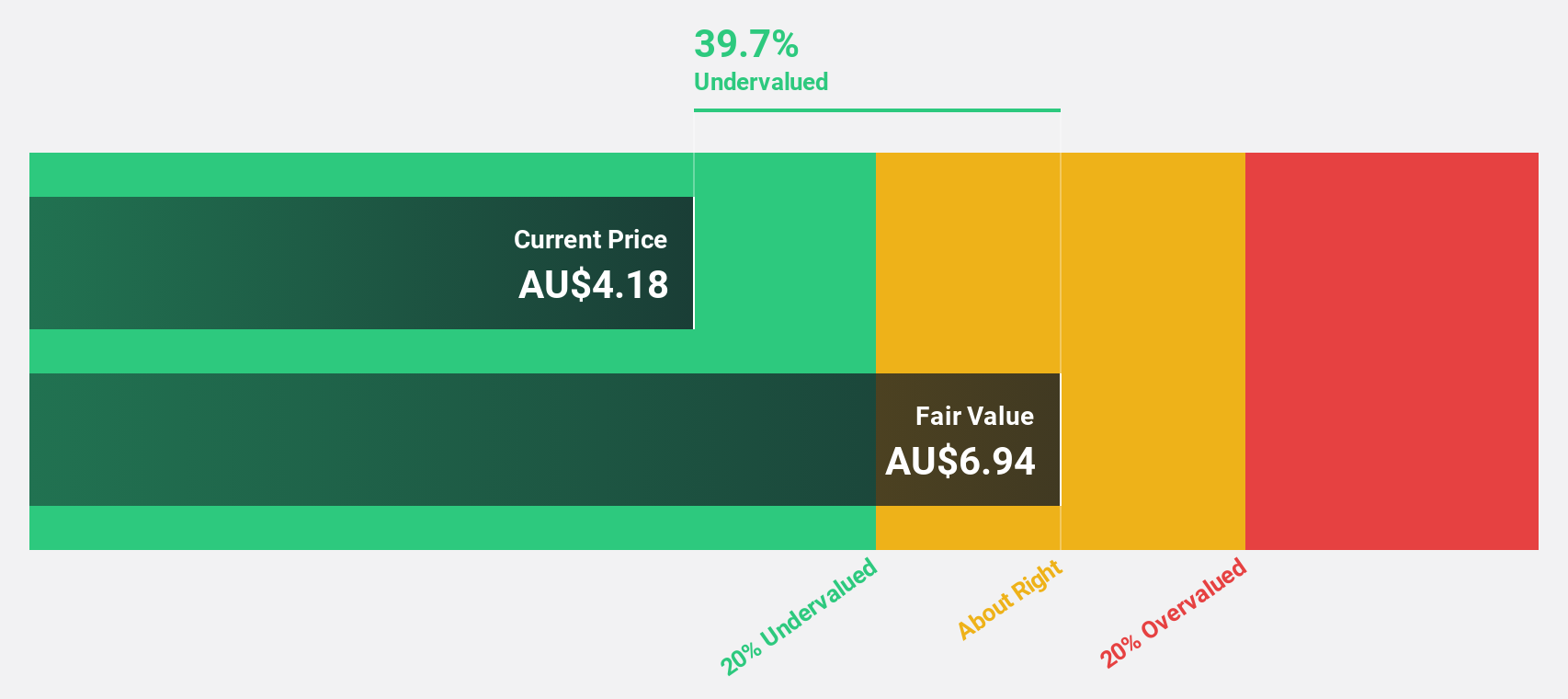

Estimated Discount To Fair Value: 22.5%

Nanosonics is currently trading at A$4, below its estimated fair value of A$5.16, reflecting a discount of over 20%. Despite a low forecasted return on equity of 13.9% in three years, earnings are projected to grow significantly at 22.9% annually, surpassing the Australian market's growth rate. Revenue growth is expected to be 9.6% per year, also outpacing the broader market's rate of 5.6%, highlighting potential for continued business expansion supported by cash flows.

- Our growth report here indicates Nanosonics may be poised for an improving outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of Nanosonics.

Nick Scali (ASX:NCK)

Overview: Nick Scali Limited, with a market cap of A$1.75 billion, operates in the sourcing and retailing of household furniture and related accessories across Australia, New Zealand, and the United Kingdom.

Operations: The company's revenue is primarily generated from the retailing of furniture, amounting to A$495.28 million.

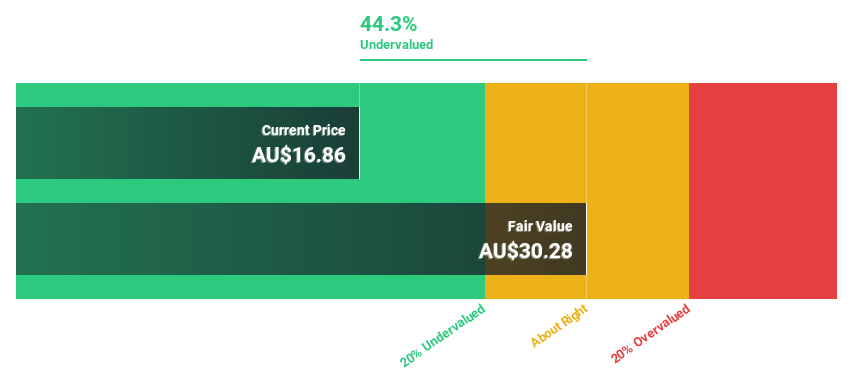

Estimated Discount To Fair Value: 39.3%

Nick Scali is trading at A$20.51, significantly below its estimated fair value of A$33.76, indicating it is undervalued by more than 20%. Despite a decline in net income to A$57.68 million from the previous year's A$80.61 million, revenue growth is forecasted at 9% annually, outpacing the Australian market's 5.6%. Although profit margins have decreased to 11.6%, earnings are expected to grow faster than the market at 17% per year.

- In light of our recent growth report, it seems possible that Nick Scali's financial performance will exceed current levels.

- Unlock comprehensive insights into our analysis of Nick Scali stock in this financial health report.

Seize The Opportunity

- Reveal the 31 hidden gems among our Undervalued ASX Stocks Based On Cash Flows screener with a single click here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nanosonics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10