- Earlier this week, BellRing Brands reported third-quarter 2025 earnings, revealing net sales of US$547.5 million alongside a substantial decline in net income to US$21 million, and narrowed its full-year guidance, citing retailer inventory reductions and cost pressures.

- Legal provisions and increased promotional spending further weighed on profitability, prompting several law firms to launch investigations into the company’s disclosures and investor communications following the announcement.

- We'll explore how reduced retailer inventory levels and the company's revised guidance could alter BellRing Brands' investment narrative and longer-term outlook.

The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

BellRing Brands Investment Narrative Recap

To hold BellRing Brands stock, investors have needed to believe in the continued expansion of the ready-to-drink protein category and BellRing's ability to outpace cost pressures through category leadership and product innovation. However, the latest results, highlighted by a steep decline in quarterly profits and a narrowed full-year outlook due to retailer inventory reductions and legal provisions, now threaten that near-term growth catalyst and amplify the risk of ongoing margin pressure from cost inflation and increased promotional activity.

Among recent developments, the company's completion of its US$102.96 million share repurchase program stands out. While returning capital to shareholders can signal confidence, it arrives just as BellRing faces headwinds from reduced retailer orders and rising costs, factors weighing directly on the predictability of future earnings and the potential for sustained value creation. Contrary to previous years, investors should also be aware of...

Read the full narrative on BellRing Brands (it's free!)

BellRing Brands' outlook anticipates $2.8 billion in revenue and $312.5 million in earnings by 2028. Achieving this means sustaining an 8.2% annual revenue growth rate and increasing earnings by $84.2 million from the current $228.3 million.

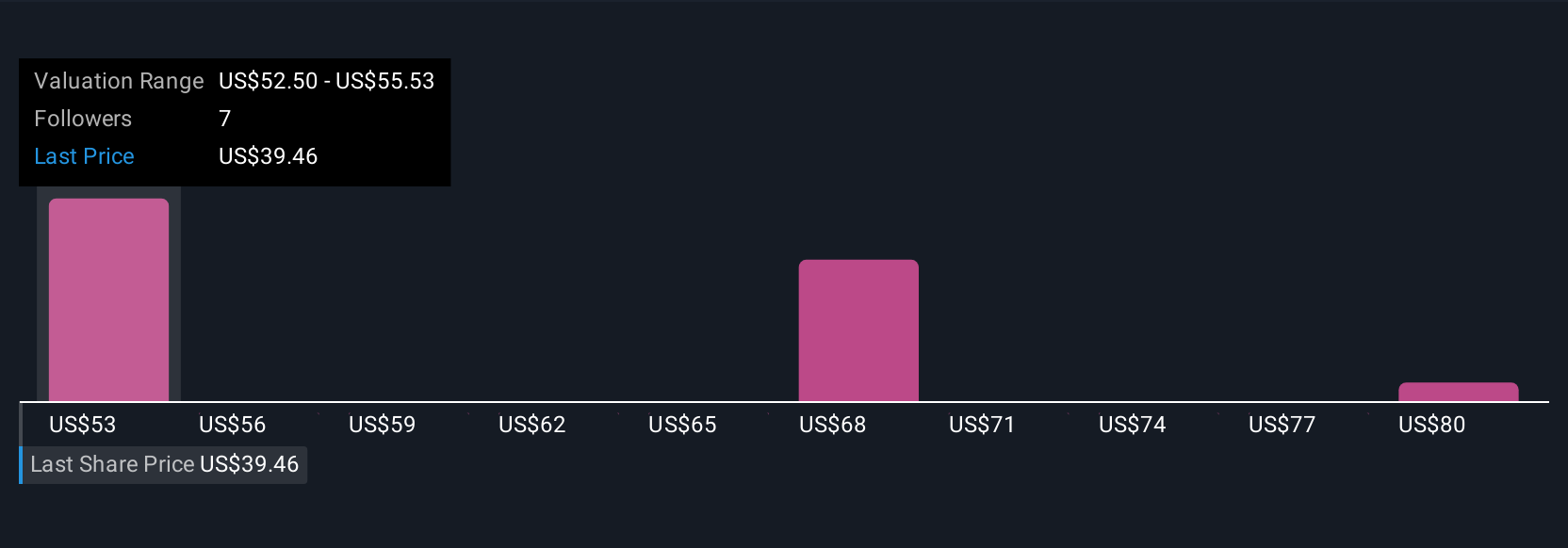

Uncover how BellRing Brands' forecasts yield a $60.53 fair value, a 55% upside to its current price.

Exploring Other Perspectives

Three members of the Simply Wall St Community estimate BellRing Brands’ fair value between US$60.53 and US$82.83, a wide spread. With concerns about margin compression due to rising costs, these differences show just how much investor outlooks, and expectations for the company’s resilience, can vary.

Explore 3 other fair value estimates on BellRing Brands - why the stock might be worth just $60.53!

Build Your Own BellRing Brands Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your BellRing Brands research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free BellRing Brands research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate BellRing Brands' overall financial health at a glance.

Searching For A Fresh Perspective?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 26 companies in the world exploring or producing it. Find the list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BellRing Brands might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com