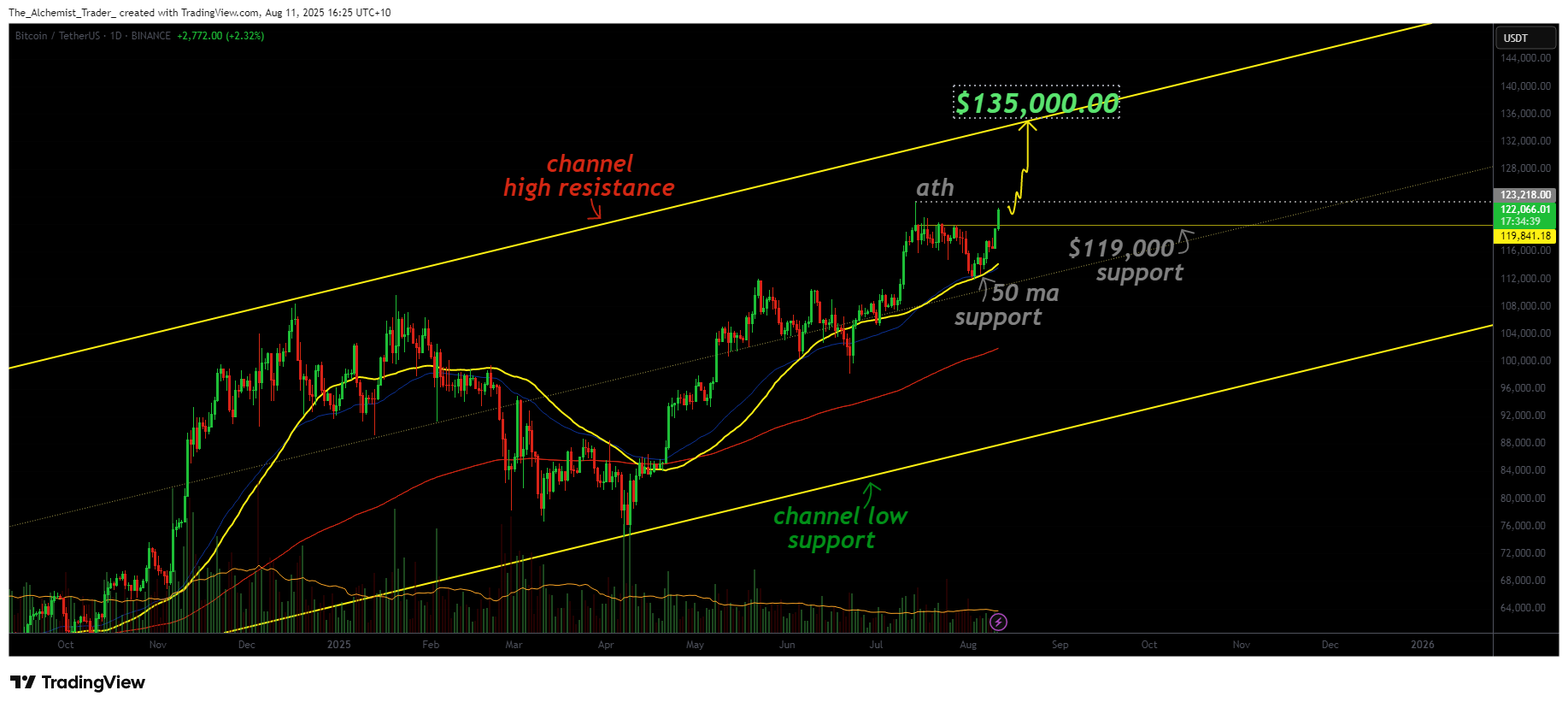

Bitcoin eyes $135k as daily structure holds strong above $119k support

Bitcoin is moving higher on the daily timeframe after breaching all key resistances below its all-time high. A test of the channel’s upper boundary is likely before a corrective phase sets in, targeting $135,000.

- $119K is the critical support level maintaining bullish structure.

- BTC is approaching high timeframe resistance beyond all-time high at $135K.

- Rejection may trigger range trading between $100K and the channel top.

Bitcoin (BTC) has cleared multiple resistance levels, leaving only the all-time high ahead. Once this final barrier is breached, it could trigger an accelerated push into the channel’s high resistance zone. However, this area may act as a cap for price action, leading to a rejection and rotation back toward established support.

Key technical points

- Current Support: $119K remains critical to keep bullish projection intact.

- Immediate Target: Channel high resistance above all-time highs.

- Potential Rotation: Rejection at resistance could lead to $100K retest.

From a technical standpoint, Bitcoin’s price is gravitating toward the upper regions of its trading channel at $135,000. The breakout through prior resistance levels has created a clear path toward the all-time high, and beyond that, the upper boundary of the channel.

This resistance zone is significant, as historical price action suggests that Bitcoin often pauses or reverses after extended runs into high timeframe resistance. A rejection from this area would not necessarily end the bullish structure, but it would likely trigger a rotational move back toward $100,000 support, placing BTC into a broad consolidation phase within the channel.

The primary bullish condition is that $119,000 support continues to hold on a closing basis. This level now acts as the structural anchor for the current uptrend. A breach below it would shift market dynamics toward a deeper correction and possibly a retest of lower range levels.

In the near term, price action remains poised for further upside. Traders should watch closely for momentum shifts as BTC approaches the high resistance zone. Sustained buying volume through this area could open the door to rapid price discovery, while a rejection would confirm the anticipated range-bound behavior between $100,000 and the channel high.

What to expect in the coming price action

Bitcoin is likely to continue trending toward its channel high, situated above the current all-time high. A rejection from this zone could lead to a prolonged range between $100,000 support and the upper channel resistance at $135,000.

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10