Will AMP's (ASX:AMP) Board Refresh Reveal a New Approach to Governance and Growth?

- AMP Limited announced the retirement of Andrea Slattery from its Board, appointment of Linda Elkins as independent non-executive director, release of half-year earnings with revenue at A$1.38 billion and net income of A$98 million, and a declared interim dividend of A$0.02 per share, payable September 26, 2025.

- Linda Elkins’ appointment brings extensive wealth management and superannuation expertise to the Board at a time of ongoing industry and company transformation.

- We’ll consider how the leadership transition and reaffirmed dividend shape AMP’s outlook for future earnings and governance.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

AMP Investment Narrative Recap

To be a shareholder in AMP today, you need to believe the company’s transformation in wealth management and digital banking can unlock long-term earnings growth, despite shrinking revenues and industry margin pressures. The recent board change, with Linda Elkins replacing Andrea Slattery, marks a shift in governance expertise, but does not materially alter the most important short-term catalyst: the operational success of AMP Bank GO and new digital initiatives. The central near-term risk remains margin compression from intensifying competition and regulatory fee caps.

Among AMP’s latest announcements, the reaffirmed interim dividend of A$0.02 per share stands out for its consistency, offering some stability to shareholders amid leadership and operational changes. This dividend payout, while modest, ties to the key catalyst of balancing reinvestment with shareholder returns as AMP pursues cost control and digital expansion.

However, in contrast to these steady signals for shareholders, the persistent risk of earnings pressure from fee caps and managed account competition is something investors should be aware of…

Read the full narrative on AMP (it's free!)

AMP's outlook anticipates A$1.4 billion in revenue and A$322.0 million in earnings by 2028. This implies a 21.5% annual revenue decline, but earnings are expected to increase by A$142.0 million from the current A$180.0 million.

Uncover how AMP's forecasts yield a A$1.76 fair value, in line with its current price.

Exploring Other Perspectives

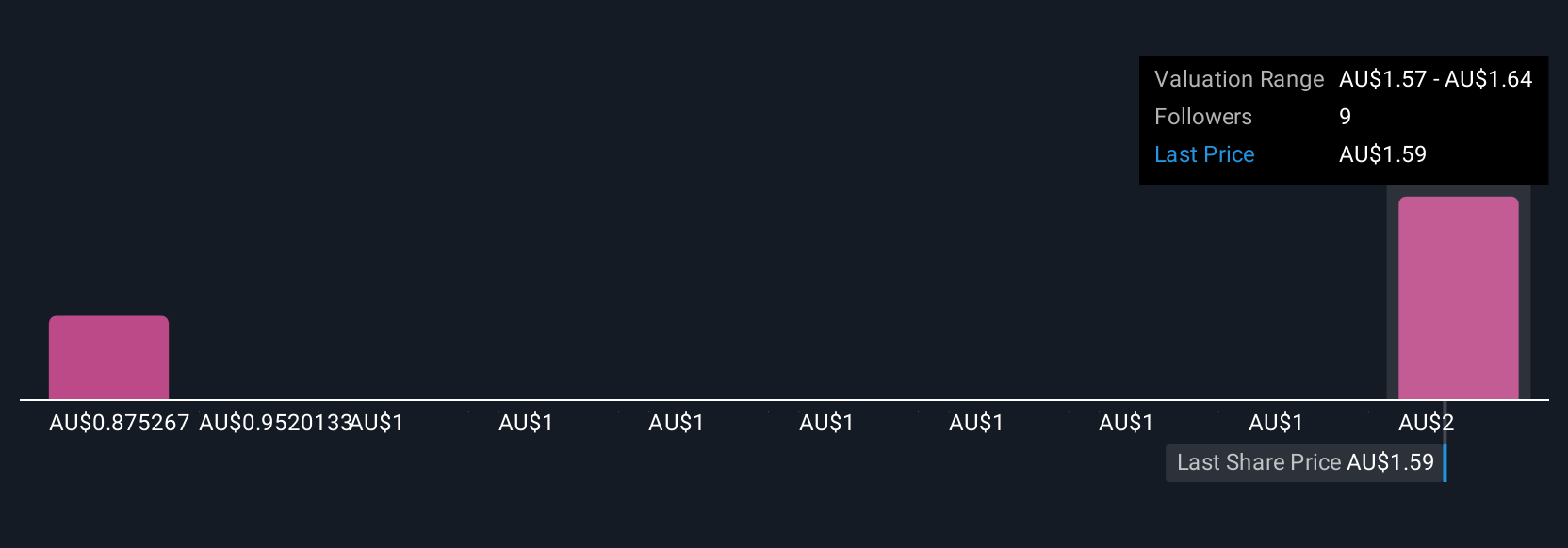

Members of the Simply Wall St Community valued AMP between A$0.91 and A$1.76 per share, reflecting wide views from just 2 estimates. With ongoing margin compression pressures, readers should consider how competitive dynamics may influence these outlooks and explore a variety of these perspectives.

Explore 2 other fair value estimates on AMP - why the stock might be worth as much as A$1.76!

Build Your Own AMP Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your AMP research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free AMP research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate AMP's overall financial health at a glance.

Curious About Other Options?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 18 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10