Applied Industrial Technologies, Inc. (NYSE:AIT) reported better-than-expected earnings for the fourth quarter on Thursday.

The company posted quarterly earnings of $2.80 per share which beat the analyst consensus estimate of $2.65 per share. The company reported quarterly sales of $1.225 billion which beat the analyst consensus estimate of $1.183 billion.

Applied Industrial Techs said it sees FY2026 GAAP EPS of $10.00-$10.75 versus market estimates of $9.96. The company also expects sales of $4.747 billion-$4.883 billion versus projections of $4.522 billion.

Neil A. Schrimsher, Applied’s President & Chief Executive Officer, commented, “We ended fiscal 2025 on an encouraging note with fourth quarter sales and EPS exceeding our expectations. Sales returned to positive organic growth with underlying trends improving as the quarter progressed. This was driven by stronger than expected Engineered Solutions segment sales where our teams executed exceptionally well, including capitalizing on recent order strength and firming demand across several verticals.”

Applied Industrial shares fell 5.4% to trade at $258.00 on Friday.

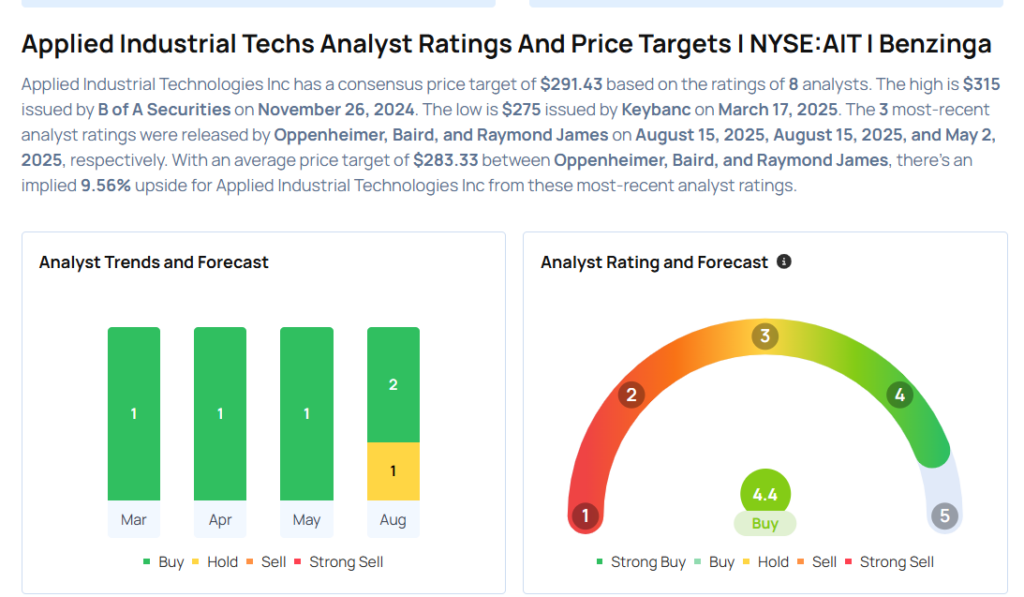

These analysts made changes to their price targets on Applied Industrial following earnings announcement.

- Baird analyst David Manthey maintained Applied Industrial Techs with an Outperform rating and raised the price target from $265 to $300.

- Oppenheimer analyst Christopher Glynn maintained the stock with an Outperform rating and raised the price target from $290 to $300.

- Raymond James analyst Sam Darkatsh downgraded the stock from Outperform to Market Perform.

Considering buying AIT stock? Here’s what analysts think:

Read This Next:

- Wall Street’s Most Accurate Analysts Give Their Take On 3 Defensive Stocks Delivering High-Dividend Yields

Photo via Shutterstock