Coherent Corp. (NYSE:COHR) will release financial results for the fourth quarter after the closing bell on Wednesday, Aug. 13.

Analysts expect the Saxonburg, Pennsylvania-based company to report quarterly earnings at 92 cents per share, up from 61 cents per share in the year-ago period. Coherent projects to report quarterly revenue at $1.51 billion, compared to $1.31 billion a year earlier, according to data from Benzinga Pro.

On Aug. 7, Coherent announced a multi-year deal with Apple to supply Face ID laser tech for iPhones and iPads.

Coherent shares gained 2.6% to close at $116.56 on Tuesday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

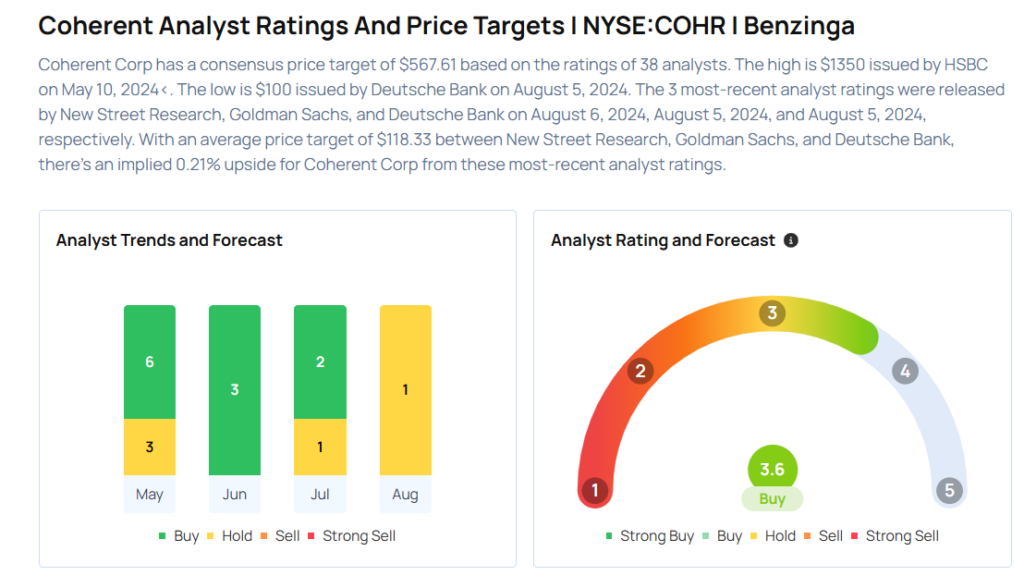

Let's have a look at how Benzinga's most-accurate analysts have rated the company in the recent period.

- Morgan Stanley analyst Meta Marshall maintained an Equal-Weight rating and increased the price target from $92 to $97 on Aug. 4, 2025. This analyst has an accuracy rate of 76%.

- Susquehanna analyst Mehdi Hosseini maintained a Positive rating and boosted the price target from $100 to $120 on July 22, 2025. This analyst has an accuracy rate of 68%.

- JP Morgan analyst Samik Chatterjee maintained an Overweight rating and boosted the price target from $100 to $127 on July 17, 2025. This analyst has an accuracy rate of 73%.

- Wolfe Research analyst George Notter initiated coverage on the stock with an Outperform rating on July 8, 2025. This analyst has an accuracy rate of 75%.

- Citigroup analyst Atif Malik maintained a Buy rating and raised the price target from $100 to $115 on June 3, 2025. This analyst has an accuracy rate of 83%.

Considering buying COHR stock? Here’s what analysts think:

Read This Next:

- Wall Street’s Most Accurate Analysts Spotlight On 3 Consumer Stocks Delivering High-Dividend Yields

Photo via Shutterstock