Will Edgewise Therapeutics’ (EWTX) Rising Losses Reshape Its Long-Term Investment Strategy?

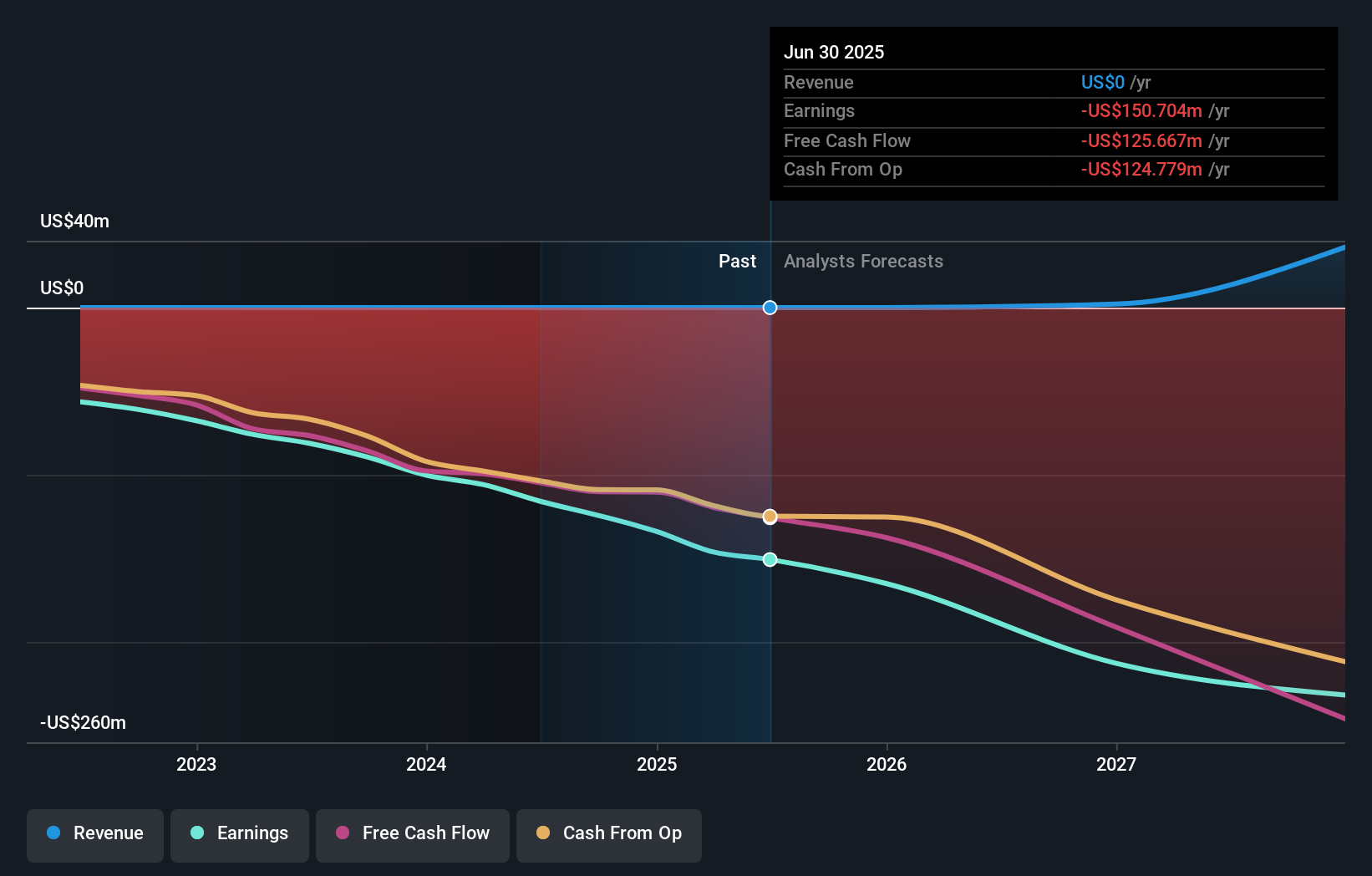

- Edgewise Therapeutics, Inc. reported its second quarter and six-month earnings for the period ended June 30, 2025, disclosing a net loss of US$36.12 million for the quarter and US$76.91 million for the half-year, both increases from the same periods last year.

- Although the company's per-share loss for the quarter remained flat at US$0.34, overall losses grew year-over-year reflecting rising expenses or investment activity.

- Given the rise in net loss while per-share loss stayed unchanged, we'll explore how this development shapes Edgewise Therapeutics' investment outlook.

Find companies with promising cash flow potential yet trading below their fair value.

What Is Edgewise Therapeutics' Investment Narrative?

Shareholders in Edgewise Therapeutics are essentially betting on the company’s ability to translate its bullish clinical trial momentum, particularly around sevasemten and EDG-7500, into meaningful commercial outcomes in rare and severe diseases. The recent quarterly results show a widening net loss compared to last year, despite per-share losses staying flat, which suggests expenses are rising in line with broader clinical ambitions. For now, the company remains pre-revenue and unprofitable, with a long runway ahead before any potential product launches. Importantly, these results do not immediately adjust the most closely watched short-term catalysts, such as pivotal trial readouts or regulatory milestones expected in the coming quarters. However, growing losses could increase pressure on the company to manage costs or raise additional capital, both key risks that now loom slightly larger in the investment story after the latest report.

On the other hand, if burn rates persist, investors may need to rethink the company’s capital needs.

Our valuation report unveils the possibility Edgewise Therapeutics' shares may be trading at a premium.Exploring Other Perspectives

Explore another fair value estimate on Edgewise Therapeutics - why the stock might be worth just $38.33!

Build Your Own Edgewise Therapeutics Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Edgewise Therapeutics research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Edgewise Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Edgewise Therapeutics' overall financial health at a glance.

Seeking Other Investments?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 27 best rare earth metal stocks of the very few that mine this essential strategic resource.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 18 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Edgewise Therapeutics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10