Compass Therapeutics And 2 Other Promising Penny Stocks To Consider

As the U.S. stock market continues its rally, with major indices like the S&P 500 and Nasdaq reaching new all-time highs, investors are exploring diverse opportunities to capitalize on this momentum. Penny stocks, often perceived as relics of past trading days, still present intriguing prospects when backed by robust financials. In this article, we explore three penny stocks that stand out for their balance sheet strength and potential for significant returns, offering investors a chance to uncover hidden value in quality companies.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Waterdrop (WDH) | $1.88 | $669.08M | ✅ 4 ⚠️ 0 View Analysis > |

| WM Technology (MAPS) | $1.13 | $204.42M | ✅ 4 ⚠️ 2 View Analysis > |

| Puma Biotechnology (PBYI) | $4.87 | $245.31M | ✅ 3 ⚠️ 2 View Analysis > |

| Performance Shipping (PSHG) | $1.84 | $22.88M | ✅ 4 ⚠️ 2 View Analysis > |

| Tuniu (TOUR) | $0.9326 | $88.89M | ✅ 3 ⚠️ 2 View Analysis > |

| CI&T (CINT) | $4.96 | $696.85M | ✅ 5 ⚠️ 0 View Analysis > |

| BAB (BABB) | $0.904375 | $6.46M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $4.08 | $82.7M | ✅ 3 ⚠️ 3 View Analysis > |

| Resources Connection (RGP) | $4.55 | $149.03M | ✅ 3 ⚠️ 1 View Analysis > |

| TETRA Technologies (TTI) | $3.97 | $522.46M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 410 stocks from our US Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Compass Therapeutics (CMPX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Compass Therapeutics, Inc. is a clinical-stage biopharmaceutical company focused on developing antibody-based therapeutics for treating various human diseases in the United States, with a market cap of $438.36 million.

Operations: Compass Therapeutics does not have reported revenue segments.

Market Cap: $438.36M

Compass Therapeutics, Inc. is a pre-revenue biopharmaceutical company with a market cap of US$438.36 million, focusing on antibody-based therapeutics. Despite being unprofitable and reporting increased losses recently, the company maintains a strong financial position with short-term assets of US$106.2 million exceeding both its short and long-term liabilities. It is debt-free and has not significantly diluted shareholders over the past year. The company's revenue is forecast to grow substantially, though it remains unprofitable with no near-term profitability expected. Recently added to multiple Russell Growth Indexes, Compass continues to attract attention in the biotech sector despite its current challenges.

- Jump into the full analysis health report here for a deeper understanding of Compass Therapeutics.

- Examine Compass Therapeutics' earnings growth report to understand how analysts expect it to perform.

Stitch Fix (SFIX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Stitch Fix, Inc. operates an online platform offering a variety of apparel, shoes, and accessories for diverse customer segments in the United States, with a market cap of approximately $588.49 million.

Operations: The company generates revenue of $1.28 billion from its online retail segment.

Market Cap: $588.49M

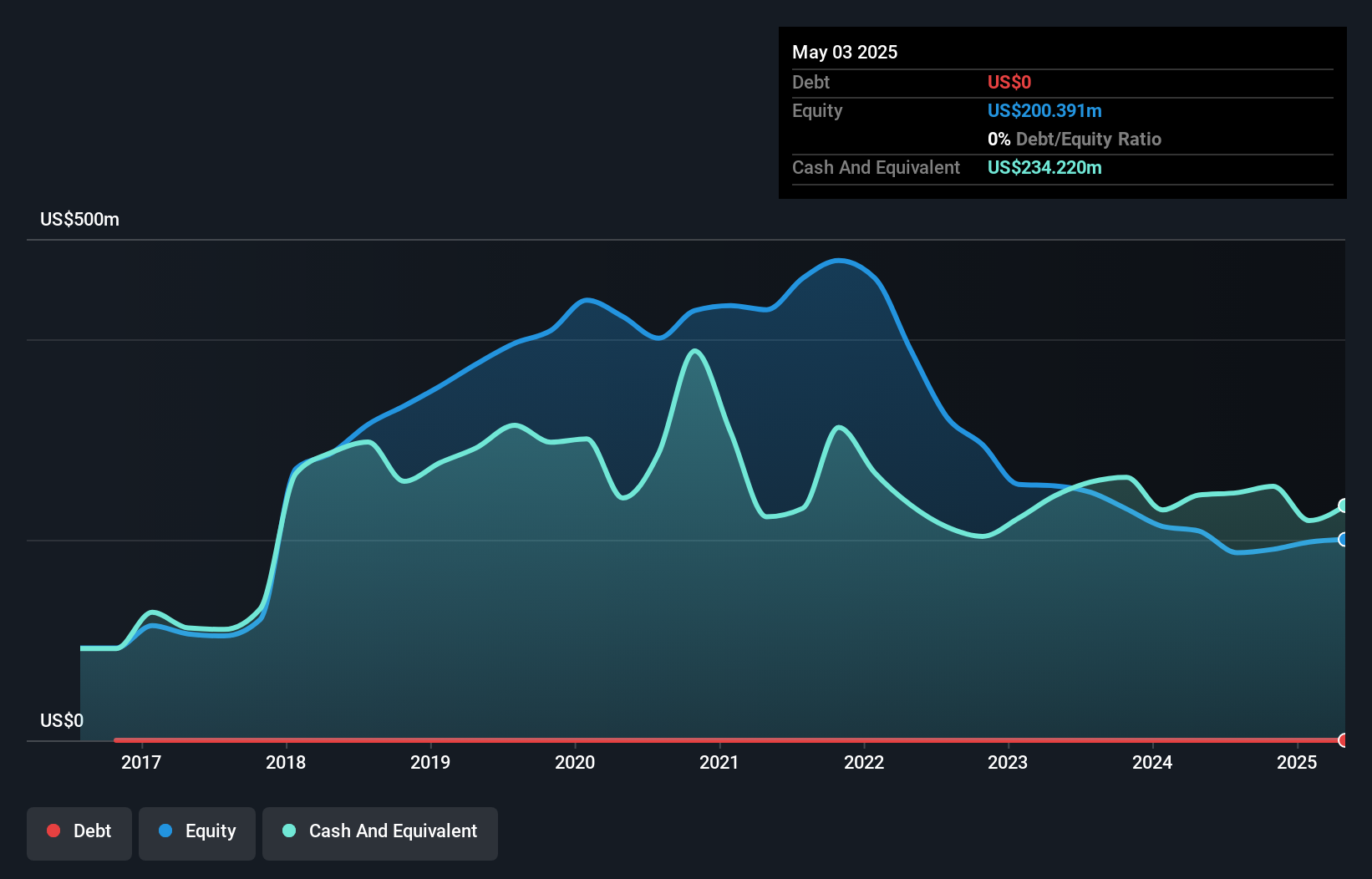

Stitch Fix, Inc., with a market cap of US$588.49 million, has been added to multiple Russell Growth Indexes, reflecting its growing visibility in the market. Despite being unprofitable and not expected to achieve profitability soon, it maintains a strong financial position with short-term assets of US$373.3 million exceeding both short and long-term liabilities. The company reported third-quarter sales of US$325.02 million and reduced net losses compared to the previous year, indicating some operational improvements. It is debt-free and has not significantly diluted shareholders recently, though insider selling has been significant over the past three months.

- Click here to discover the nuances of Stitch Fix with our detailed analytical financial health report.

- Assess Stitch Fix's future earnings estimates with our detailed growth reports.

Stereotaxis (STXS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Stereotaxis, Inc. designs, manufactures, and markets robotic systems and information systems for interventional laboratories globally, with a market cap of $234.31 million.

Operations: The company generates revenue from its Surgical & Medical Equipment segment, totaling $31.81 million.

Market Cap: $234.31M

Stereotaxis, Inc., with a market cap of US$234.31 million, remains unprofitable and isn't forecast to achieve profitability in the near term. However, it has shown revenue growth potential, reporting US$8.8 million for Q2 2025 compared to US$4.5 million the previous year and projecting double-digit revenue growth for 2025. The company is debt-free and has a seasoned board with an average tenure of 8.5 years. Recent FDA clearance for its MAGiC Sweep catheter highlights advancements in robotic medical technology, potentially enhancing future revenue streams despite current financial challenges.

- Click to explore a detailed breakdown of our findings in Stereotaxis' financial health report.

- Evaluate Stereotaxis' prospects by accessing our earnings growth report.

Key Takeaways

- Reveal the 410 hidden gems among our US Penny Stocks screener with a single click here.

- Want To Explore Some Alternatives? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10