Global Penny Stocks To Watch In August 2025

Global markets have shown resilience, with the Nasdaq Composite reaching a new all-time high, supported by strong corporate earnings and strategic investments. Amidst these developments, investors are increasingly attentive to smaller opportunities that might offer significant growth potential. Penny stocks, despite their somewhat outdated label, remain an area of interest for those seeking to uncover value in companies with solid financial foundations and long-term prospects.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.34 | A$104.25M | ✅ 4 ⚠️ 3 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.49 | HK$909.23M | ✅ 4 ⚠️ 1 View Analysis > |

| GTN (ASX:GTN) | A$0.39 | A$74.36M | ✅ 4 ⚠️ 2 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.52 | HK$2.05B | ✅ 4 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.535 | SGD216.83M | ✅ 4 ⚠️ 1 View Analysis > |

| MGB Berhad (KLSE:MGB) | MYR0.50 | MYR295.83M | ✅ 5 ⚠️ 2 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.90 | SGD11.41B | ✅ 5 ⚠️ 1 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.175 | £186.75M | ✅ 4 ⚠️ 2 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.956 | €32.24M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 3,798 stocks from our Global Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Beijing UBOX Online Technology (SEHK:2429)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Beijing UBOX Online Technology Corp. operates vending machines in Mainland China and has a market cap of HK$2.71 billion.

Operations: The company's revenue is primarily derived from its Unmanned Retail Business at CN¥1.97 billion, followed by Merchandise Wholesale at CN¥552.82 million, and Advertising and System Support Services contributing CN¥134.34 million.

Market Cap: HK$2.71B

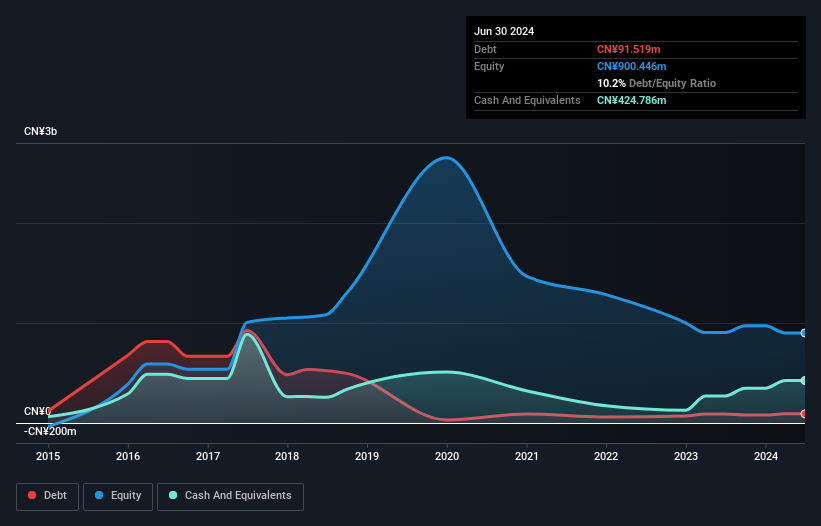

Beijing UBOX Online Technology Corp. has a market cap of HK$2.71 billion, deriving significant revenue from its Unmanned Retail Business (CN¥1.97 billion). Despite being unprofitable, it has reduced losses over the past five years by 11.3% annually and maintains more cash than its total debt, suggesting financial stability. The company has a sufficient cash runway for over three years based on current free cash flow and no meaningful shareholder dilution in the past year. However, its share price remains highly volatile and Return on Equity is negative at -26.15%. Recent amendments to the Articles of Association were approved at the AGM in May 2025.

- Navigate through the intricacies of Beijing UBOX Online Technology with our comprehensive balance sheet health report here.

- Evaluate Beijing UBOX Online Technology's historical performance by accessing our past performance report.

Low Keng Huat (Singapore) (SGX:F1E)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Low Keng Huat (Singapore) Limited is an investment holding company involved in property development, hotel operations, and investment activities across Singapore, Australia, and Malaysia with a market capitalization of SGD354.63 million.

Operations: The company's revenue is primarily derived from property development at SGD415.78 million, followed by investment activities including construction at SGD66.71 million, and hotel operations contributing SGD50.08 million.

Market Cap: SGD354.63M

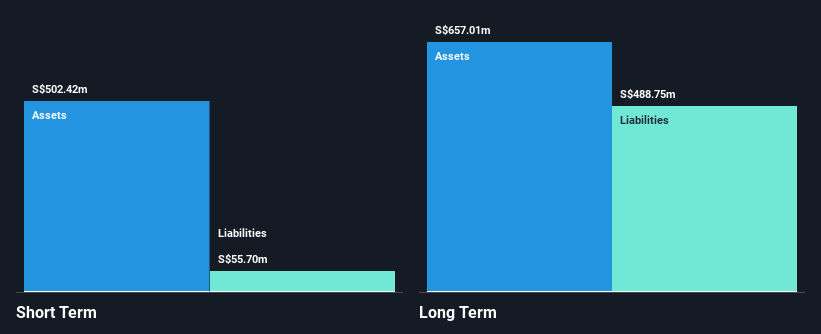

Low Keng Huat (Singapore) Limited, with a market cap of SGD354.63 million, has become profitable this year despite earnings declining by 50.5% annually over the past five years. The company’s short-term assets of SGD409 million comfortably cover both short and long-term liabilities, though interest payments are not well covered by EBIT at 1.3x. A dividend yield of 3.13% is not adequately supported by current earnings, and a significant one-off loss impacted recent financial results. The board and management team are experienced with average tenures exceeding six years, while debt levels have been reduced but remain high relative to equity at 62.1%.

- Click here and access our complete financial health analysis report to understand the dynamics of Low Keng Huat (Singapore).

- Gain insights into Low Keng Huat (Singapore)'s past trends and performance with our report on the company's historical track record.

Shanghai Kinlita Chemical (SZSE:300225)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Shanghai Kinlita Chemical Co., Ltd. focuses on the research, production, sale, and service of industrial coatings in China with a market cap of CN¥2.03 billion.

Operations: The company's revenue primarily comes from its operations in China, amounting to CN¥738.68 million.

Market Cap: CN¥2.03B

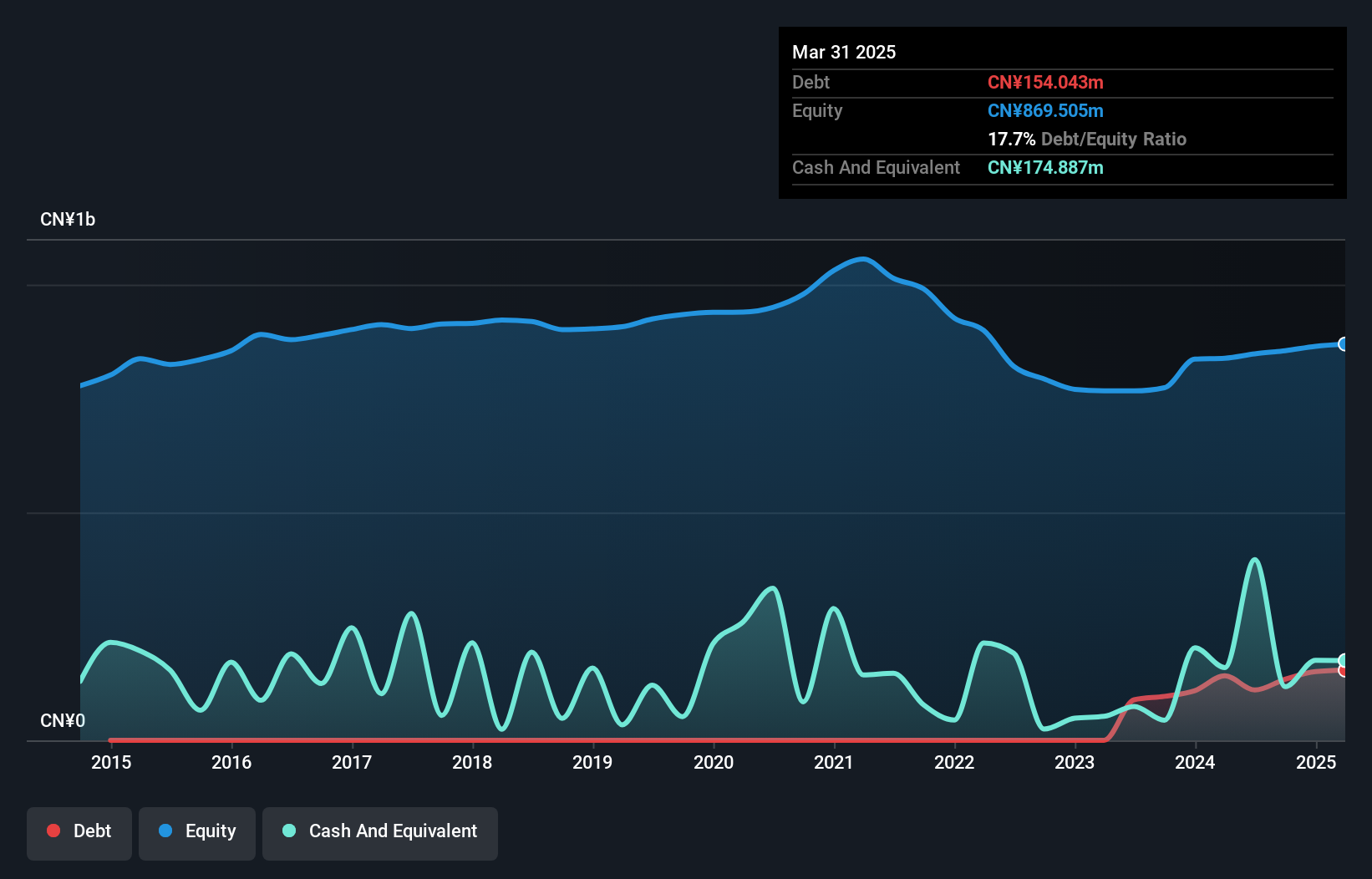

Shanghai Kinlita Chemical Co., Ltd. has shown a significant earnings growth of 66% over the past year, surpassing the industry average. The company's financial position is robust, with short-term assets exceeding both long-term liabilities and short-term liabilities. Debt levels are well-managed, as cash exceeds total debt and operating cash flow covers debt effectively. Recent dividend affirmations indicate shareholder returns despite a low return on equity of 3.6%. However, a large one-off gain of CN¥13.2 million has impacted recent financial results, suggesting caution in evaluating sustainable profit growth trends amidst an experienced management team and board.

- Take a closer look at Shanghai Kinlita Chemical's potential here in our financial health report.

- Gain insights into Shanghai Kinlita Chemical's historical outcomes by reviewing our past performance report.

Seize The Opportunity

- Discover the full array of 3,798 Global Penny Stocks right here.

- Curious About Other Options? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10