Liquidia Corporation (NASDAQ:LQDA) reported a loss for the second quarter on Tuesday.

The company posted a second-quarter loss of 49 cents, missing the consensus of a loss of 43 cents. Sales reached $8.84 million compared to the consensus of $3.86 million.

In its second-quarter earnings release, the company said that in July and August 2025 it analyzed interim data from the 52-week, prospective, open-label ASCENT study, which fully enrolled 54 patients with pulmonary hypertension associated with interstitial lung disease (PH-ILD).

Dr. Roger Jeffs, Liquidia’s Chief Executive Officer, said, “The second quarter was a defining period for Liquidia with the FDA approval and rapid commercial launch of YUTREPIA™ (treprostinil) inhalation powder. More than 350 physicians across the country have already prescribed YUTREPIA to treat patients with pulmonary arterial hypertension (PAH) and pulmonary hypertension associated with interstitial lung disease (PH-ILD), including those new to prostacyclin treatment or transitioning from Tyvaso®, Tyvaso DPI®, and even from oral prostacyclins. In the 11 weeks since approval, we’ve recorded over 900 unique patient prescriptions leading to more than 550 patient starts. This initial demand has exceeded my own high expectations.”

Liquidia shares gained 2.6% to trade at $24.72 on Wednesday.

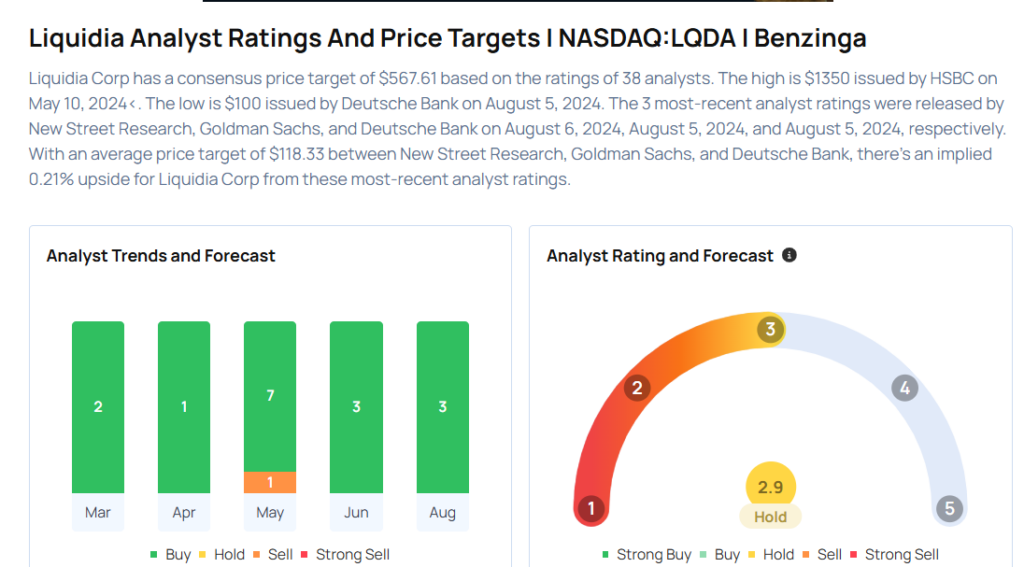

These analysts made changes to their price targets on Liquidia following earnings announcement.

- Wells Fargo analyst Tiago Fauth maintained Liquidia with an Overweight rating and raised the price target from $25 to $31.

- Raymond James analyst Ryan Deschner maintained the stock with a Strong Buy and raised the price target from $33 to $41.

Considering buying LQDA stock? Here’s what analysts think:

Read This Next:

- Top 2 Tech & Telecom Stocks That May Fall Off A Cliff In Q3

Photo via Shutterstock