What Does Bitmine's 684% Surge Mean as Immersion Tech Hype Fuels Debate?

Thinking about what to do with Bitmine Immersion Technologies stock? You are definitely not alone. The ticker (BMNR) has turned heads recently, sparking plenty of debate. Let us unpack the story so far and set the stage for a close-up on valuation that might just help you make a more informed decision.

Over the last year, Bitmine’s stock has certainly given investors reason to look twice. Despite some recent short-term dips, with a 5% drop in the past day and almost 7% in the past week, the 30-day performance is up an impressive 29%. Taking an even longer view, the 90-day return jumps to more than 645%, with a year-to-date lift just under 684%. Of course, zooming out to the three- and five-year marks, those returns soften considerably, so timing has been everything with this stock. What is mostly driving these swings? News around immersive mining technology and broader market volatility appears to keep the risk meter running high for Bitmine, and analysts are closely focused on whether its recent momentum reflects a true transformation or just heightened speculation.

Now for the eye-opener: according to typical valuation checks, Bitmine scores a 0 out of 6 on undervaluation. This means it is not currently flagged as undervalued by any of the usual metrics analysts watch. But do these standard approaches really tell the whole story? Let us break down how these valuation checks work, then get to a deeper way to think about what this stock could be worth.

Bitmine Immersion Technologies delivered 373.1% returns over the last year. See how this stacks up to the rest of the Software industry.Approach 1: Bitmine Immersion Technologies Cash Flows

The discounted cash flow (DCF) model estimates a company's value by projecting its future free cash flows and discounting them back to today’s value. This gives investors an idea of what the business is really worth now, based on future expectations.

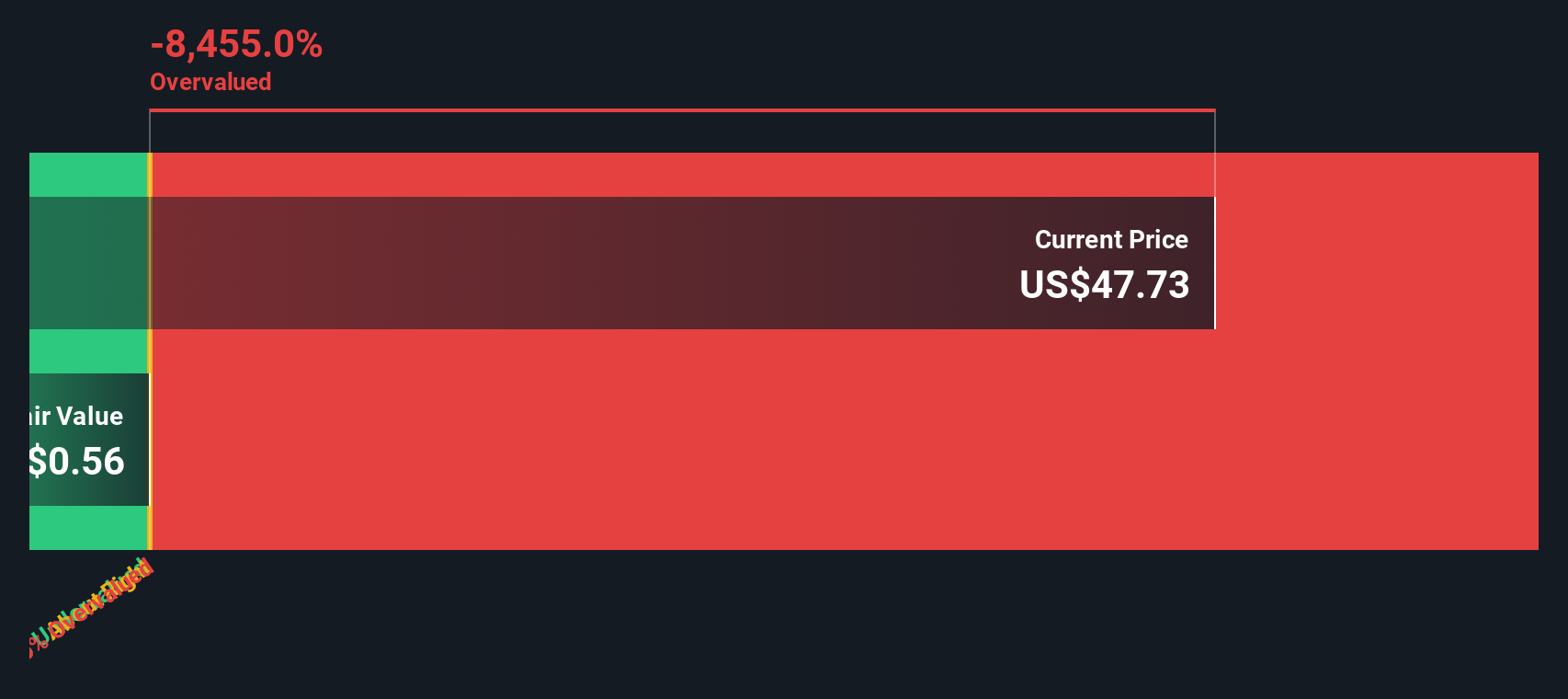

Currently, Bitmine Immersion Technologies reports a Free Cash Flow (FCF) of $0.84 Million. Analysts forecast robust growth ahead, with free cash flow expected to reach nearly $7.75 Million by 2035, implying strong annual increases over the next decade. The result of putting these numbers through a two-stage DCF model is an intrinsic fair value per share of $0.88, based on the company’s expected future cash flows.

When measured against the actual share price, the DCF calculation signals that Bitmine is trading at a significant premium compared to its calculated value. In fact, it is approximately 6165% overvalued by this approach. This suggests the market’s current enthusiasm far exceeds what the company’s projected cash flows can justify.

Result: OVERVALUED

Approach 2: Bitmine Immersion Technologies Price vs Book

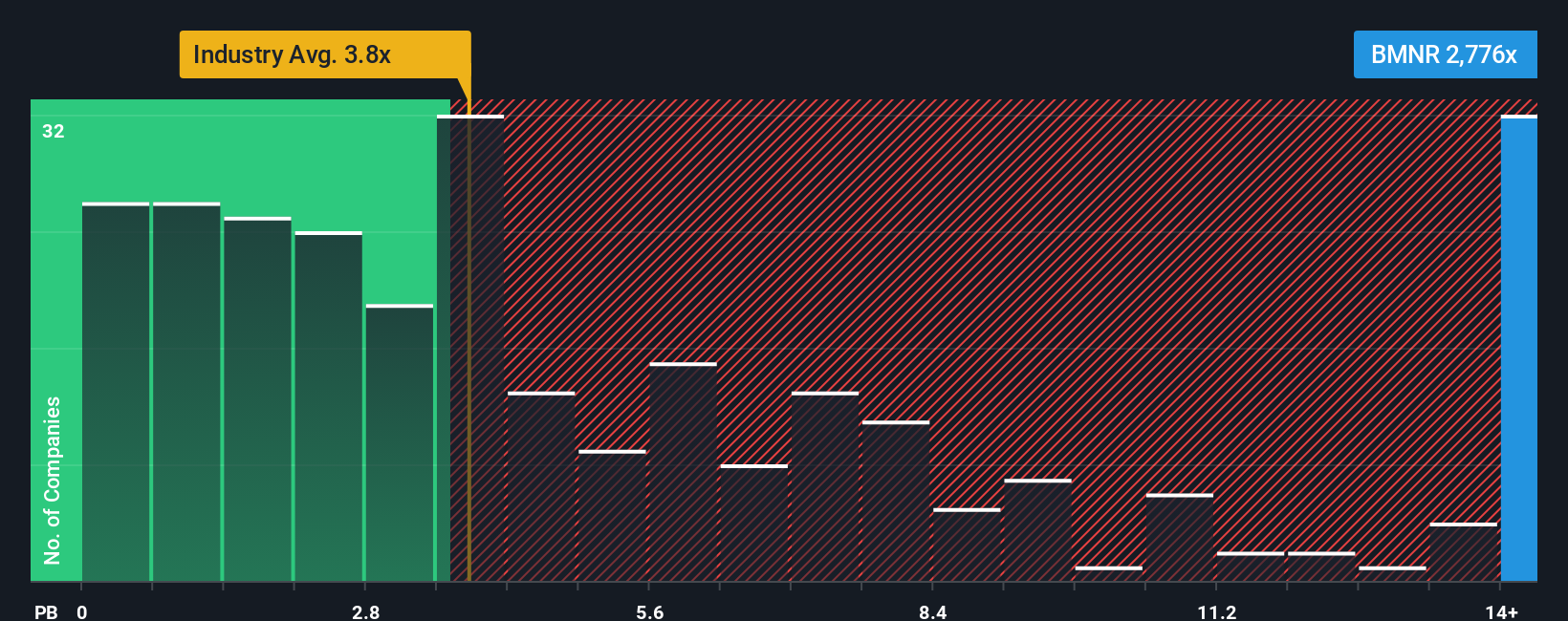

For emerging or rapidly evolving companies, the price-to-book (P/B) ratio is often a key valuation tool, especially when profitability is not yet stabilized or earnings are volatile. This metric helps investors judge how the market values Bitmine’s assets compared to their accounting worth. It provides a sensible reference for companies in transition or reinvestment phases.

Typically, a “normal” or “fair” price-to-book ratio reflects not only the company’s asset base, but also expectations for future growth and the perceived risks those assets might face. High-growth tech names or firms with significant intangible value can often trade at elevated P/B ratios. Comparing ratios within the same industry is essential to provide proper context.

Bitmine Immersion Technologies currently trades at a lofty P/B of 2088.24x. For comparison, the software industry average stands at just 3.62x, while the average for Bitmine’s peers is around 10.96x. This places Bitmine’s valuation well above standard benchmarks. Simply Wall St’s proprietary Fair Ratio, designed to capture all the fine print including growth potential and risk, suggests a more typical P/B multiple for Bitmine would be closer to its industry and peer group. The dramatic difference between Bitmine’s actual ratio and what the Fair Ratio prescribes highlights significant overvaluation using this method.

Result: OVERVALUED

Upgrade Your Decision Making: Choose your Bitmine Immersion Technologies Narrative

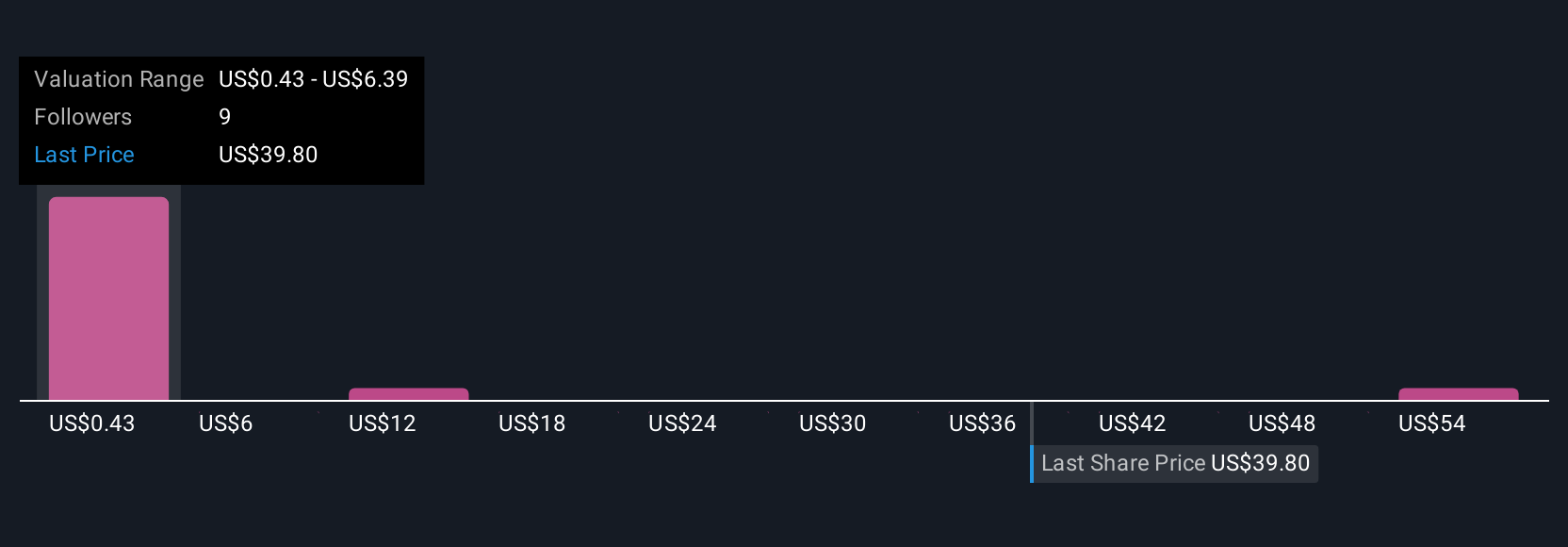

A Narrative is more than just a number; it is the story you believe about Bitmine Immersion Technologies, connecting your view on the company’s future with a financial forecast and a fair value estimate.

Narratives help investors move beyond standard valuation models by making it simple to define, test, and adjust their own perspectives on what Bitmine could achieve. This all happens within an interactive platform trusted by millions in the Simply Wall St community.

By tying your Narrative to actual estimates for revenue, earnings, and margins, you see how your story leads directly to a Fair Value, which you can instantly compare to the current price to help inform your decision to buy, sell, or hold.

The best part? Narratives are always up to date, evolving in real time as fresh news or earnings reports are released, so your outlook stays relevant without extra effort.

For Bitmine, one investor’s Narrative might reflect excitement about rapid tech adoption and assign a high fair value, while another’s could be cautious, projecting much lower potential. Narratives highlight both viewpoints, making smarter investing more accessible to everyone.

Do you think there's more to the story for Bitmine Immersion Technologies? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bitmine Immersion Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10