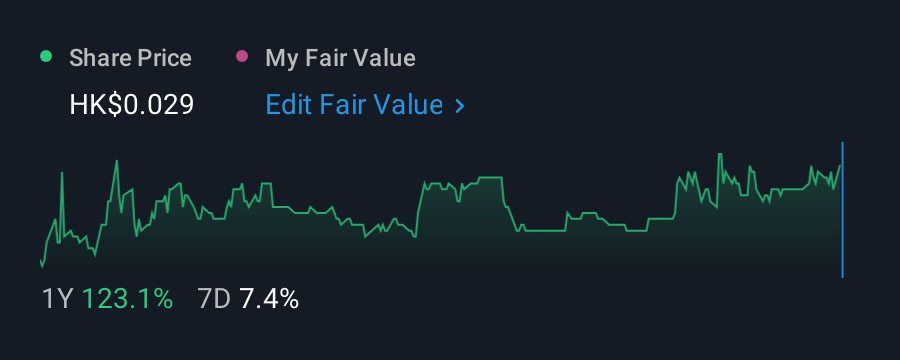

Sing Lee Software (Group) (HKG:8076) Is Carrying A Fair Bit Of Debt

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, Sing Lee Software (Group) Limited (HKG:8076) does carry debt. But the real question is whether this debt is making the company risky.

This technology could replace computers: discover the 20 stocks are working to make quantum computing a reality.

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we examine debt levels, we first consider both cash and debt levels, together.

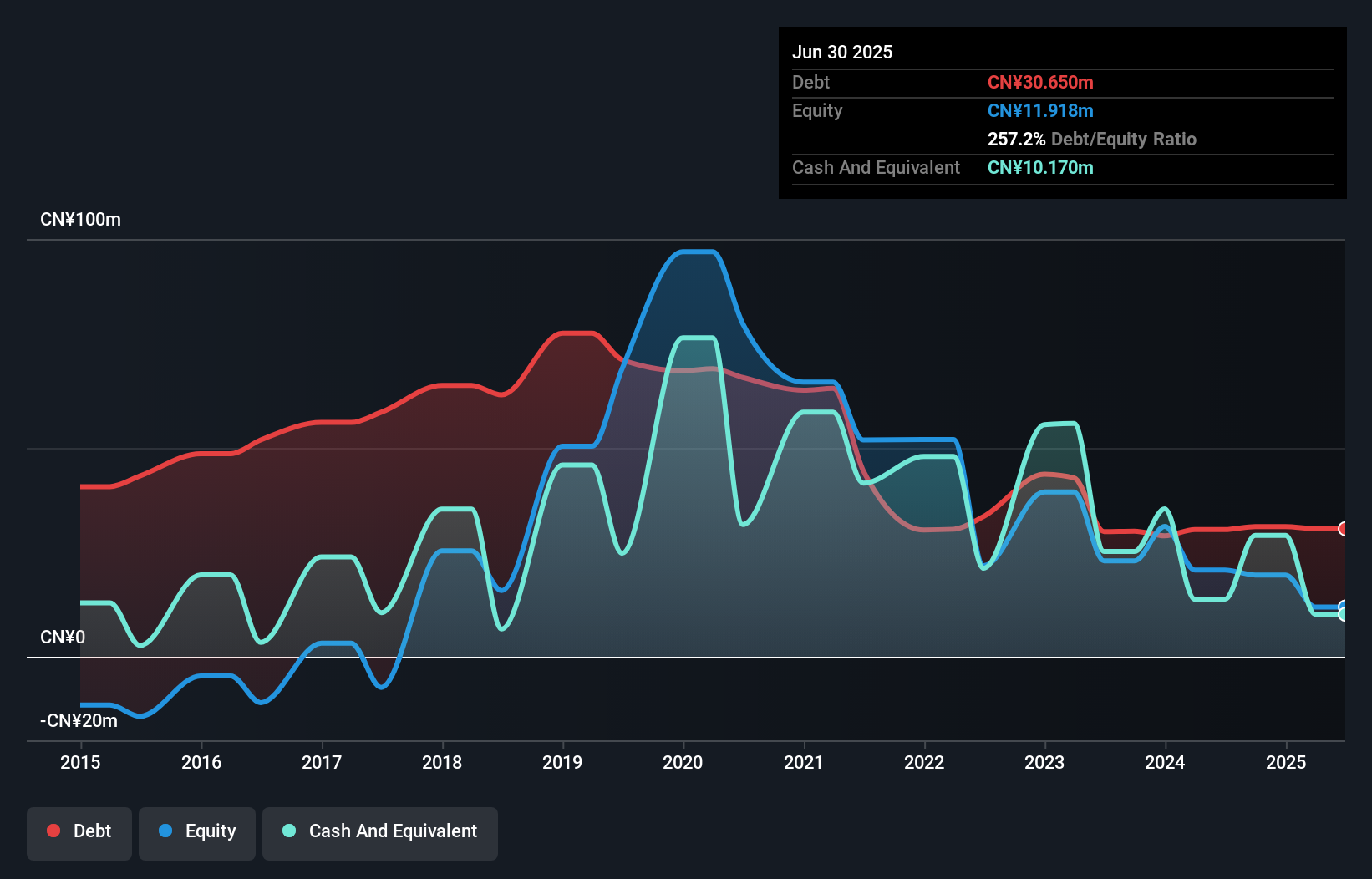

How Much Debt Does Sing Lee Software (Group) Carry?

As you can see below, Sing Lee Software (Group) had CN¥30.7m of debt, at June 2025, which is about the same as the year before. You can click the chart for greater detail. However, it does have CN¥10.2m in cash offsetting this, leading to net debt of about CN¥20.5m.

A Look At Sing Lee Software (Group)'s Liabilities

We can see from the most recent balance sheet that Sing Lee Software (Group) had liabilities of CN¥10.1m falling due within a year, and liabilities of CN¥27.9m due beyond that. Offsetting these obligations, it had cash of CN¥10.2m as well as receivables valued at CN¥18.2m due within 12 months. So it has liabilities totalling CN¥9.56m more than its cash and near-term receivables, combined.

Sing Lee Software (Group) has a market capitalization of CN¥35.1m, so it could very likely raise cash to ameliorate its balance sheet, if the need arose. However, it is still worthwhile taking a close look at its ability to pay off debt. When analysing debt levels, the balance sheet is the obvious place to start. But it is Sing Lee Software (Group)'s earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

View our latest analysis for Sing Lee Software (Group)

Over 12 months, Sing Lee Software (Group) made a loss at the EBIT level, and saw its revenue drop to CN¥52m, which is a fall of 28%. To be frank that doesn't bode well.

Caveat Emptor

While Sing Lee Software (Group)'s falling revenue is about as heartwarming as a wet blanket, arguably its earnings before interest and tax (EBIT) loss is even less appealing. Its EBIT loss was a whopping CN¥8.4m. Considering that alongside the liabilities mentioned above does not give us much confidence that company should be using so much debt. Quite frankly we think the balance sheet is far from match-fit, although it could be improved with time. Another cause for caution is that is bled CN¥1.4m in negative free cash flow over the last twelve months. So suffice it to say we do consider the stock to be risky. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. To that end, you should be aware of the 2 warning signs we've spotted with Sing Lee Software (Group) .

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10