ASX Stocks That May Be Trading Below Intrinsic Value Estimates In August 2025

As the Australian market approaches the end of a tepid trading week, with the ASX 200 showing modest gains and global indices offering little influence, investors are keenly observing potential opportunities amidst flat earnings reports and economic updates. In such an environment, identifying stocks that may be trading below their intrinsic value can be particularly appealing for those looking to capitalize on undervalued assets.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Vysarn (ASX:VYS) | A$0.55 | A$0.98 | 43.8% |

| Superloop (ASX:SLC) | A$3.28 | A$6.54 | 49.9% |

| Reckon (ASX:RKN) | A$0.63 | A$1.19 | 46.9% |

| PointsBet Holdings (ASX:PBH) | A$1.27 | A$2.14 | 40.6% |

| LGI (ASX:LGI) | A$4.34 | A$7.98 | 45.6% |

| Elders (ASX:ELD) | A$7.65 | A$14.04 | 45.5% |

| Collins Foods (ASX:CKF) | A$9.54 | A$16.30 | 41.5% |

| Austal (ASX:ASB) | A$6.76 | A$13.20 | 48.8% |

| archTIS (ASX:AR9) | A$0.205 | A$0.41 | 49.7% |

| Advanced Braking Technology (ASX:ABV) | A$0.095 | A$0.16 | 41.8% |

Click here to see the full list of 35 stocks from our Undervalued ASX Stocks Based On Cash Flows screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Duratec (ASX:DUR)

Overview: Duratec Limited, with a market cap of A$393.17 million, provides assessment, protection, remediation, and refurbishment services for steel and concrete infrastructure assets in Australia.

Operations: Duratec's revenue is derived from several segments, including Energy (A$62.54 million), Defence (A$193.48 million), Buildings & Facades (A$113.64 million), and Mining & Industrial (A$144.05 million).

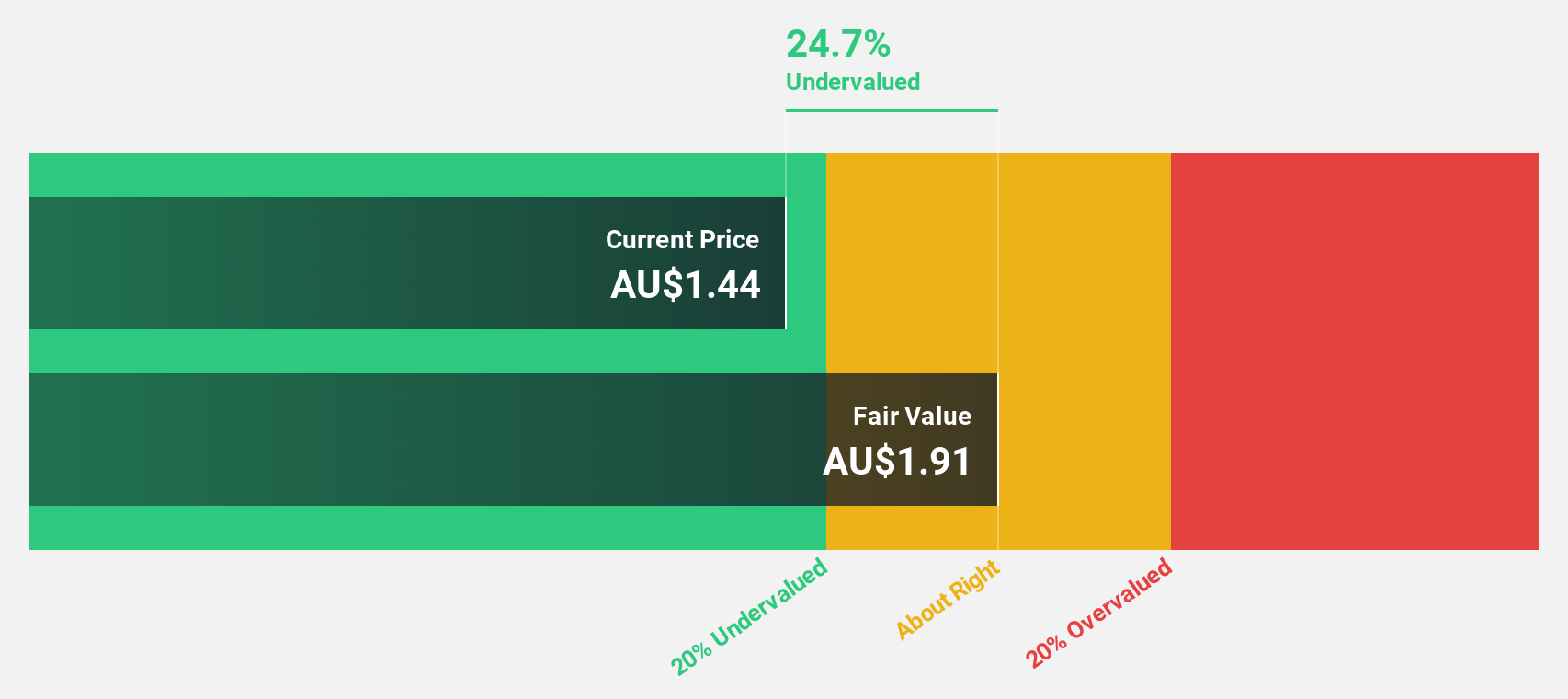

Estimated Discount To Fair Value: 20.6%

Duratec, currently priced at A$1.56, is trading 20.6% below its estimated fair value of A$1.96, highlighting its potential as an undervalued stock based on cash flows. Despite a history of unstable dividends, Duratec's earnings are projected to grow at 12% annually, outpacing the Australian market's 11%. Revenue growth is forecasted at 7.9%, surpassing the market average of 5.6%. Recent discussions on revised FY25 guidance may impact future performance assessments.

- Insights from our recent growth report point to a promising forecast for Duratec's business outlook.

- Navigate through the intricacies of Duratec with our comprehensive financial health report here.

LGI (ASX:LGI)

Overview: LGI Limited focuses on carbon abatement and renewable energy solutions using biogas from landfill, with a market cap of A$385.43 million.

Operations: The company's revenue is derived from three main segments: Carbon Abatement (A$17.29 million), Renewable Energy (A$17.08 million), and Infrastructure Construction and Management (A$2.37 million).

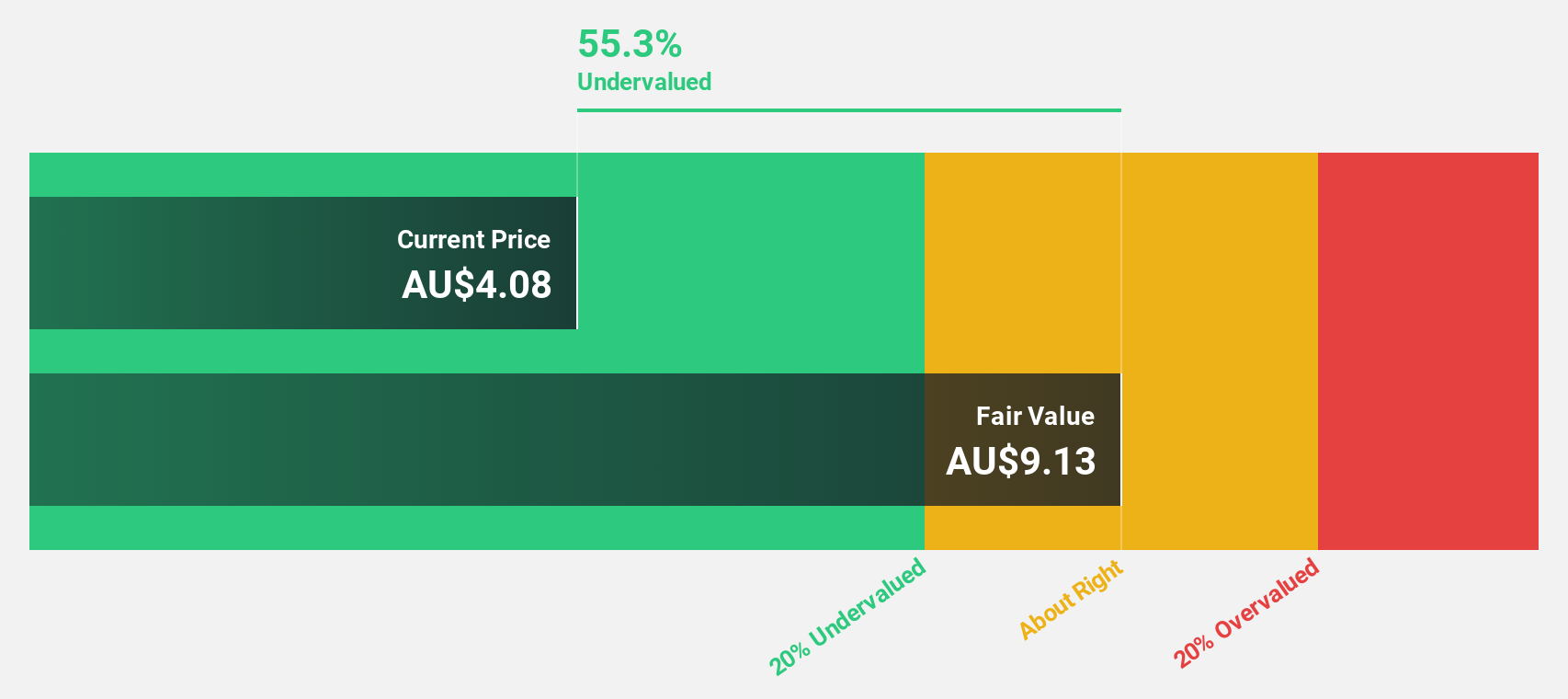

Estimated Discount To Fair Value: 45.6%

LGI, priced at A$4.34, is trading 45.6% below its estimated fair value of A$7.98, indicating significant undervaluation based on cash flows. The company's earnings are expected to grow significantly at 25% annually over the next three years, well above the Australian market's average growth rate of 11%. Recent developments include a contract for a grid-scale battery energy storage system in Sydney, aligning with LGI's strategic expansion and potentially enhancing future revenue streams through electricity spot market opportunities and grid support services.

- Upon reviewing our latest growth report, LGI's projected financial performance appears quite optimistic.

- Delve into the full analysis health report here for a deeper understanding of LGI.

Mader Group (ASX:MAD)

Overview: Mader Group Limited is a contracting company that offers specialist technical services in the mining, energy, and industrial sectors both in Australia and internationally, with a market cap of A$1.60 billion.

Operations: The company generates revenue from its Staffing & Outsourcing Services segment, amounting to A$811.54 million.

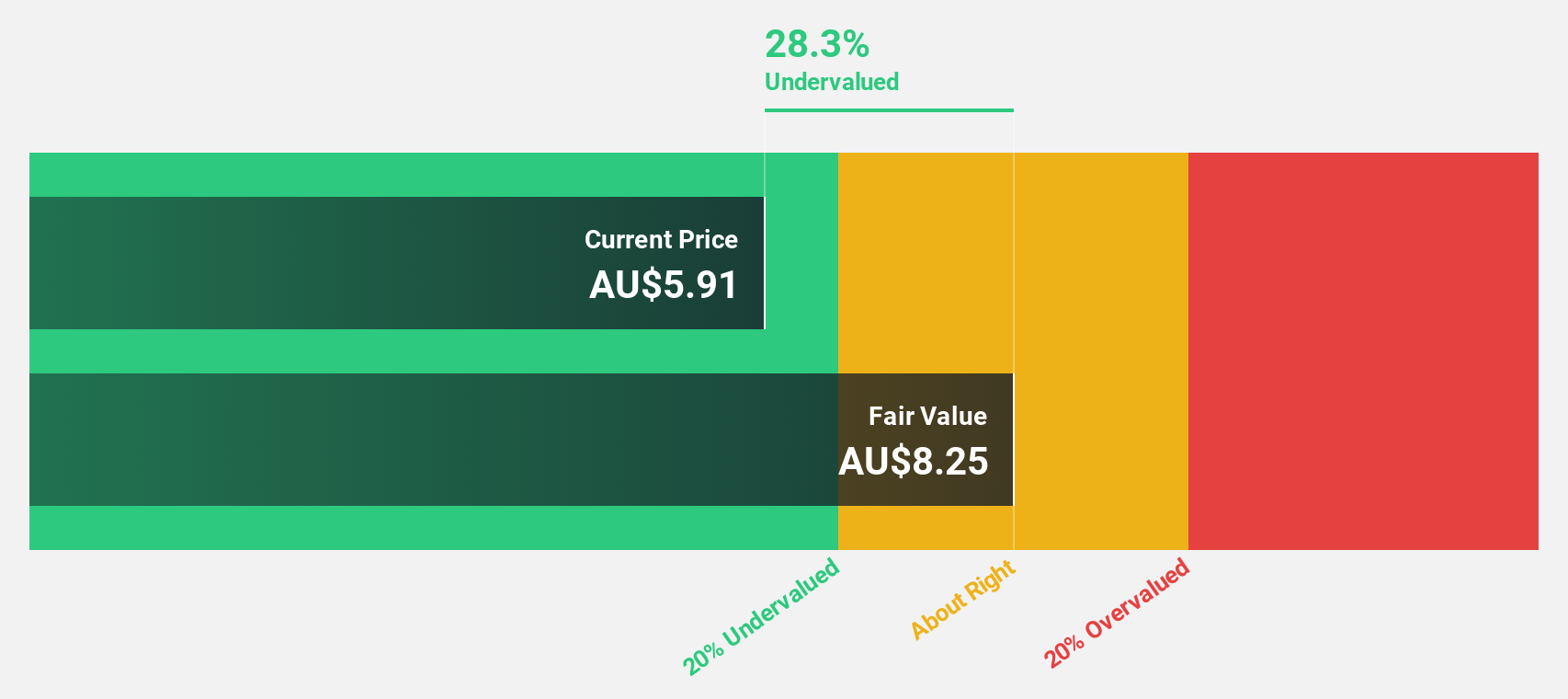

Estimated Discount To Fair Value: 13.6%

Mader Group, priced at A$7.91, is trading below its estimated fair value of A$9.16, reflecting some undervaluation based on cash flows. The company's earnings are projected to grow 13.5% annually, surpassing the Australian market's average growth rate of 11%. Although revenue growth is forecasted at 11.1% per year—faster than the market—it remains moderate compared to significant benchmarks for high growth rates in the industry.

- Our growth report here indicates Mader Group may be poised for an improving outlook.

- Unlock comprehensive insights into our analysis of Mader Group stock in this financial health report.

Where To Now?

- Take a closer look at our Undervalued ASX Stocks Based On Cash Flows list of 35 companies by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10