Spotlight On 3 Promising Penny Stocks With Over $60M Market Cap

As the U.S. market navigates a period of volatility marked by tech stock declines and fluctuating indices, investors are keenly watching for opportunities that might offer stability amidst uncertainty. Penny stocks, though an older term, still capture the essence of investing in smaller or less-established companies that may present significant value potential. By focusing on those with solid financials and growth potential, investors can uncover promising opportunities within this category.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Waterdrop (WDH) | $1.83 | $643.76M | ✅ 4 ⚠️ 0 View Analysis > |

| CuriosityStream (CURI) | $4.05 | $243.88M | ✅ 4 ⚠️ 2 View Analysis > |

| WM Technology (MAPS) | $1.05 | $197.61M | ✅ 4 ⚠️ 1 View Analysis > |

| Performance Shipping (PSHG) | $1.85 | $23.25M | ✅ 4 ⚠️ 2 View Analysis > |

| Tuniu (TOUR) | $0.9326 | $93.84M | ✅ 3 ⚠️ 2 View Analysis > |

| Table Trac (TBTC) | $4.935 | $22.59M | ✅ 2 ⚠️ 2 View Analysis > |

| BAB (BABB) | $0.949375 | $6.88M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.81 | $86.78M | ✅ 3 ⚠️ 3 View Analysis > |

| North European Oil Royalty Trust (NRT) | $4.98 | $46.5M | ✅ 2 ⚠️ 2 View Analysis > |

| Resources Connection (RGP) | $4.72 | $158.36M | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 393 stocks from our US Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Ovid Therapeutics (OVID)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Ovid Therapeutics Inc. is a biopharmaceutical company focused on developing impactful medicines for epilepsies and seizure-related neurological disorders in the United States, with a market cap of $66.33 million.

Operations: The company's revenue is derived entirely from its Pharmaceuticals segment, totaling $6.65 million.

Market Cap: $66.33M

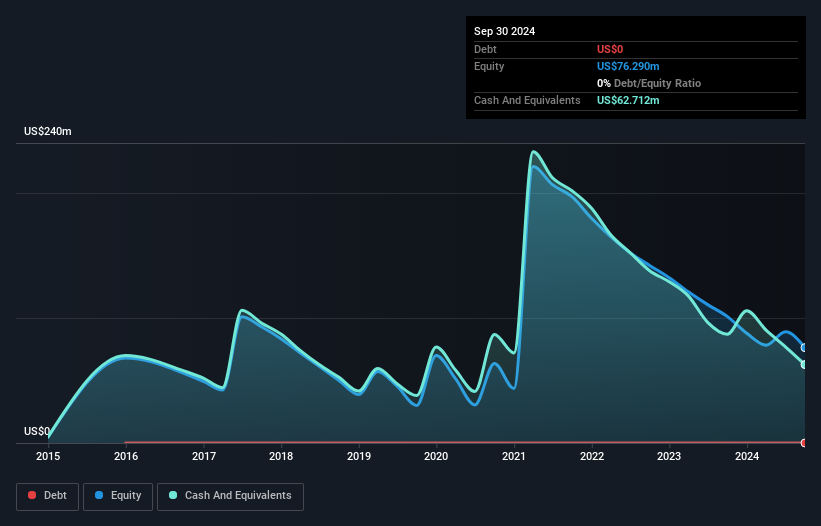

Ovid Therapeutics, with a market cap of US$66.33 million, recently reported a significant increase in revenue to US$6.27 million for Q2 2025 from US$0.169 million the previous year, though it remains unprofitable with a net loss of US$4.68 million. The company is debt-free but faces less than a year of cash runway if free cash flow continues to reduce at historical rates. Its share price has been highly volatile over the past three months, and while revenue is forecast to grow annually by 13.32%, earnings are expected to decline by an average of 15.8% per year over the next three years.

- Click to explore a detailed breakdown of our findings in Ovid Therapeutics' financial health report.

- Gain insights into Ovid Therapeutics' outlook and expected performance with our report on the company's earnings estimates.

Zura Bio (ZURA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Zura Bio Limited is a clinical-stage biotechnology company focused on developing medicines for immune and inflammatory disorders in the United States, with a market cap of $113.13 million.

Operations: Currently, there are no reported revenue segments for Zura Bio Limited.

Market Cap: $113.13M

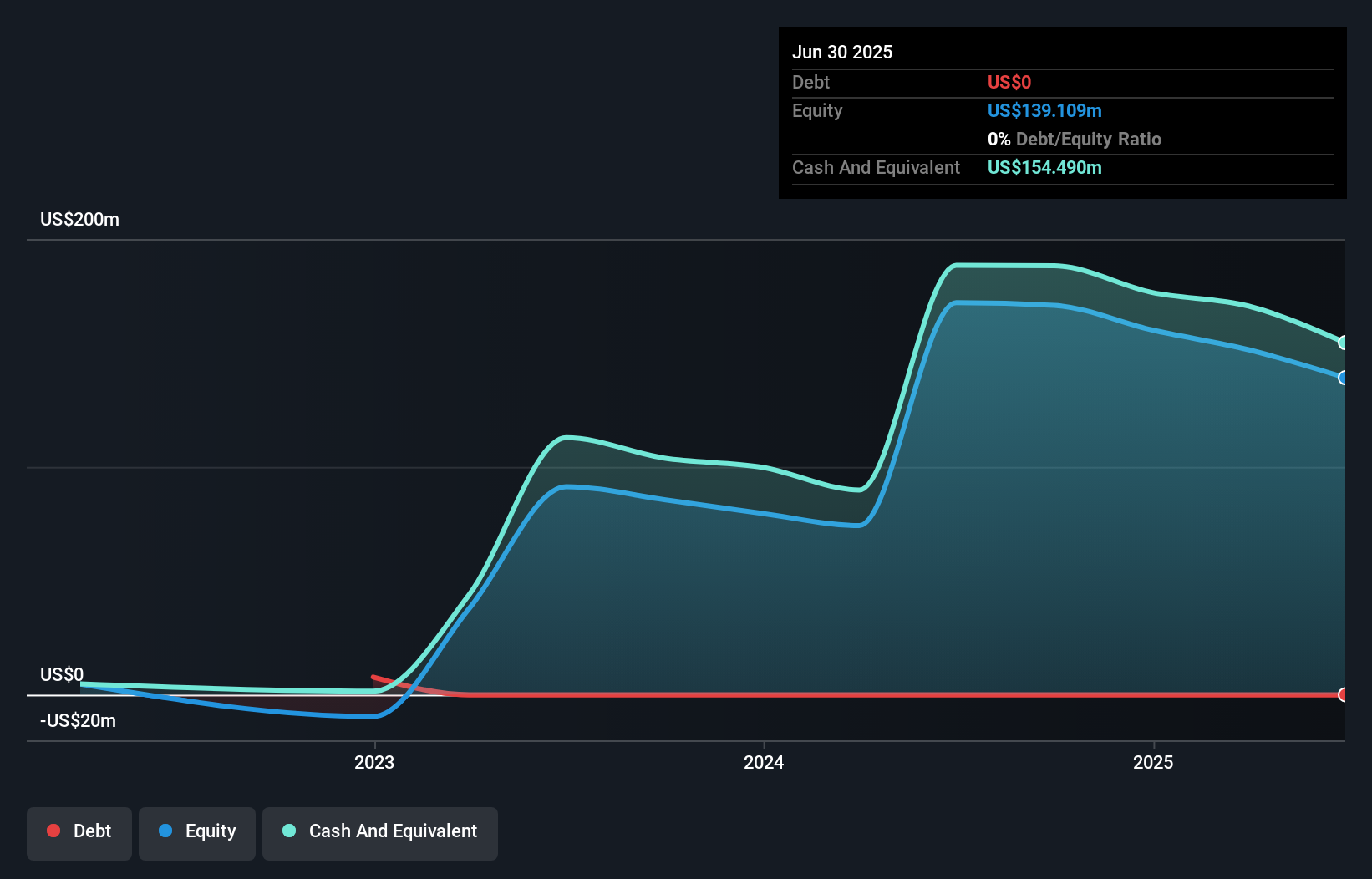

Zura Bio, a clinical-stage biotech company with a market cap of US$113.13 million, remains pre-revenue and unprofitable, reporting a net loss of US$15.99 million for Q2 2025. Despite its financial challenges, Zura is debt-free and has sufficient cash runway for over three years based on current free cash flow levels. Recent executive changes include the appointment of Eric Hyllengren as CFO to bolster financial strategy and operational execution. The stock's volatility remains high, reflected in its recent removal from several Russell growth indices while being added to value benchmarks like the Russell Microcap Value Index.

- Get an in-depth perspective on Zura Bio's performance by reading our balance sheet health report here.

- Examine Zura Bio's earnings growth report to understand how analysts expect it to perform.

Kandi Technologies Group (KNDI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Kandi Technologies Group, Inc. is a company that produces and sells electric off-road vehicles and associated parts in China, the United States, and internationally, with a market cap of approximately $122.96 million.

Operations: Kandi Technologies Group does not report specific revenue segments.

Market Cap: $122.96M

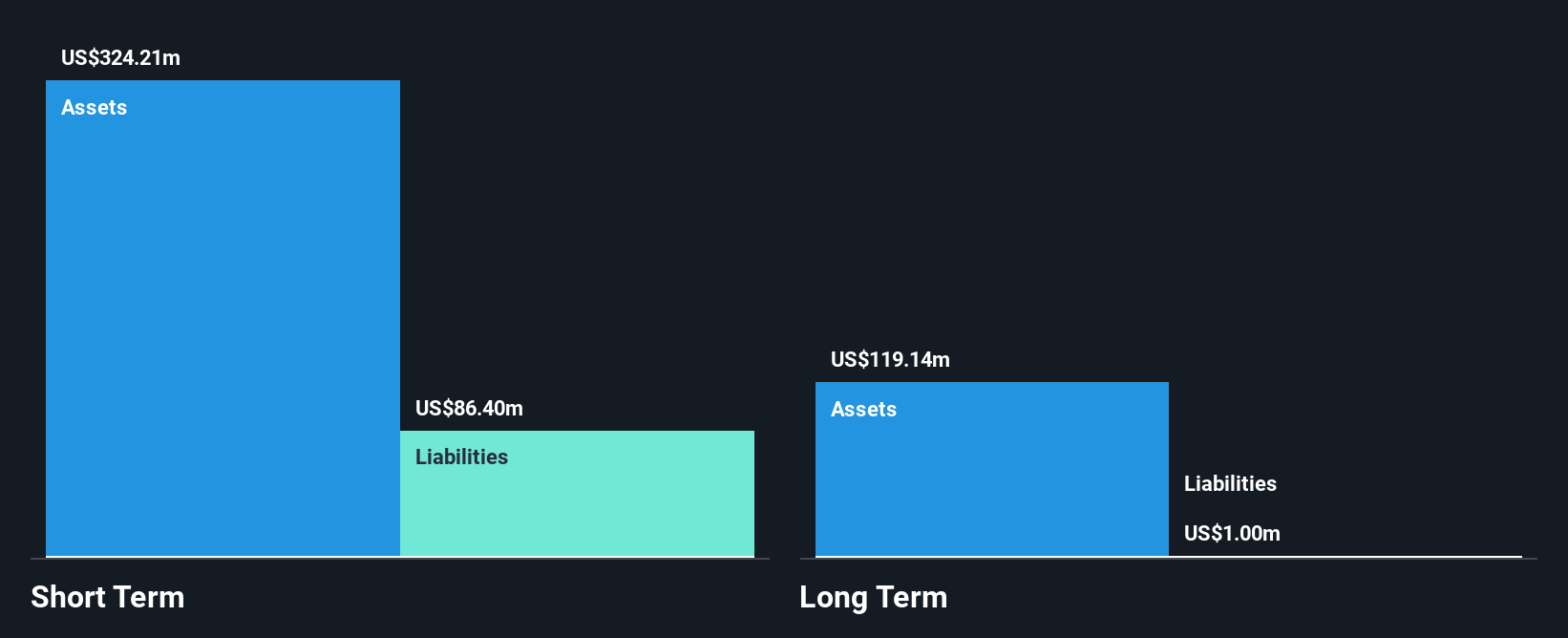

Kandi Technologies Group, Inc., with a market cap of US$122.96 million, has strategically positioned itself in the electric vehicle and battery swapping sectors. Despite declining earnings over recent years, Kandi's financial health is supported by more cash than debt and a stable cash runway exceeding three years. The company's collaboration with Contemporary Amperex Technology Co. Ltd. (CATL) marks a significant milestone, integrating Kandi into CATL's global supplier ecosystem for battery swap stations—a move that could enhance revenue streams significantly. Additionally, Kandi's ventures into AI-driven robotics highlight its commitment to innovation and diversification within smart mobility solutions.

- Click here and access our complete financial health analysis report to understand the dynamics of Kandi Technologies Group.

- Gain insights into Kandi Technologies Group's past trends and performance with our report on the company's historical track record.

Make It Happen

- Unlock our comprehensive list of 393 US Penny Stocks by clicking here.

- Interested In Other Possibilities? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zura Bio might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10