Assessing Bristol-Myers Squibb (BMY) Valuation After Recent Share Price Pullback

Bristol-Myers Squibb (BMY) has caught investors’ attention after a recent pullback, with shares dipping about 2% over the past month despite a modest 4% gain for the year. For longtime holders, moves like these raise questions: Is the market rethinking the company’s prospects, or simply adjusting to new developments? The latest price action is subtle, and since healthcare stocks often respond to pipeline news and changing industry headwinds, even quieter shifts can prompt debates on value.

Bristol-Myers Squibb’s journey this year has not been smooth. After a difficult period that saw the company’s stock fall more than 15% since January, shares have regained some ground in recent months. However, the longer-term picture is mixed, with losses accumulating over the past three and five years. Despite this, the company has reported positive net income growth even as revenue has edged lower. This dynamic could influence how investors evaluate future risks and rewards.

With the price rebounding from recent lows and valuation metrics suggesting a potential discount, is now a good time to take a closer look at Bristol-Myers Squibb, or is the market already accounting for any potential upside?

Most Popular Narrative: 26.3% Undervalued

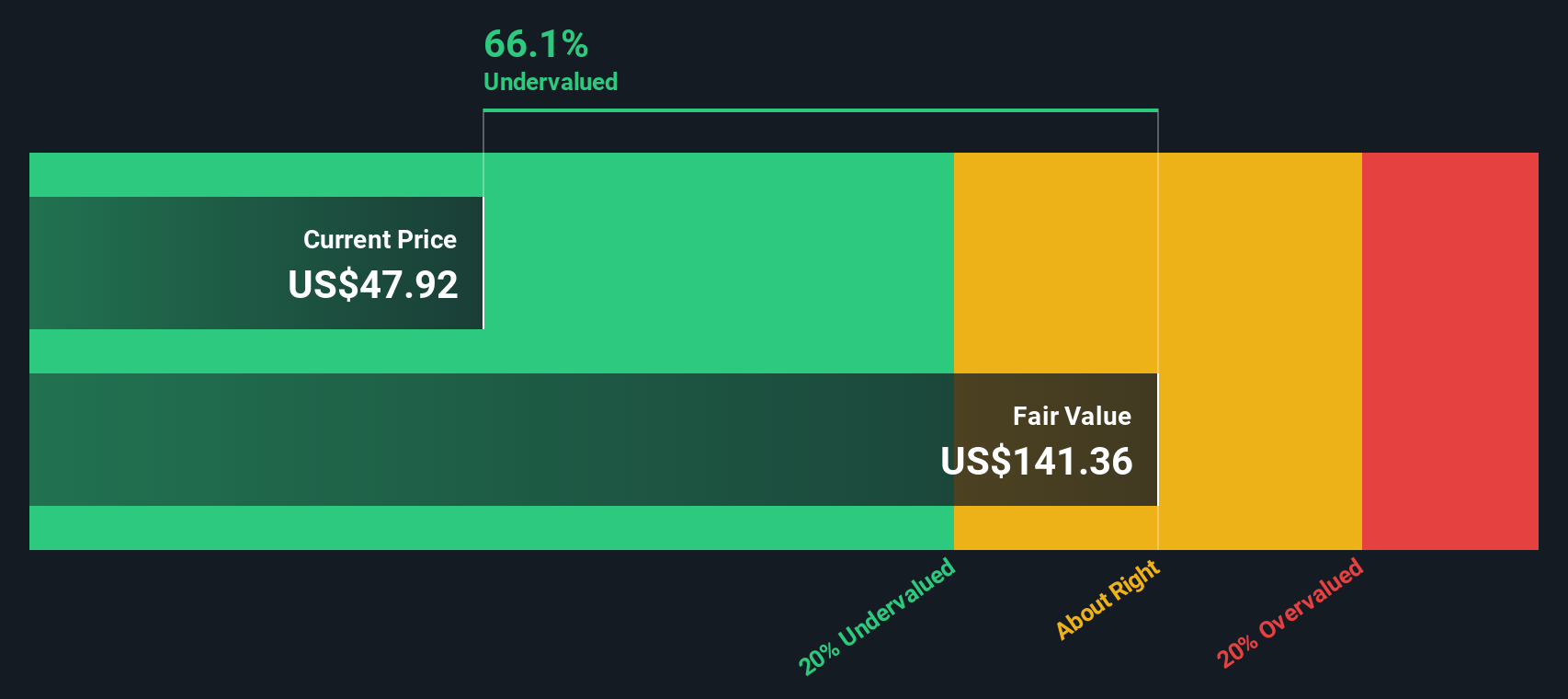

According to the narrative by Evangelos, Bristol-Myers Squibb may be trading at a notable discount to its estimated fair value. This presents the case for a potentially undervalued opportunity.

Product Approvals: The U.S. approval of Opdivo Qvantig and the launch of Cobenfy for schizophrenia are expected to contribute to future growth.

Curious about what fuels such a bullish price target? The narrative's fair value hinges on bold growth assumptions and significant cost-saving plans that could shift the outlook for years to come. Want to know the financial drivers most investors are missing? Find out how one key metric, beyond just next year's earnings, is shaping this valuation story.

Result: Fair Value of $65 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, risks remain, including weaker future revenue guidance and the possibility that cost-saving plans may not materialize as projected.

Find out about the key risks to this Bristol-Myers Squibb narrative.Another View: Discounted Cash Flow Model

While the first approach uses earnings multiples to highlight value, our DCF model provides a different angle. It suggests Bristol-Myers Squibb could be even further undervalued, which challenges traditional valuation signals. Could DCF be spotting hidden upside?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Bristol-Myers Squibb Narrative

If you have a different viewpoint or want to dig into the numbers firsthand, you can shape your own perspective in just a few minutes. do it your way.

A great starting point for your Bristol-Myers Squibb research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Broaden your investing horizons and get ahead of market trends by checking out the latest standout stock ideas on Simply Wall Street. Missing out could mean overlooking the next breakout performer, so act now and give yourself every advantage.

- Uncover the power of compounding income streams and start building wealth with dividend stocks with yields > 3%, which offer yields over 3%.

- Harness the potential of humans and machines working together by spotting the most promising healthcare AI stocks driving breakthroughs in medical technology.

- Get ahead of the curve and track the industry’s top quantum computing stocks that are transforming the digital world.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bristol-Myers Squibb might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10