August 2025's Leading Growth Stocks With Strong Insider Ownership

As the U.S. stock market navigates a mixed landscape with major indices showing varied performances, investor optimism is buoyed by potential interest rate cuts and robust corporate earnings reports. In this environment, growth companies with high insider ownership can be particularly appealing as they often signal strong confidence from those closest to the business, which can be crucial during times of economic uncertainty.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Upstart Holdings (UPST) | 12.5% | 93.2% |

| Prairie Operating (PROP) | 30.9% | 86.3% |

| Niu Technologies (NIU) | 37.2% | 92.8% |

| Hippo Holdings (HIPO) | 12.9% | 41.2% |

| Hesai Group (HSAI) | 21.3% | 41.5% |

| FTC Solar (FTCI) | 23.2% | 63% |

| Credo Technology Group Holding (CRDO) | 11.5% | 36.4% |

| Cloudflare (NET) | 10.6% | 46.1% |

| Atour Lifestyle Holdings (ATAT) | 21.9% | 23.5% |

| Astera Labs (ALAB) | 12.3% | 37.1% |

Click here to see the full list of 195 stocks from our Fast Growing US Companies With High Insider Ownership screener.

Let's explore several standout options from the results in the screener.

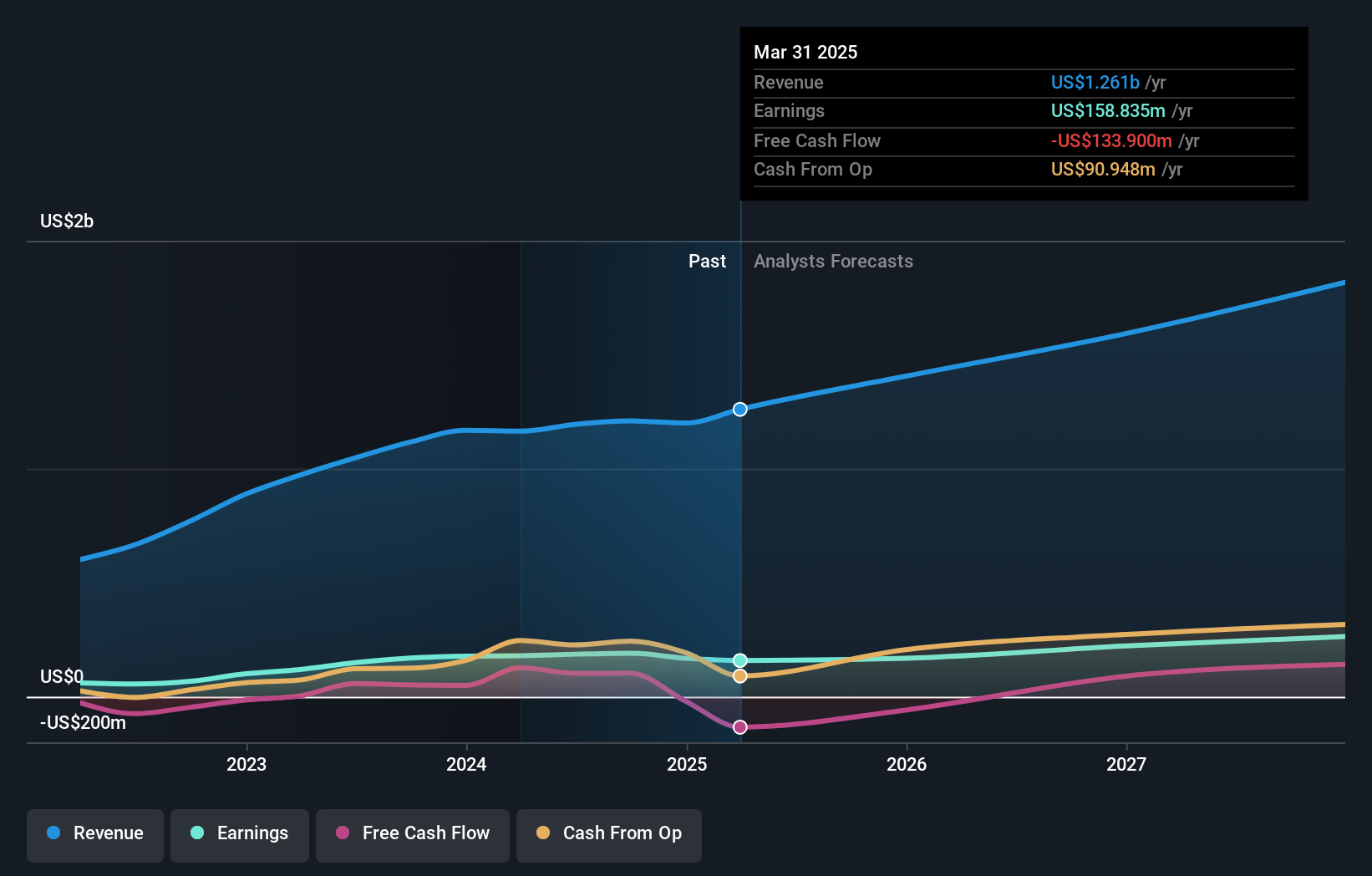

AAON (AAON)

Simply Wall St Growth Rating: ★★★★★☆

Overview: AAON, Inc., along with its subsidiaries, is involved in the engineering, manufacturing, marketing, and selling of air conditioning and heating equipment across the United States and Canada, with a market cap of approximately $7.01 billion.

Operations: The company's revenue segments consist of $782.31 million from AAON Oklahoma, $273.12 million from AAON Coil Products, and $249.04 million from Basx.

Insider Ownership: 17.3%

AAON shows potential as a growth company with high insider ownership in the United States. Despite recent lowered financial guidance for 2025, its earnings are forecast to grow significantly at 26.1% annually, outpacing the US market average of 15%. The company's revenue is expected to grow at 13.5% per year, faster than the US market's 9.3%. However, profit margins have decreased from last year and recent inefficiencies may impact short-term performance.

- Delve into the full analysis future growth report here for a deeper understanding of AAON.

- The analysis detailed in our AAON valuation report hints at an inflated share price compared to its estimated value.

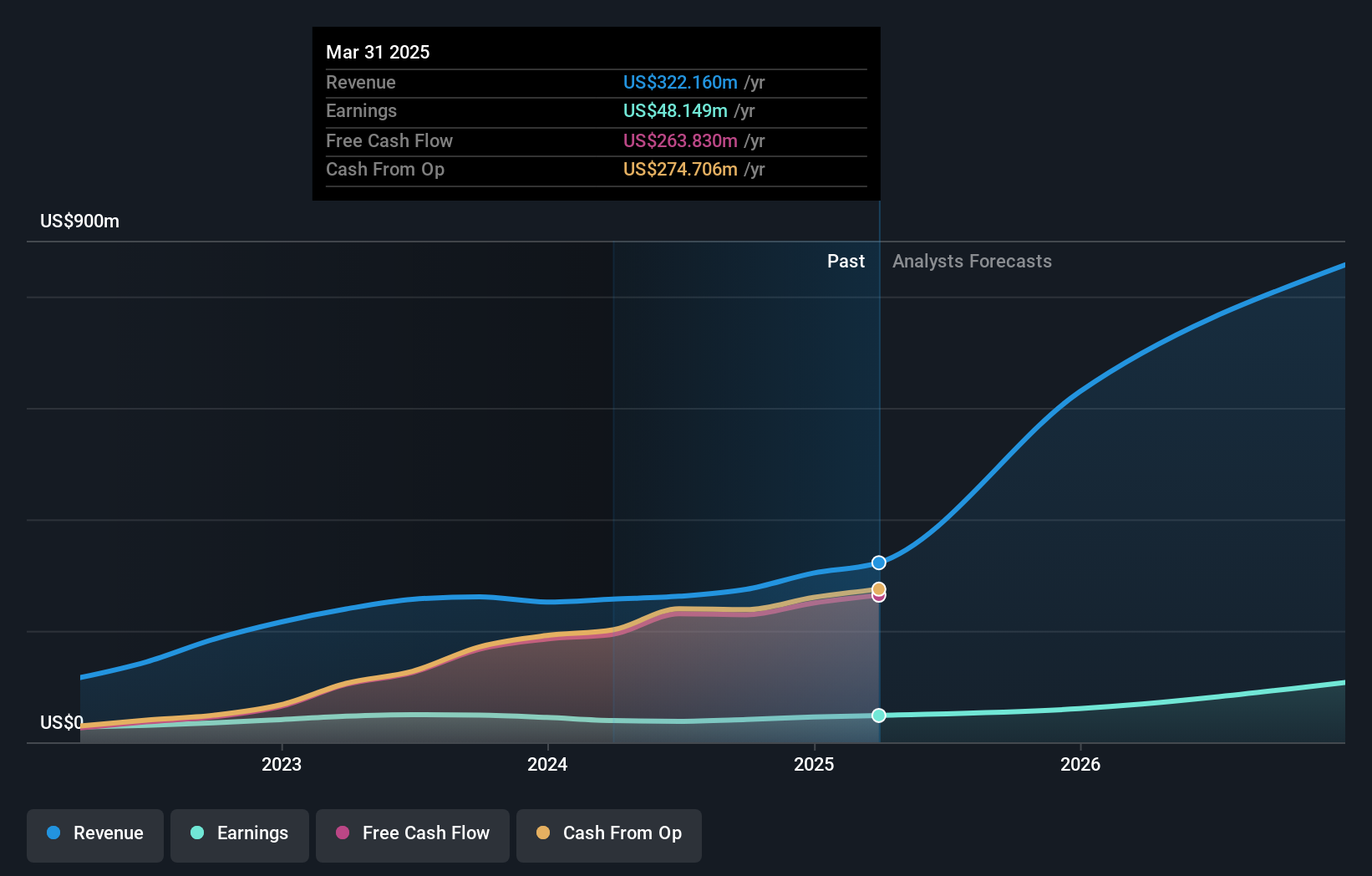

Coastal Financial (CCB)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Coastal Financial Corporation, with a market cap of $1.67 billion, operates as the bank holding company for Coastal Community Bank, offering a range of banking products and services to small and medium-sized businesses, professionals, and individuals in the Puget Sound region in Washington.

Operations: The company's revenue segments include CCBX at $234.44 million, Community Bank at $85.81 million, and Treasury & Administration at $16.15 million.

Insider Ownership: 14.3%

Coastal Financial is positioned for growth with earnings projected to rise 56.9% annually, surpassing the US market average. Revenue is expected to grow at 47.9% per year, also outpacing the market. Despite recent index exclusions and consistent net charge-offs totaling US$49.3 million last quarter, the company has strengthened its leadership team with experienced executives to drive digital banking initiatives and community-focused growth strategies forward.

- Get an in-depth perspective on Coastal Financial's performance by reading our analyst estimates report here.

- According our valuation report, there's an indication that Coastal Financial's share price might be on the expensive side.

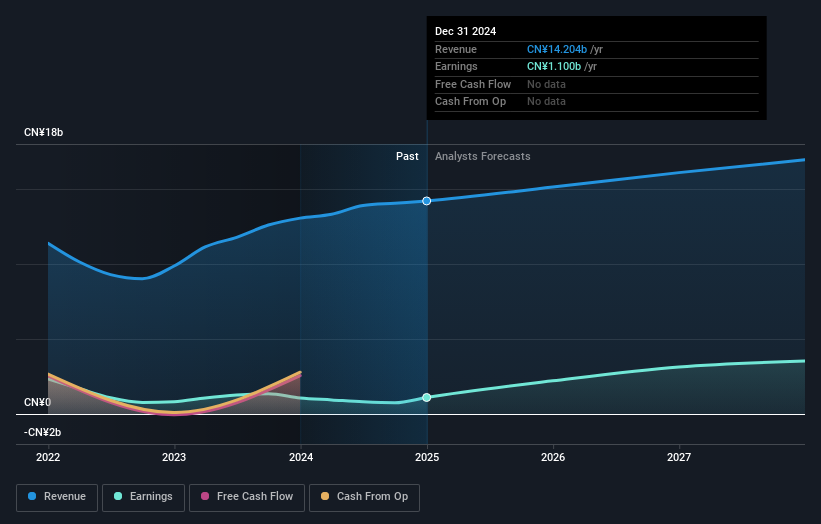

LexinFintech Holdings (LX)

Simply Wall St Growth Rating: ★★★★★☆

Overview: LexinFintech Holdings Ltd., along with its subsidiaries, provides online direct sales and consumer finance services in China, with a market cap of approximately $1.14 billion.

Operations: The company's revenue segments include online retailers, generating CN¥14.01 billion.

Insider Ownership: 35%

LexinFintech Holdings is poised for substantial earnings growth, with forecasts indicating a 32.6% annual increase, outpacing the US market. Despite a slight dip in revenue to CNY 3.59 billion for Q2 2025, net income surged to CNY 511.4 million from CNY 226.53 million year-over-year. The company announced a share buyback program worth up to US$50 million and maintained its positive earnings guidance for the full year, signaling confidence in future performance.

- Click here and access our complete growth analysis report to understand the dynamics of LexinFintech Holdings.

- Insights from our recent valuation report point to the potential undervaluation of LexinFintech Holdings shares in the market.

Turning Ideas Into Actions

- Access the full spectrum of 195 Fast Growing US Companies With High Insider Ownership by clicking on this link.

- Seeking Other Investments? Uncover 13 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10