Promising Penny Stocks To Watch In August 2025

As the U.S. stock market navigates a mixed landscape, with major indices showing varied performances and investor attention focused on potential interest rate cuts, opportunities continue to emerge for those looking beyond the mainstream. Penny stocks, while often seen as remnants of past market eras, still hold promise for investors seeking affordability combined with growth potential. By honing in on companies with strong financials and clear growth paths, these smaller or newer entities can offer intriguing prospects in today's investment climate.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $2.30 | $492.9M | ✅ 5 ⚠️ 0 View Analysis > |

| ATRenew (RERE) | $4.55 | $1.02B | ✅ 3 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.85 | $669.08M | ✅ 4 ⚠️ 0 View Analysis > |

| CuriosityStream (CURI) | $4.38 | $253.73M | ✅ 4 ⚠️ 2 View Analysis > |

| WM Technology (MAPS) | $1.12 | $191.54M | ✅ 4 ⚠️ 2 View Analysis > |

| Performance Shipping (PSHG) | $1.92 | $23.87M | ✅ 4 ⚠️ 2 View Analysis > |

| Table Trac (TBTC) | $4.37 | $20.27M | ✅ 2 ⚠️ 2 View Analysis > |

| BAB (BABB) | $0.905 | $6.57M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $4.01 | $90.86M | ✅ 3 ⚠️ 3 View Analysis > |

| TETRA Technologies (TTI) | $4.47 | $595.76M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 382 stocks from our US Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

VAALCO Energy (EGY)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: VAALCO Energy, Inc. is an independent energy company focused on acquiring, exploring, developing, and producing crude oil and natural gas in Gabon, Egypt, Equatorial Guinea, Cote d'Ivoire, and Canada with a market cap of $412.86 million.

Operations: The company's revenue is primarily derived from its operations in the exploration and production of hydrocarbons, totaling $469.28 million.

Market Cap: $412.86M

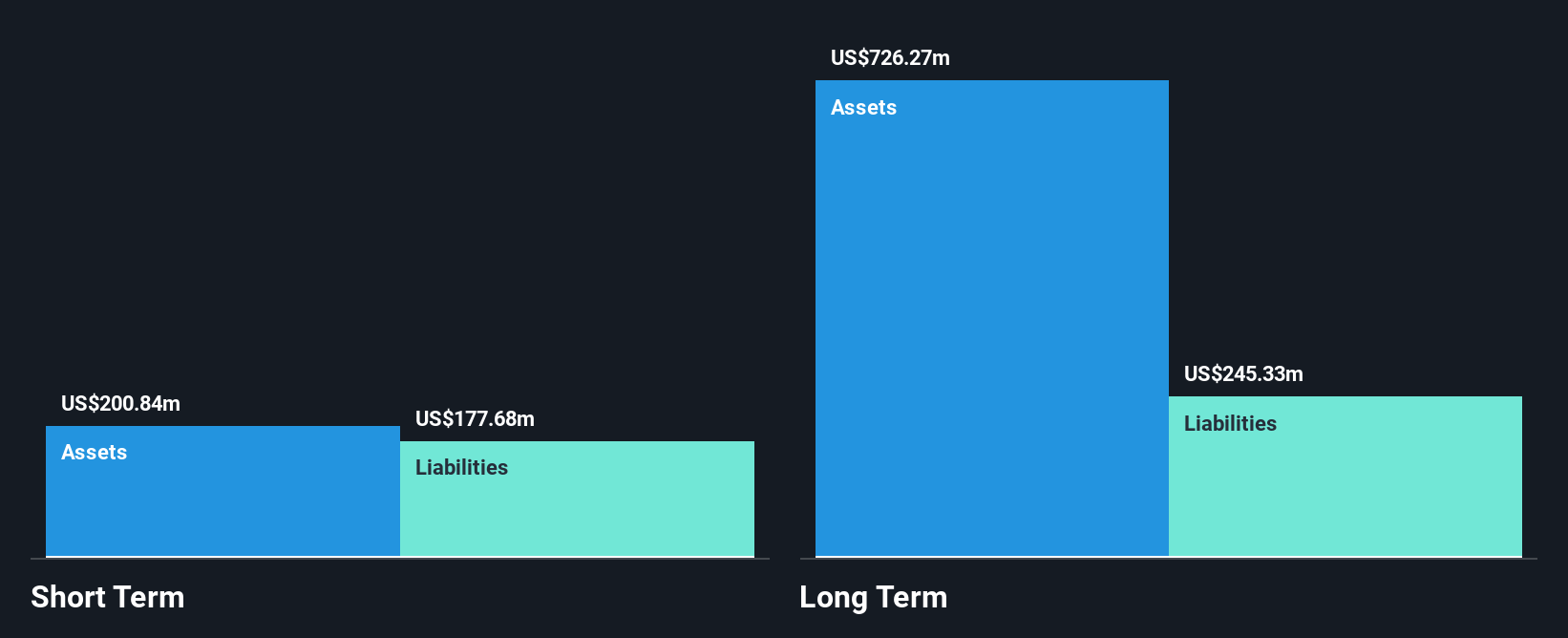

VAALCO Energy, with a market cap of US$412.86 million, has demonstrated financial stability through its strong coverage of short-term liabilities by short-term assets and robust cash flow covering its debt. The company recently reported a decline in net income for the second quarter to US$8.38 million from US$28.15 million the previous year, reflecting challenges in earnings growth. Despite this, VAALCO's interest payments are well-covered by EBIT, and it maintains high-quality earnings with no significant shareholder dilution recently. The firm continues to provide production guidance and pays a quarterly dividend of $0.0625 per share.

- Unlock comprehensive insights into our analysis of VAALCO Energy stock in this financial health report.

- Assess VAALCO Energy's future earnings estimates with our detailed growth reports.

Riskified (RSKD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Riskified Ltd. develops an e-commerce risk intelligence platform that helps online merchants build trusted consumer relationships across various regions, with a market cap of approximately $718.32 million.

Operations: The company generates revenue primarily from its Security Software & Services segment, totaling $335.83 million.

Market Cap: $718.32M

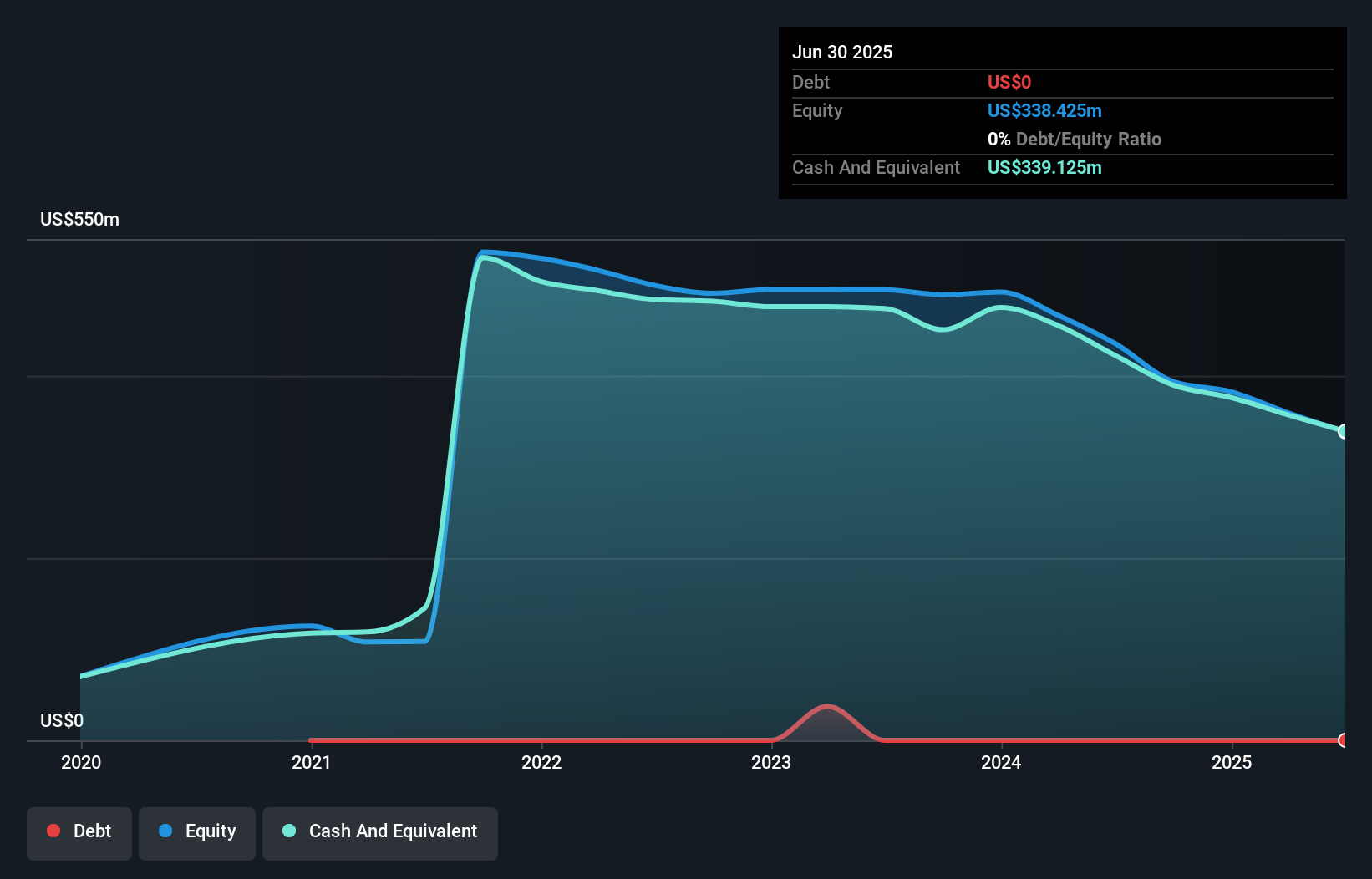

Riskified Ltd., with a market cap of US$718.32 million, is trading significantly below its estimated fair value. Despite being unprofitable, the company has reduced losses by 21% annually over five years and maintains a strong cash position with no debt. Recent earnings showed increased sales but also higher net losses year-on-year. The firm raised its revenue guidance for 2025 to between US$336 million and US$346 million, reflecting optimism in future performance. Additionally, Riskified's strategic partnership with HUMAN Security aims to enhance fraud prevention in AI-driven ecommerce environments, addressing emerging risks associated with automated shopping agents.

- Take a closer look at Riskified's potential here in our financial health report.

- Evaluate Riskified's prospects by accessing our earnings growth report.

VTEX (VTEX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: VTEX, along with its subsidiaries, offers a software-as-a-service digital commerce platform for enterprise brands and retailers, with a market cap of $762.43 million.

Operations: The company's revenue is derived entirely from its Internet Software & Services segment, totaling $230.50 million.

Market Cap: $762.43M

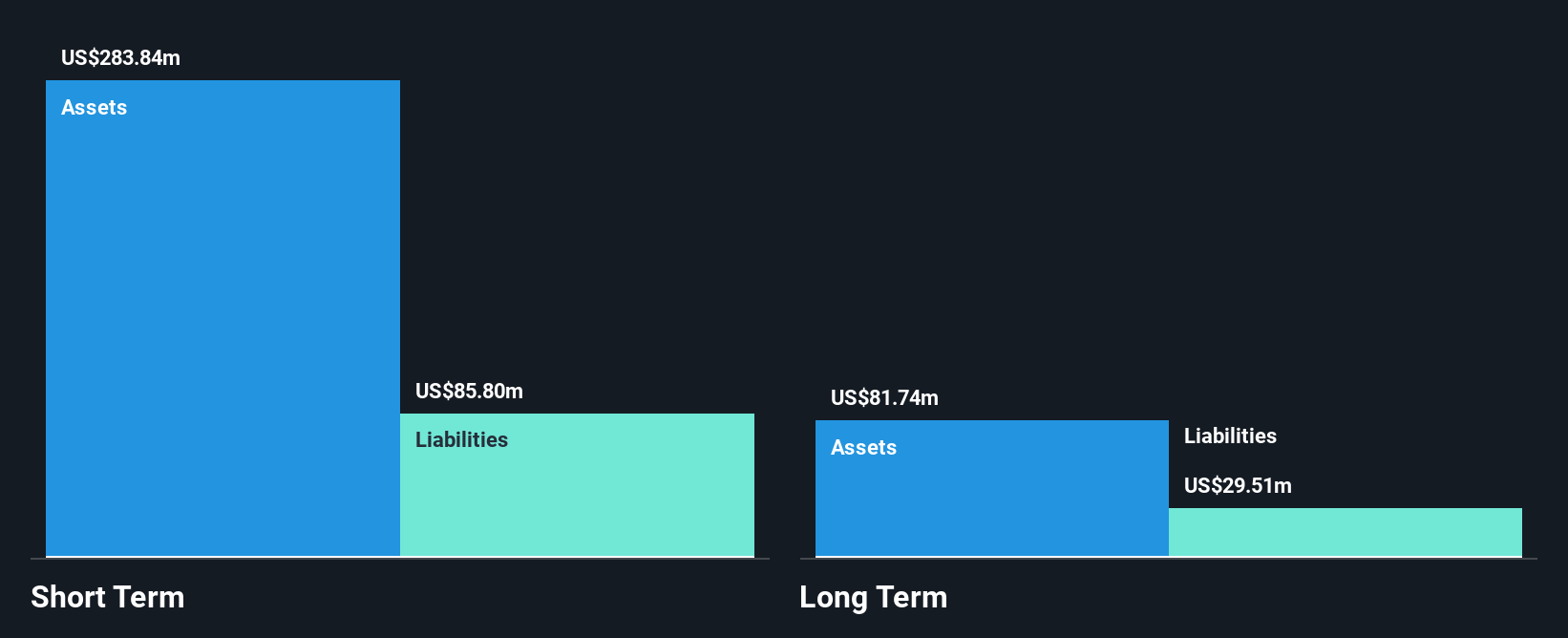

VTEX, with a market cap of US$762.43 million, stands out for its robust enterprise-grade digital commerce platform. The company has experienced management and board teams, with average tenures of 3.6 and 4.3 years respectively. VTEX's recent financials indicate revenue growth to US$58.79 million in Q2 2025, but net income fell to US$2.99 million from the previous year due to large one-off losses impacting results. Despite low return on equity at 4.1%, VTEX remains debt-free and has initiated a $40 million share repurchase program, reflecting confidence in its valuation and future prospects amidst ongoing B2B innovation initiatives.

- Click here to discover the nuances of VTEX with our detailed analytical financial health report.

- Learn about VTEX's future growth trajectory here.

Make It Happen

- Explore the 382 names from our US Penny Stocks screener here.

- Ready To Venture Into Other Investment Styles? We've found 19 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10