Okta, Inc. (NASDAQ:OKTA) will release financial results for the second quarter after the closing bell on Tuesday, Aug. 26.

Analysts expect the San Francisco, California-based company to report quarterly earnings at 85 cents per share, up from 72 cents per share in the year-ago period. Okta projects to report quarterly revenue at $711.84 million, compared to $646 million a year earlier, according to data from Benzinga Pro.

On Aug. 14, Okta announced the appointment of David Schellhase and Mary Agnes Wilderotter to the Company’s board of directors.

Okta shares rose 2.5% to close at $92.05 on Friday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

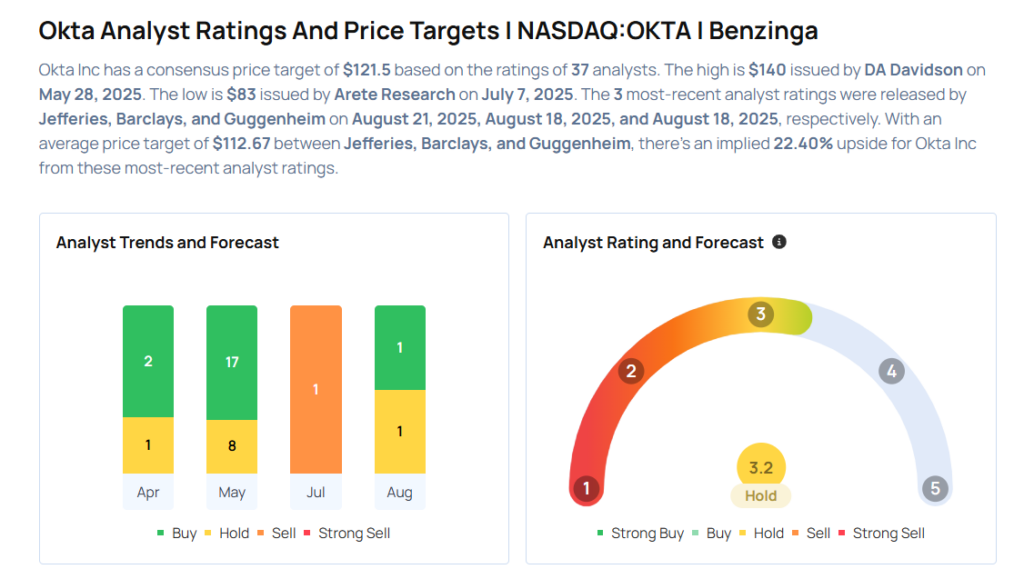

Let's have a look at how Benzinga's most-accurate analysts have rated the company in the recent period.

- Jefferies analyst Joseph Gallo maintained a Hold rating and cut the price target from $105 to $100 on Aug. 21, 2025. This analyst has an accuracy rate of 68%.

- Barclays analyst Saket Kalia maintained an Equal-Weight rating and slashed the price target from $120 to $100 on Aug. 18, 2025. This analyst has an accuracy rate of 79%.

- Guggenheim analyst John Difucci reiterated a Buy rating with a price target of $138 on Aug. 18, 2025. This analyst has an accuracy rate of 67%.

- Mizuho analyst Gregg Moskowitz maintained an Outperform rating and cut the price target from $135 to $130 on May 28, 2025. This analyst has an accuracy rate of 69%.

- BMO Capital analyst Keith Bachman maintained a Market Perform rating and slashed the price target from $135 to $132 on May 28, 2025. This analyst has an accuracy rate of 79%.

Considering buying OKTA stock? Here’s what analysts think:

Read This Next:

- Top 2 Tech Stocks That May Collapse In August

Photo via Shutterstock