Marvell Technology (MRVL) Unveils Industry's First 2nm 64 Gbps D2D Interconnect

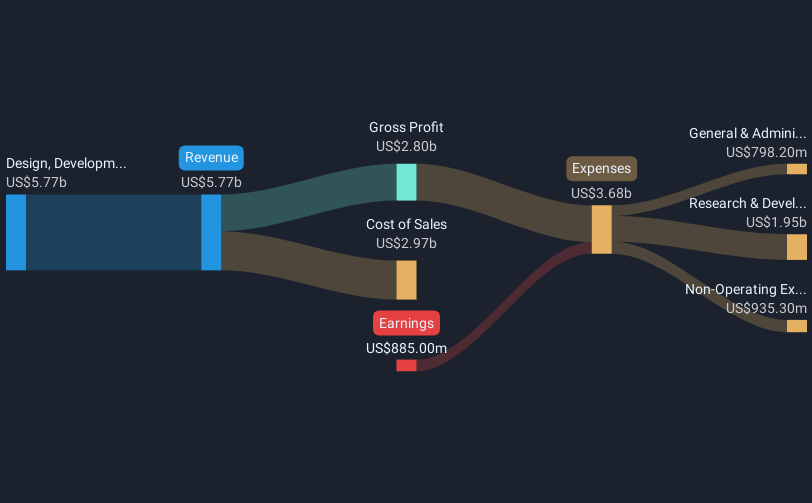

Marvell Technology (MRVL) recently announced the launch of its innovative 2nm 64 Gbps bi-directional die-to-die interconnect, enhancing bandwidth and efficiency for XPUs. This announcement aligns with the company's impressive 14.97% price increase over the past quarter. The new product highlights Marvell's continued commitment to pioneering semiconductor solutions, which further strengthens its market position amidst the backdrop of significant market events. While the broader market indices, like the S&P 500, experienced modest gains, Marvell's robust earnings report and strategic partnerships likely added weight to its stock performance during this period.

Buy, Hold or Sell Marvell Technology? View our complete analysis and fair value estimate and you decide.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

The recent launch of Marvell Technology’s 2nm 64 Gbps bi-directional die-to-die interconnect may bolster the company's narrative of enhancing AI data center capabilities. This new technology could potentially accelerate revenue and earnings growth by creating efficiencies and expanding market opportunities, particularly in high-performance computing applications. With strong AI demand and custom silicon ramp-up, these advancements align well with Marvell's goals of meeting its US$2.5 billion AI revenue target by fiscal 2026.

Over the past five years, Marvell's total shareholder return, including share price and dividends, was 93.58%, reflecting substantial longer-term growth. However, when comparing its one-year performance, Marvell underperformed the US Semiconductor industry, which returned 34.4% over the past year. This indicates that while the company has achieved significant longer-term growth, it faced challenges in keeping pace with broader industry trends over the recent year.

With current shares trading at US$74.26 and a consensus price target of US$91.10, the stock presents a potential upside of approximately 22.3%. The integration of innovative technologies suggests a positive impact on future revenue and earnings forecasts. However, the potential risks, such as reliance on a few key customers and technological shifts, may need careful management to sustain growth trajectories and align with market expectations of improved profit margins and revenue rates.

Evaluate Marvell Technology's historical performance by accessing our past performance report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10