Alibaba Group Holding (NYSE:BABA) posted better-than-expected revenue for the first quarter on Friday.

The company posted quarterly revenue of $34.57 billion, up 2% year-over-year, surpassing the consensus estimate of $34.26 billion. On a like-for-like basis, excluding revenue from the divested Sun Art and Intime businesses, Alibaba’s revenue would have grown 10% year-over-year.

Despite the top-line beat, adjusted earnings per American Depositary Share (ADS) came in at $2.06, falling short of the analyst consensus of $2.13.

Alibaba CEO Eddie Wu said the company drove strong growth by focusing on consumption and AI + Cloud, hitting milestones in quick commerce and boosting engagement across its platforms.

Alibaba shares rose 1.5% to trade at $137.01 on Tuesday.

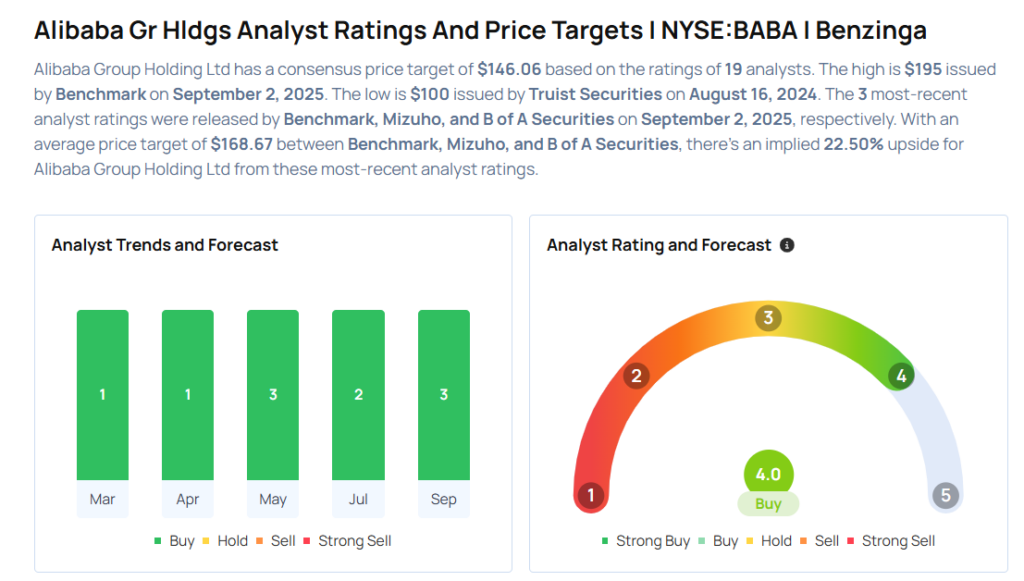

These analysts made changes to their price targets on Alibaba following earnings announcement.

- B of A Securities analyst Joyce Ju maintained Alibaba with a Buy and raised the price target from $135 to $152.

- Mizuho analyst Jason Helfstein maintained the stock with an Outperform rating and raised the price target from $149 to $159.

- Benchmark analyst Fawne Jiang maintained Alibaba with a Buy and raised the price target from $176 to $195.

Considering buying BABA stock? Here’s what analysts think:

Read This Next:

- Top 2 Consumer Stocks That May Collapse In Q3

Photo via Shutterstock