As of Sept. 4, 2025, two stocks in the financial sector could be flashing a real warning to investors who value momentum as a key criteria in their trading decisions.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered overbought when the RSI is above 70, according to Benzinga Pro.

Here's the latest list of major overbought players in this sector.

Lendingtree Inc (NASDAQ:TREE)

- On July 31, LendingTree posted better-than-expected quarterly earnings. “Our company continues to generate impressive financial results, with Adjusted EBITDA up 35% YoY, fueled by strong revenue growth across all three segments of the business,” said Doug Lebda, Chairman and CEO. The company's stock jumped around 33% over the past month and has a 52-week high of $70.90.

- RSI Value: 79.4

- TREE Price Action: Shares of Lendingtree rose 3.3% to trade at $70.72 on Thursday.

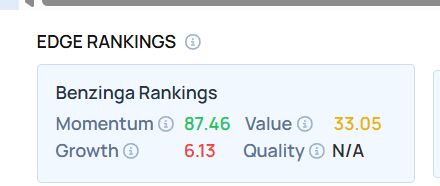

- Edge Stock Ratings: 87.46 Momentum score with Value at 33.05.

Enova International Inc (NYSE:ENVA)

- On July 24, Enova International posted better-than-expected quarterly earnings. “We are pleased to report another quarter of strong performance,” said David Fisher, Enova’s CEO. “For the fifth quarter in a row, we generated greater than 20% year-over-year growth in revenue, originations and adjusted EPS. We remain committed to prudently managing the business to produce sustainable and profitable growth, and we believe our diversified business, strong competitive position, world-class team, advanced technology and analytics platform position us very well for the remainder of this year and beyond.” The company's stock gained around 20% over the past month and has a 52-week high of $123.48.

- RSI Value: 72.5

- ENVA Price Action: Shares of Enova International gained 2.6% to trade at $123.14 on Thursday.

Learn more about BZ Edge Rankings—click to see scores for other stocks in the sector and see how they compare.

Read This Next:

- Wall Street’s Most Accurate Analysts Give Their Take On 3 Financial Stocks With Over 11% Dividend Yields

Photo via Shutterstock