Ferguson Enterprises Inc. (NYSE:FERG) will release earnings results for the fourth quarter, before the opening bell on Tuesday, Sept. 16.

Analysts expect the Newport News, Virginia-based company to report quarterly earnings at $3.01 per share, up from $2.98 per share in the year-ago period. Ferguson Enterprises is projected to report quarterly revenue of $8.39 billion, compared to $7.95 billion a year earlier, according to data from Benzinga Pro.

On Sept. 11, Ferguson's board of directors declared a dividend of 83 cents per share.

Ferguson Enterprises shares rose 0.7% to close at $225.72 on Thursday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

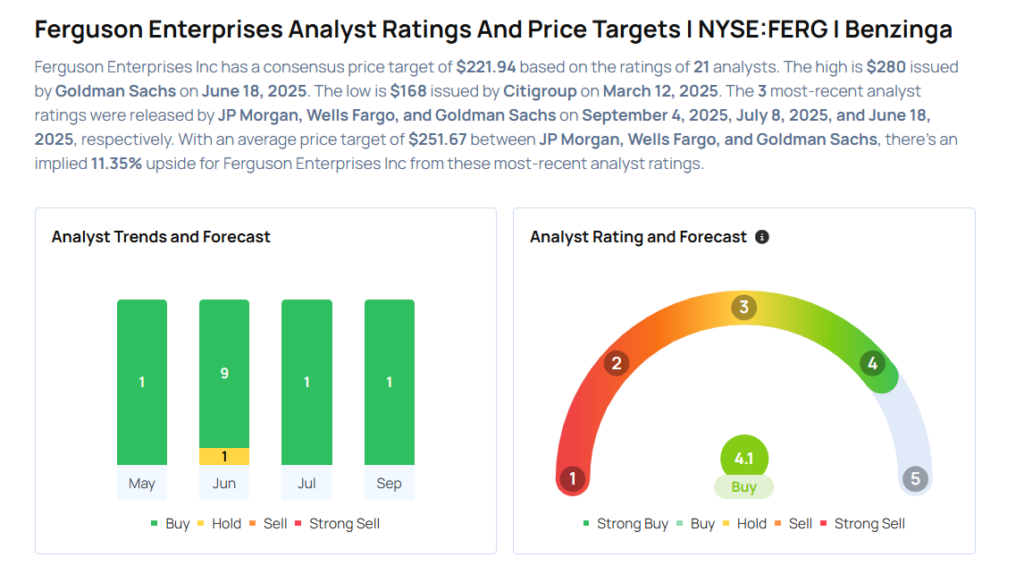

Let's have a look at how Benzinga's most-accurate analysts have rated the company in the recent period.

- Wells Fargo analyst Sam Reid maintained an Overweight rating and raised the price target from $230 to $250 on July 8, 2025. This analyst has an accuracy rate of 74%.

- Morgan Stanley analyst Annelies Vermeulen maintained an Overweight rating and boosted the price target from $195 to $220 on June 9, 2025. This analyst has an accuracy rate of 74%.

- Truist Securities analyst Keith Hughes maintained a Buy rating on June 4, 2025. This analyst has an accuracy rate of 80%.

- Oppenheimer analyst Scott Schneeberger maintained an Outperform rating and boosted the price target from $189 to $235 on June 4, 2025. This analyst has an accuracy rate of 64%.

- RBC Capital analyst Mike Dahl maintained an Outperform rating and raised the price target from $189 to $231 on June 4, 2025. This analyst has an accuracy rate of 72%

Considering buying FERG stock? Here’s what analysts think:

Read This Next:

- Top 3 Tech Stocks You’ll Regret Missing In Q3

Photo via Shutterstock