Bullish Inc. (NYSE:BLSH) CEO Tom Farley said Wednesday that the company’s flagship offerings, such as the CoinDesk 5 index, have the potential to become the “MSCI of the crypto world.”

BLSH stock is showing exceptional strength. Get the inside scoop here.

‘Bullish’ On Multi-Token Indices

During the company’s second-quarter earnings call, Farley responded to a query about Bullish’s indices business and plans to turn them into the “MSCI of the crypto world.”

“People are looking for broader sets à la the Dow or the S&P 500 or MSCI's Emerging Markets Index or something to be able to invest in a broader swath of the market while maintaining Bitcoin as their primary way to invest,” he stated.

CoinDesk 20 is a broad-based index that measures the performance of top cryptocurrencies, with Bitcoin’s (CRYPTO: BTC) weightage at over 30%. The CoinDesk 5 Index tracks the “five largest, most liquid, and investable digital assets” from the broader CoinDesk 20 Index.

Since launch, the CoinDesk 5 index has returned approximately 132%, while the CoinDesk 20 index has netted 321%.

Farley disclosed that Bullish has signed agreements with a “major global futures exchange and a major U.S. equities exchange” to launch products tied to the CoinDesk 5 and CoinDesk 20, the details of which are yet to be announced. He added that an ETF arrangement for these offerings has also been signed.

“It's going to take some time because the market needs to get more comfortable investing in more products than just Bitcoin. It's happening in real time, and we're there for it,” Farley said.

See Also: Blockchain Unicorn 5ire Launches Mainnet Following 1M Monthly Testnet Transactions

Bullish Reverses Tide In First Earnings After Public Listing

Farley’s remarks coincided with the SEC approving the listing and trading of the Grayscale Digital Large Cap Fund, which holds cryptocurrencies based on the CoinDesk 5 Index.

Meanwhile, Bullish reported its first quarterly financials since becoming public, with second-quarter earnings of $0.93 per share, up from losses of $1.03 per share last year.

Cathie Wood-led Ark Invest added 36,328 shares of Bullish across its ARK Innovation ETF (BATS:ARKK) and ARK Next Generation Internet ETF (BATS:ARKW), totaling nearly $1.97 million.

Bullish, backed by billionaire investor and entrepreneur Peter Thiel, opened to a blockbuster listing last month. It also operates a cryptocurrency news website, CoinDesk, which it acquired from Barry Silbert's Digital Currency Group in 2023.

Price Action: Shares of Bullish rose 2.12% in after-hours trading after closing 5.82% lower at $54.35 during Wednesday’s regular trading session, according to data from Benzinga Pro. Since the blockbuster debut, the stock has retraced 20%.

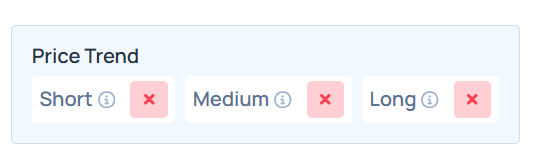

The stock was in a downward trend over the short, medium and long term. Visit Benzinga Edge Stock Rankings to compare it with other Coinbase Global Inc. (NASDAQ:COIN), the largest Wall Street-listed cryptocurrency exchange.

Read Next:

- Millionaire Trader Is Up $500,000 On Dogecoin Long, Expects ‘Monster Rally’ To $1 Still To Come

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Photo Courtesy: Kaspars Grinvalds on Shutterstock.com