Ferguson Enterprises Inc. (NYSE:FERG) posted better-than-expected fourth-quarter results on Tuesday.

Ferguson Enterprises reported fourth-quarter 2024 sales of $8.5 billion, a 6.9% increase from last year, beating analyst estimates of $8.41 billion. Adjusted earnings per share were $3.48, ahead of expectations of $2.88 and up 16.8% from the prior year. GAAP diluted EPS was $3.55, up 59.2% from $2.23.

Ferguson expects mid-single-digit revenue growth for calendar 2025. Adjusted operating margin is projected between 9.2% and 9.6%, compared with 9.1% in calendar 2024.

Interest expense is forecast between $180 million and $200 million. Capital expenditures are planned to range from $300 million to $350 million, which is slightly lower than the prior year. The adjusted effective tax rate is expected to be around 26%.

CEO Kevin Murphy said, "Throughout the year, we invested in key growth areas to drive further organic growth, completed nine acquisitions, grew our dividend and continued to execute our share buyback program, while maintaining a strong balance sheet."

Ferguson Enterprises shares fell 0.7% to $229.84 on Wednesday.

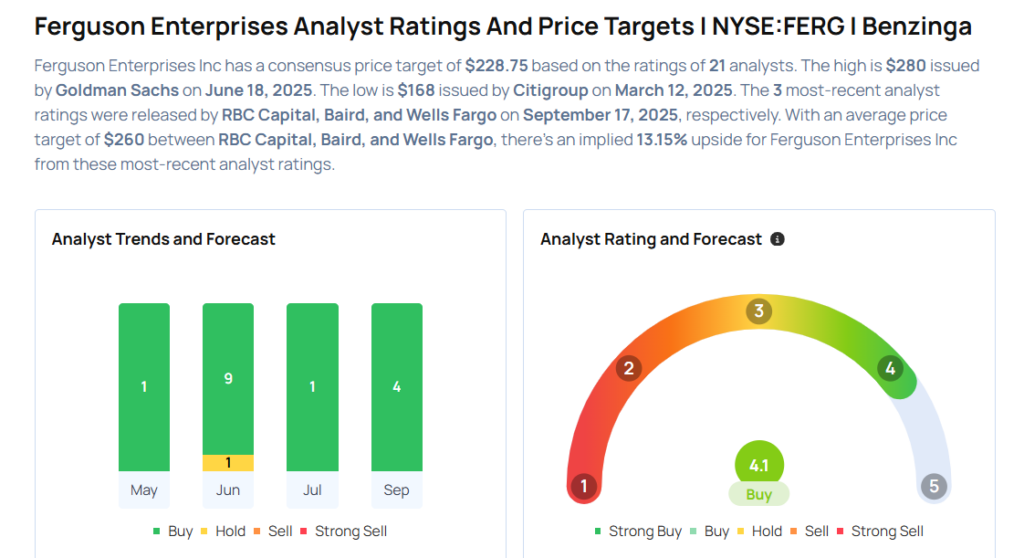

These analysts made changes to their price targets on Ferguson Enterprises following earnings announcement.

- Wells Fargo analyst Sam Reid maintained Ferguson Enterprises with an Overweight rating and raised the price target from $250 to $275.

- Baird analyst David Manthey maintained the stock with an Outperform rating and raised the price target from $260 to $262.

- RBC Capital analyst Mike Dahl maintained Ferguson Enterprises with an Outperform rating and raised the price target from $231 to $243.

Considering buying FERG stock? Here’s what analysts think:

Read This Next:

- Apple To Rally More Than 28%? Here Are 10 Top Analyst Forecasts For Wednesday

Photo via Shutterstock